NAS100 Analysis – December 21

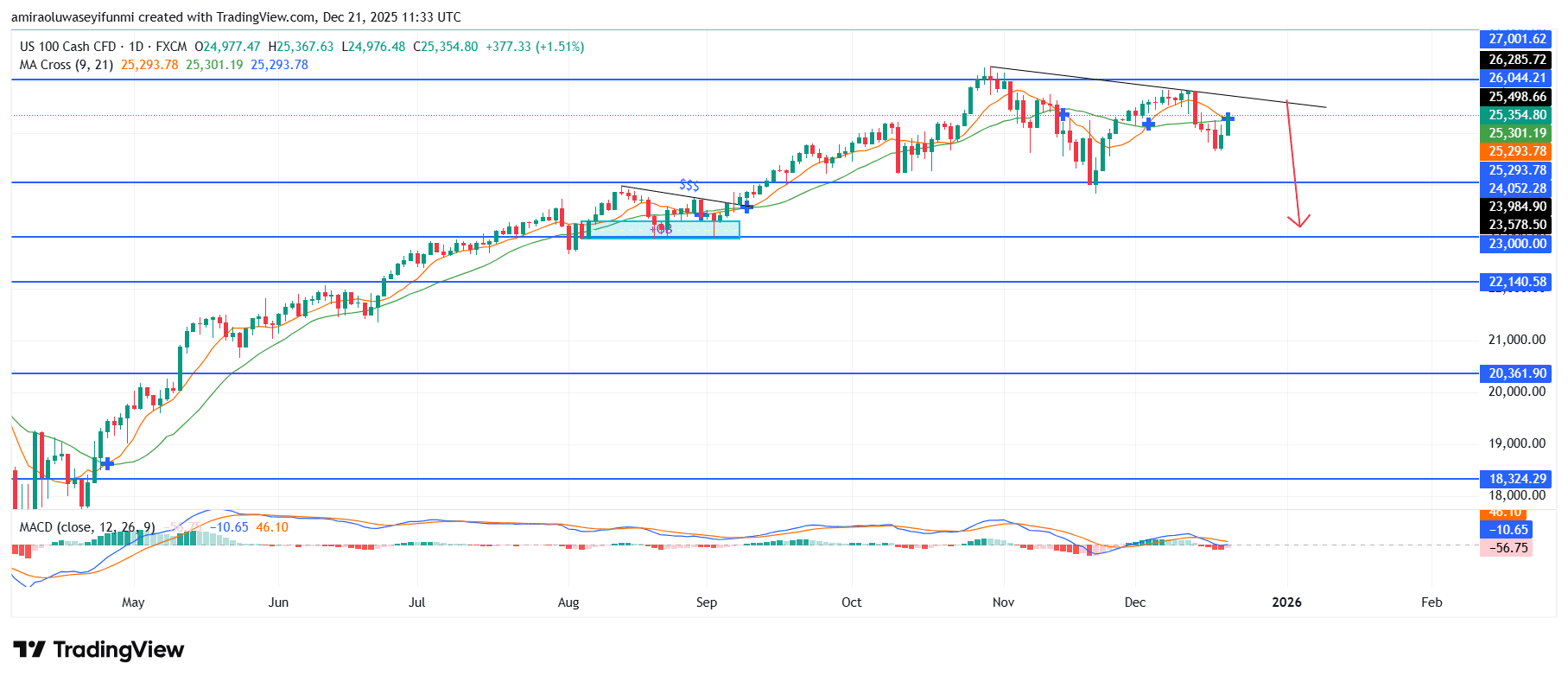

NAS100 signals emerging medium term downside risk. NAS100 is transitioning into a consolidation phase following a prolonged upward move, with key momentum indicators no longer confirming the strength observed earlier in the rally. Price action is fluctuating around the 9-day and 21-day moving averages near $25,300, both of which have started to flatten, indicating a loss of directional commitment. Meanwhile, the MACD is hovering close to its equilibrium line, reflecting fading upside momentum and increasing the probability of a broader trend adjustment.

NAS100 Key Levels

Resistance Levels: $26040, $27000, $28000

Support Levels: $24050, $23000, $22140

NAS100 Long-Term Trend: Bullish

From a technical perspective, the index has struggled to maintain acceptance above the downward-sloping resistance zone near $26,000, suggesting that supply continues to dominate at higher price levels. Recovery efforts have lacked follow-through, while the former support area around $25,500 has transitioned into an overhead resistance zone. The evolution from consistent higher highs to an emerging pattern of lower highs points to a gradual shift in control from buyers to sellers.

From a forward-looking standpoint, a decisive break below the $25,000–$24,900 region would likely expose the index to renewed selling pressure toward the $24,000 level, where earlier demand was established. Sustained weakness could extend the corrective move toward $23,600, with additional downside risk toward $22,100 over the medium term. Within this environment, rallies are increasingly viewed as corrective in nature and aligned with prevailing forex signals rather than indications of trend resumption.

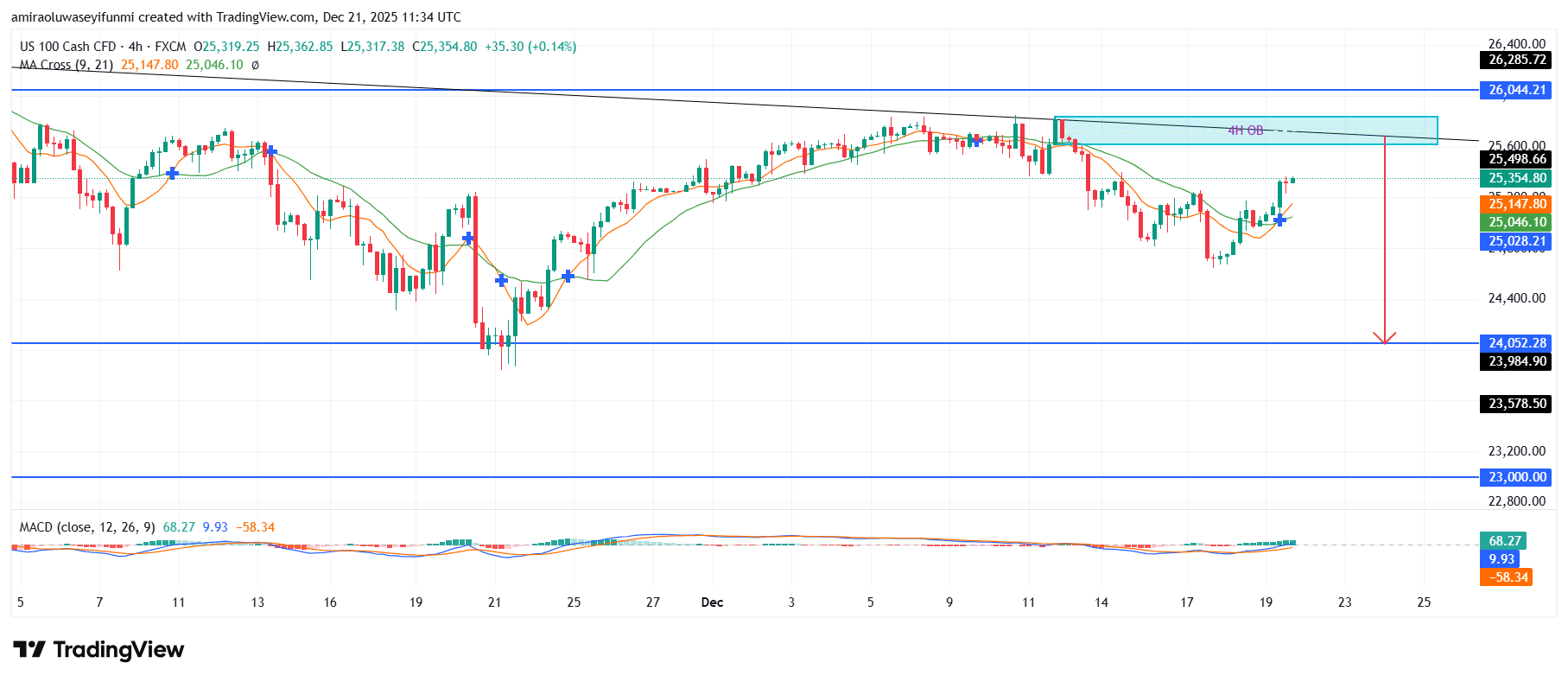

NAS100 Short-Term Trend: Bearish

On the four-hour chart, NAS100 remains structurally bearish, with price trading beneath a descending trendline that continues to limit upside attempts near $25,600. The recent rebound has stalled within a defined four-hour supply zone around $25,500–$25,700, highlighting persistent selling interest on rallies.

Short-term moving averages are clustering below this resistance area, underscoring weak bullish momentum and limited upside continuation. Rejection from current levels keeps downside risk open toward $24,050 initially, with scope for a deeper move toward the $23,600 support zone.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.