Market Analysis – November 24

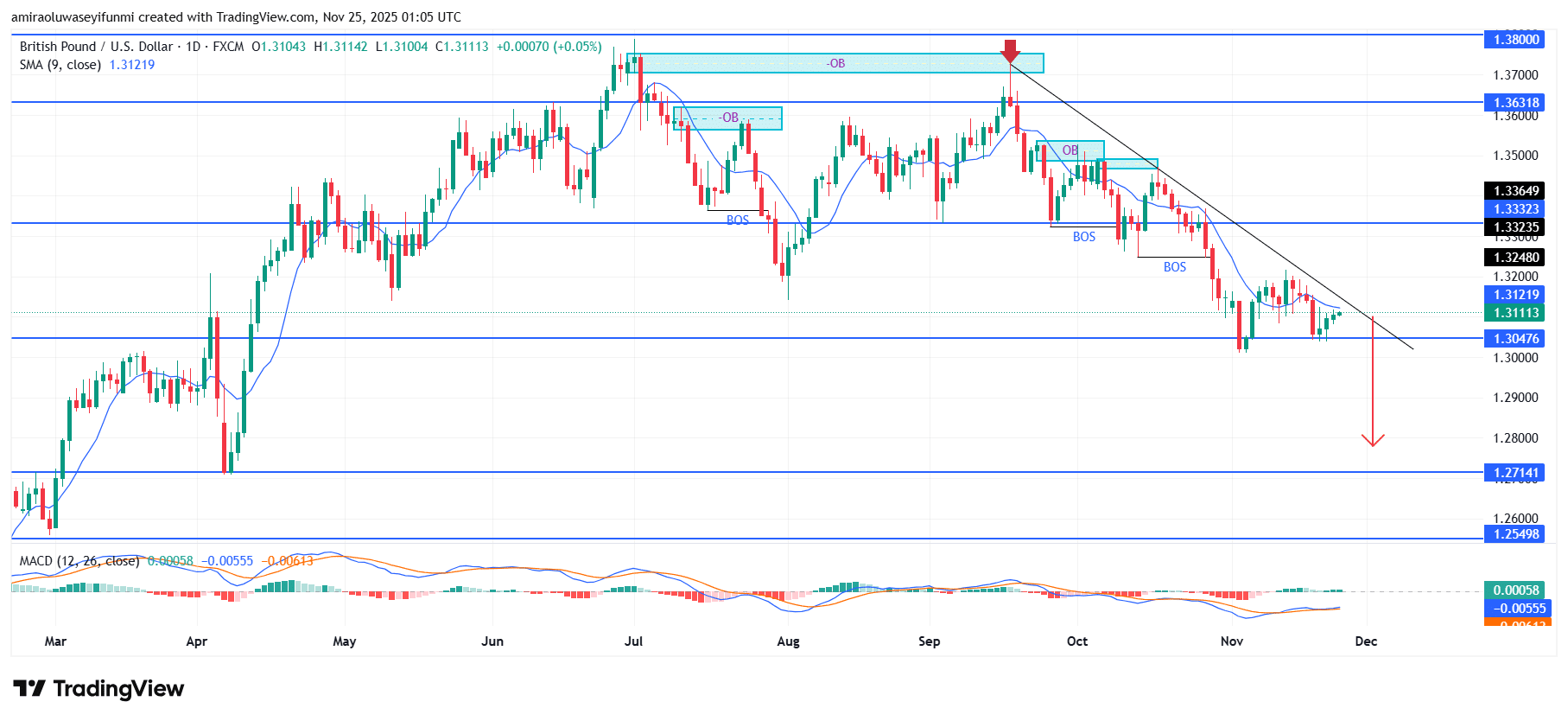

GBPUSD signals sustained downside pressure amid structural weakness. The broader directional bias on GBPUSD remains firmly bearish as the pair continues to trade beneath its descending trendline and the short-term moving average. The current alignment between price action and the MACD histogram reinforces the downward tilt, with momentum showing little indication of bullish recovery. This combination of trend structure and indicator behavior highlights persistent supply-side dominance on the daily timeframe.

GBPUSD Key Levels

Supply Levels: $1.3330, $1.3630, $1.3800

Demand Levels: $1.3050, $1.2710, $1.2550

GBPUSD Long-Term Trend: Bearish

Technically, price action continues to form bearish order blocks and consistent breaks of structure (BOS), indicating sustained institutional selling pressure. The pair recently rejected the $1.3330–$1.3360 resistance region before turning lower to retest the mid-range support at $1.3050. Repeated failures to recover above the descending trendline further confirm that sellers maintain firm control, while liquidity grabs near intra-range highs keep drawing additional supply.

Forward expectations suggest that a solid daily close below the $1.3050 level could trigger further depreciation toward the next liquidity zone at $1.2710. Should bearish momentum strengthen, a deeper move into the $1.2550 demand area remains possible, particularly if macroeconomic catalysts increase risk aversion. Unless the pair breaks above the descending trendline and successfully reclaims $1.3330, the bearish narrative is likely to persist.

GBPUSD Short-Term Trend: Bearish

GBPUSD continues to trade under the descending trendline, confirming ongoing bearish momentum on the four-hour timeframe. Price remains below the short-term moving average, reflecting weak buying interest and restrained upward movement. The continued inability to surpass the $1.3110–$1.3150 zone demonstrates persistent seller strength. A clear breakdown below $1.3050 may accelerate a move toward the $1.2900 region as bearish structure remains intact, supporting traders who rely on forex signals for directional confirmation.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.