NAS100 Analysis – December 14

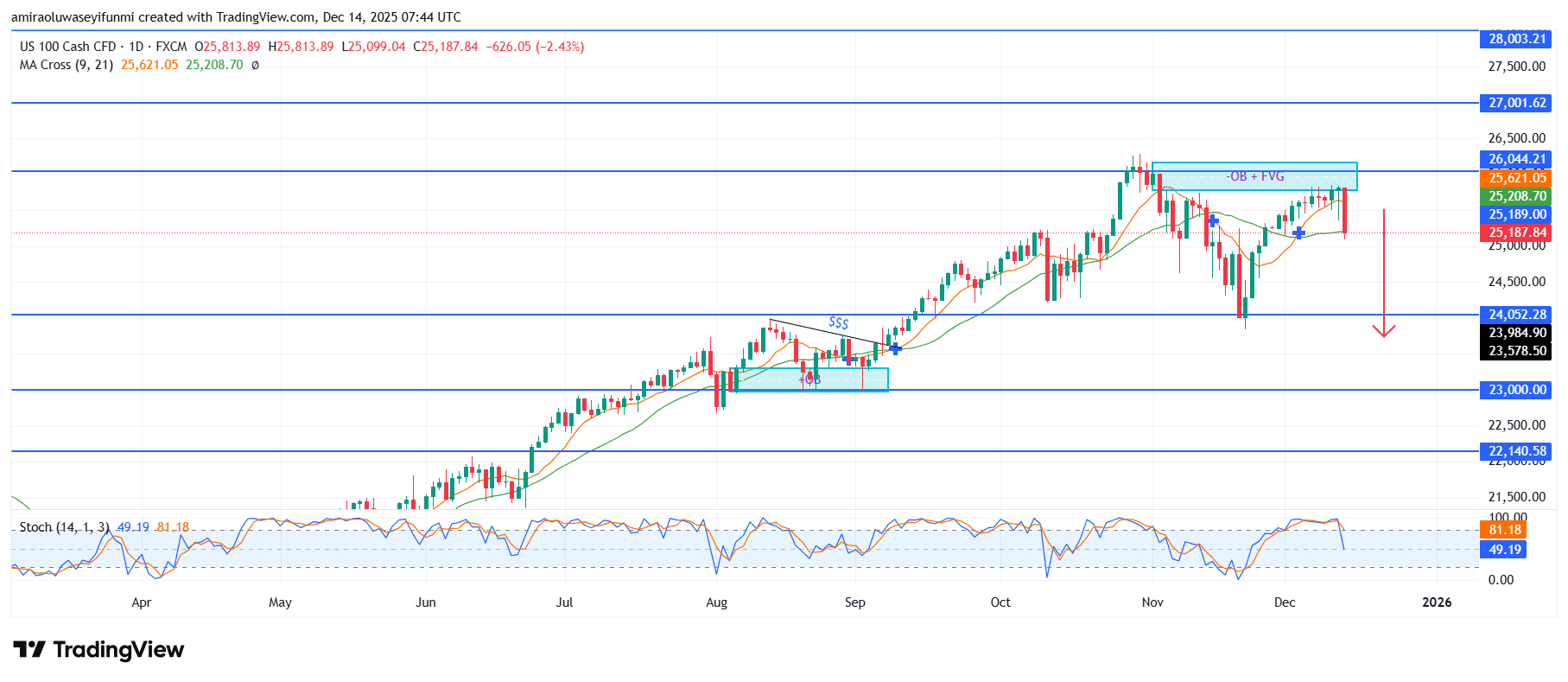

NAS100 enters early phase of structural softening following upside fatigue. NAS100 is beginning to show signs of waning trend quality after a prolonged advance, as momentum indicators rotate lower. Price action has slipped below the short-term average near $25,600, while the faster moving average is narrowing its distance from the slower line, suggesting a developing downside realignment. The Stochastic indicator has also turned down from readings above 80, highlighting fading demand and a gradual shift away from aggressive buying behavior.

NAS100 Key Levels

Resistance Levels: $26040, $27000, $28000

Support Levels: $24050, $23000, $22140

NAS100 Long-Term Trend: Bearish

From a technical perspective, the index met firm rejection within the $26,000–$26,100 supply band, an area reinforced by prior inefficiency and established resistance. The failure to sustain higher highs has resulted in softer daily closes around $25,200, signaling that sellers are regaining near-term control. With price now slipping below its recent balance zone, downside exposure opens toward the $24,100 region, where the next meaningful layer of support is located.

Looking ahead, conditions remain tilted to the downside unless NAS100 can reclaim and hold above $25,700 on a daily closing basis. A confirmed breakdown below $25,000 would likely deepen the corrective phase, drawing price toward $24,100 and potentially extending toward $23,000 under sustained risk-off conditions. In this environment, upside retracements remain vulnerable to renewed selling pressure, keeping the near-term outlook cautious and aligned with broader forex signals.

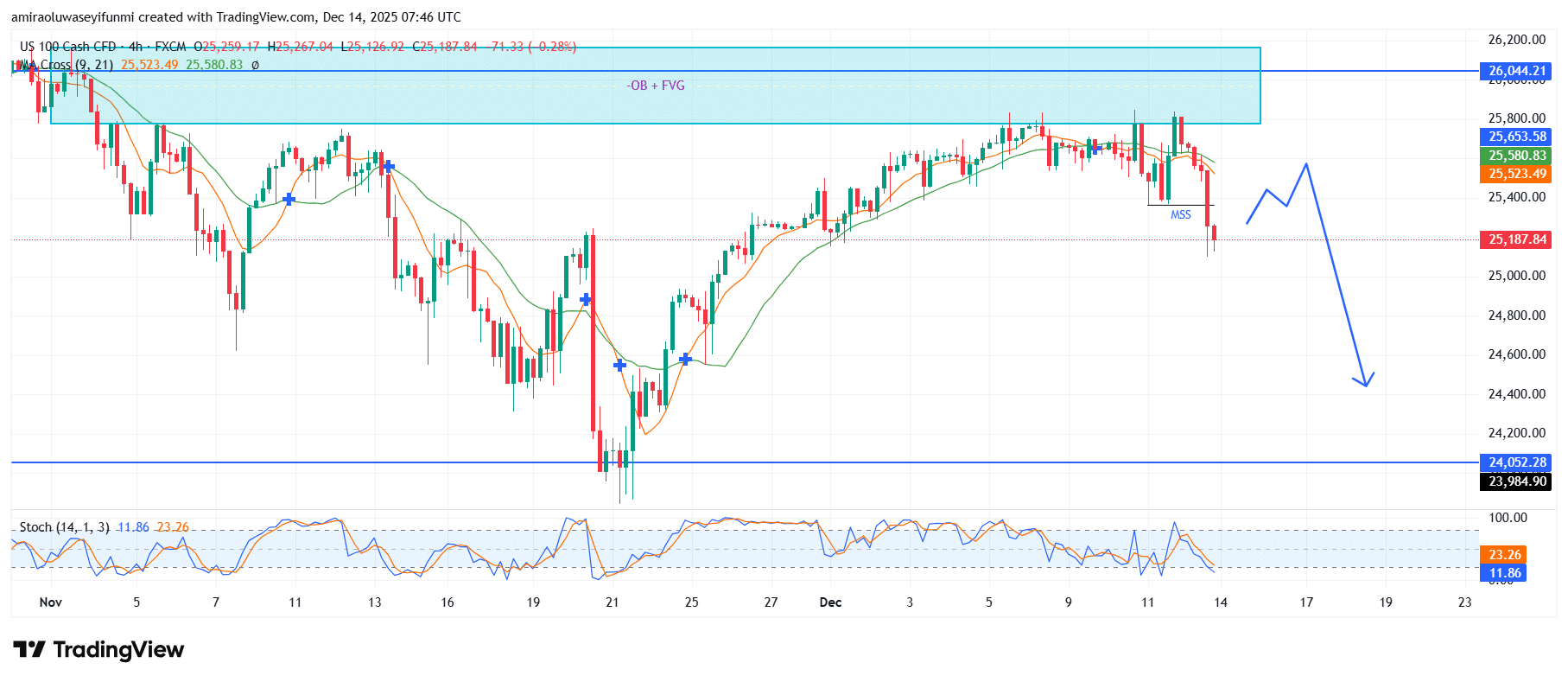

NAS100 Short-Term Trend: Bearish

On the four-hour chart, NAS100 has transitioned into a bearish structure following a clear shift below recent swing lows. Price has rejected the overhead OB and FVG zone and continues to trade beneath the short-term moving averages, which are now acting as dynamic resistance.

Momentum indicators reflect weakening bullish pressure, with the Stochastic rolling over from the mid-range and supporting further downside risk. A corrective rebound toward the $25,400–$25,600 region may unfold before continuation lower toward the $24,500 and $24,000 demand areas.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.