Market Analysis – December 2

Eurozone macro-economic indicators show a mildly fragile but overall stable environment. Inflation currently sits at 2.5%, which keeps the European Central Bank within its comfort range and suggests price pressures are under control. However, GDP growth of just 0.3% highlights weak economic expansion, limiting the euro’s upward momentum. Meanwhile, unemployment at 6% and housing price growth of 5.4% point to a resilient labor market and steady consumer demand.

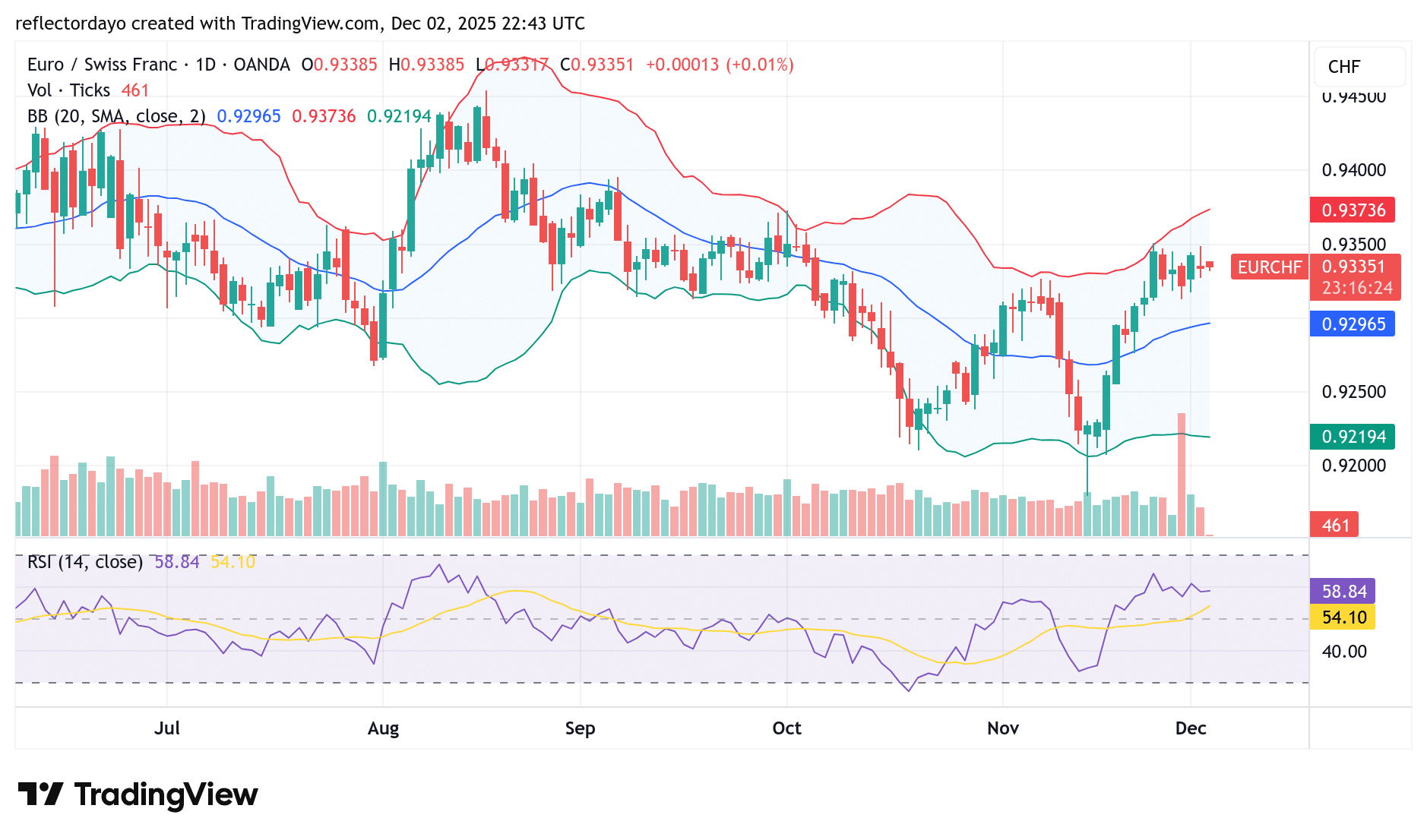

These mixed signals create a neutral-to-slightly cautious backdrop for the euro—not weak enough for a major sell-off, but not strong enough to support a decisive bullish trend. This aligns with the EUR/CHF daily chart, where price is holding above 0.930 after rebounding from 0.920, yet recent sessions show small-bodied candles and declining volume. This pattern reflects market indecision, confirming that EUR/CHF is currently supported but lacks strong bullish conviction.

EUR/CHF Key Levels

- Demand Levels: 0.93000, 0.92500, 0.92000

- Supply Levels: 0.93500, 0.94000, 0.94500

EUR/CHF Sustains Bullish Motion (Long-Term Trend: Bullish Recovery)

From the perspective of the daily chart, EUR/CHF continues to show signs of a gradual bullish recovery as buyers attempt to keep the market above the key 0.9300 support level. The pair is currently trading close to a critical resistance zone around 0.9350, a level that has acted as a major barrier in previous trading sessions. This history of rejection explains the cautious behavior among traders at this stage.

Whether the market successfully breaks above the 0.9350 resistance depends largely on the bulls’ ability to defend the 0.9300 support. A sustained hold above this level would strengthen bullish confidence, and a clear breakout through 0.9350 could invite additional buying pressure, potentially pushing EUR/CHF into higher price territories.

EUR/CHF Short-Term Trend: Bullish

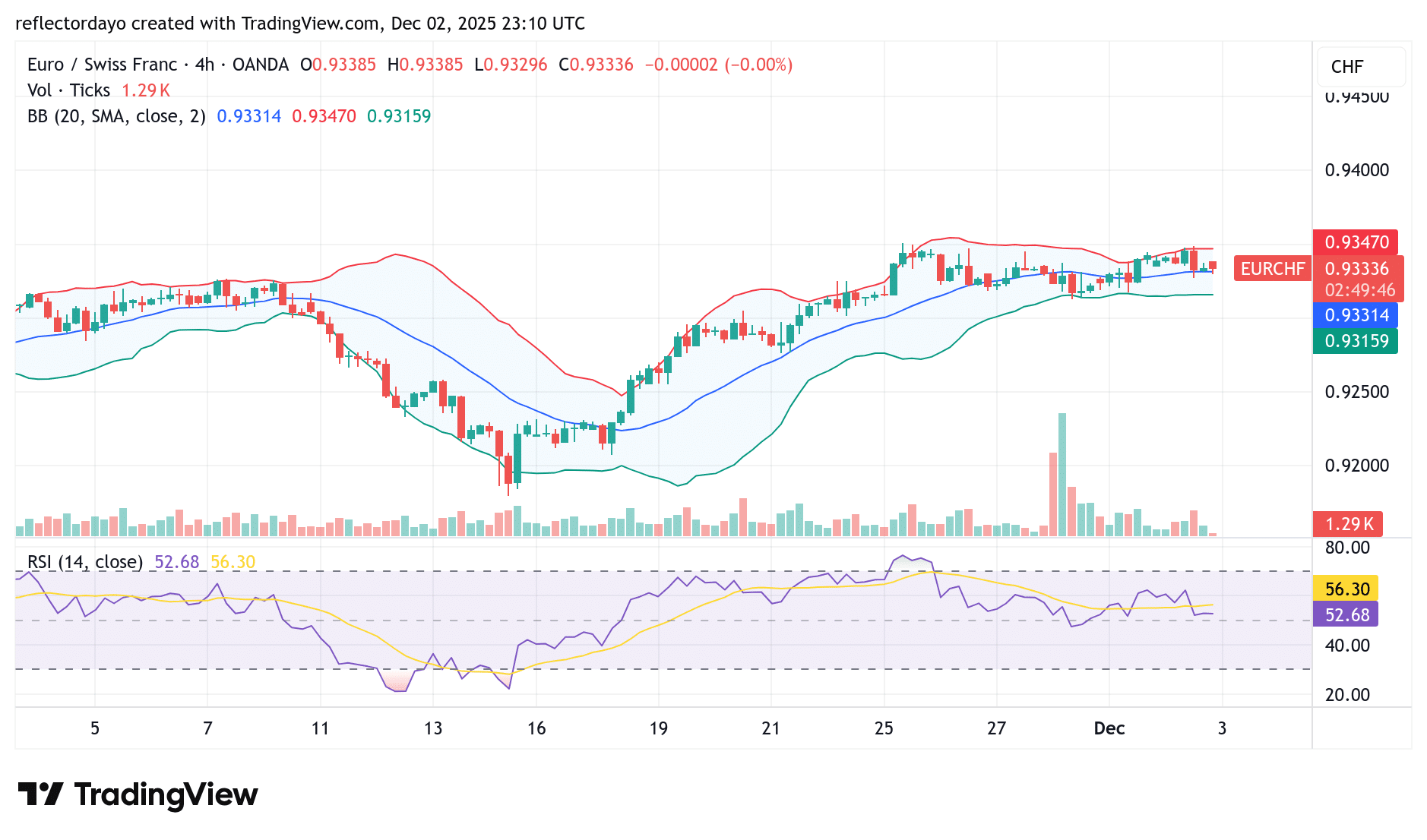

On the 4-hour chart, EUR/CHF is showing a consolidation pattern around the 0.9350 price level. Toward the end of November, trading volume spiked—likely reflecting expectations among traders that the market might break above this key resistance. However, the anticipated breakout did not materialize.

Despite this, the bulls still appear to be in control. A newly established higher support has formed around 0.9330, which also aligns with the 20-day moving average. This confluence reinforces bullish sentiment in the short term.

However, if the market breaks below this support zone, momentum could shift in favor of the bears.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.