Market Analysis – December 1

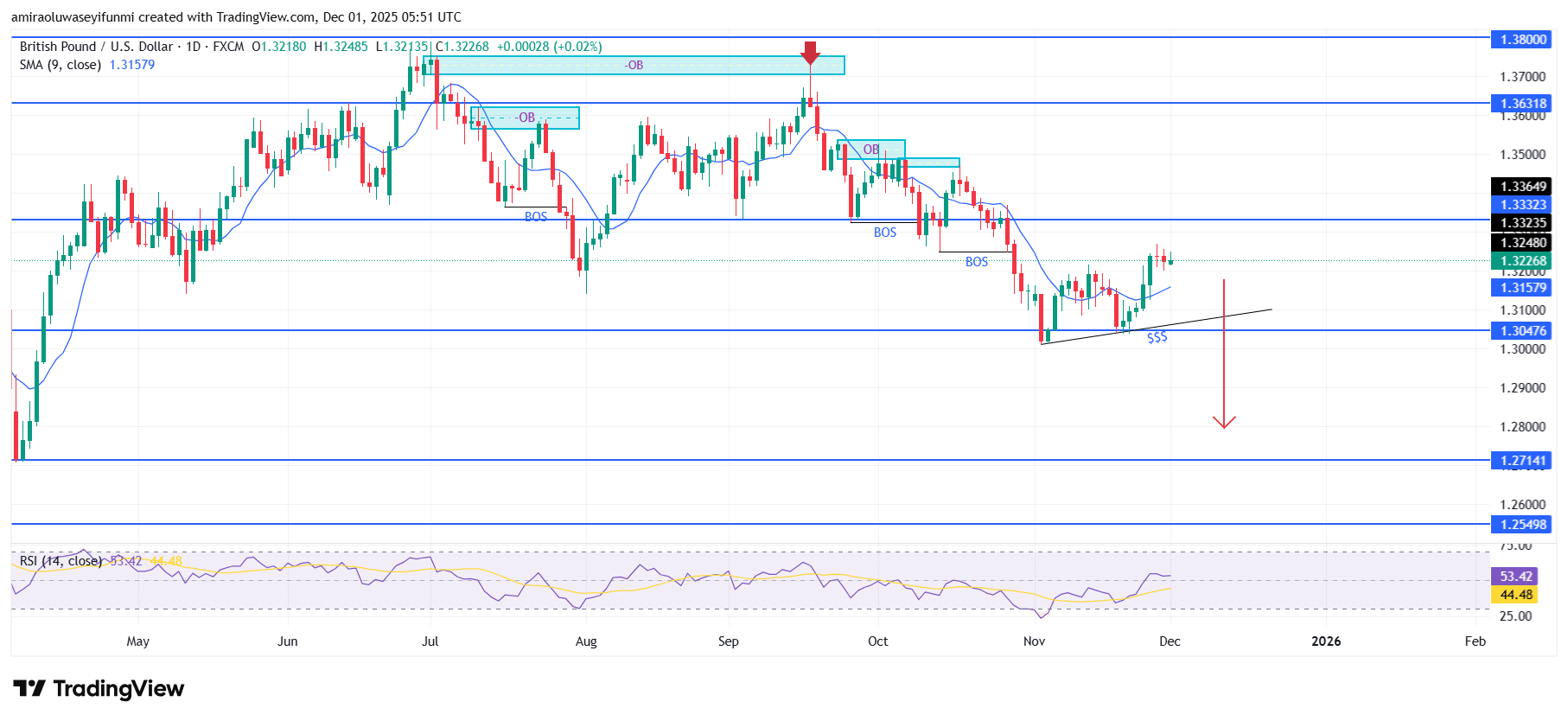

GBPUSD remains aligned for prolonged bearish continuation as structural weakness deepens. The pair maintains a broadly negative tone, with momentum indicators continuing to favour sellers. Price remains below the short-term moving average, reinforcing the prevailing downside narrative despite a modest rebound attempt. Although the RSI has risen slightly from previous lows, it still reflects a market struggling to build sustained buying strength. Altogether, these signals indicate diminishing bullish momentum and a setup supportive of further bearish follow-through.

GBPUSD Key Levels

Supply Levels: $1.3330, $1.3630, $1.3800

Demand Levels: $1.3050, $1.2710, $1.2550

GBPUSD Long-Term Trend: Bearish

The pair has consistently rejected the $1.33320 supply zone, where repeated upper-wick formations reveal firm selling pressure. The recent upward movement following the earlier break of structure appears corrective rather than a genuine shift in direction. Although the $1.31580 support area has offered a temporary base, the broader pattern of lower highs and persistent reactions from bearish order-block regions highlights ongoing downward momentum. The ascending trendline currently holding price is weakening, suggesting a likely liquidity sweep toward untested levels beneath it.

Looking ahead, sellers appear positioned to target the $1.30480 region as the next key draw, given its alignment with prior demand and accumulated liquidity. A decisive break below this area could accelerate bearish pressure toward $1.27140, with a further decline toward $1.25500 if overall sentiment remains negative. Unless buyers reclaim and maintain a close above $1.33320, the broader technical picture continues to support sustained depreciation.

GBPUSD Short-Term Trend: Bearish

GBPUSD on the four-hour chart is displaying renewed bearish momentum as price rolls back beneath the short-term moving average. The inability to hold gains above $1.32480 signals weakening bullish participation and reinforces the dominant downside structure. Current movement suggests sellers may attempt to drive price toward the ascending trendline and the liquidity zone near $1.30480. A confirmed break below this support would strengthen expectations for continued bearish extension into lower valuation zones, aligning with the outlook highlighted by forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.