NAS100 Analysis – December 7

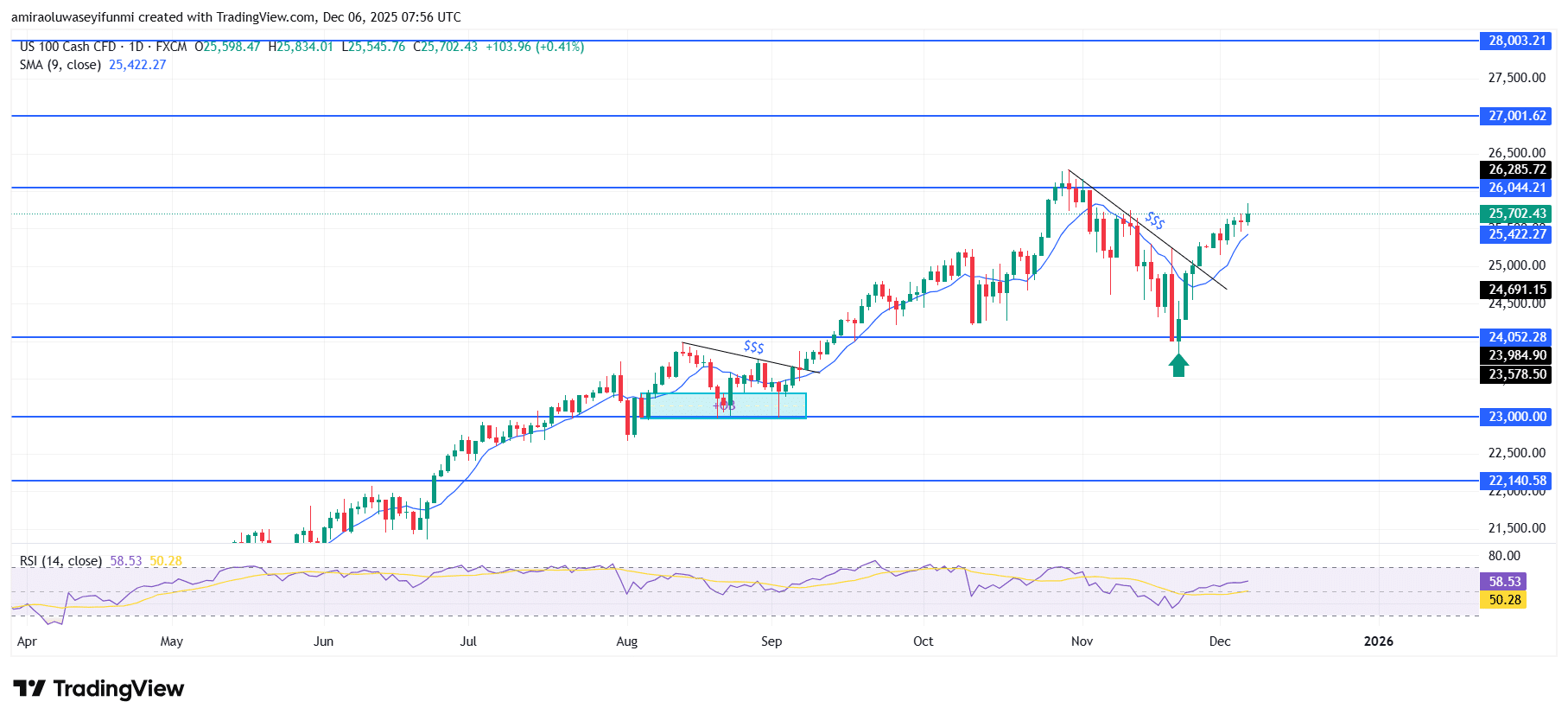

NAS100 reflects strengthening upward bias supported by firming momentum signals. The index continues to reinforce a clear bullish structure on the daily timeframe, with price advancing steadily above the short-term SMA positioned near $25,420. Momentum conditions remain favourable, as the RSI holds comfortably above the midpoint around 58, indicating renewed risk appetite and stronger market conviction. This alignment between improving sentiment and stable trend direction supports an environment conducive to continued upward movement.

NAS100 Key Levels

Resistance Levels: $26040, $27000, $28000

Support Levels: $24050, $23000, $22140

NAS100 Long-Term Trend: Bullish

NAS100 has broken decisively above the prior descending correction line, turning the $25,420 zone into a strengthened base for buyers. The strong rebound from the $23,580–$24,050 demand area signals solid accumulation, suggesting that larger market participants defended the region. Current price movement is driving into the $26,040–$26,290 resistance pocket, showing that buyers are gradually absorbing available supply as the index transitions from recovery into sustained progression.

Projections indicate that a clear break above $26,040 may open the path toward a retest of the $27,000 zone, with potential for an extended push toward the broader $28,000 region. The ongoing structure of rising momentum and higher lows sustains the bullish outlook while positioning market participants for further gains. Should price revisit and hold above the $25,420 support area, it would likely solidify the next upward leg toward new cycle highs.

NAS100 Short-Term Trend: Bullish

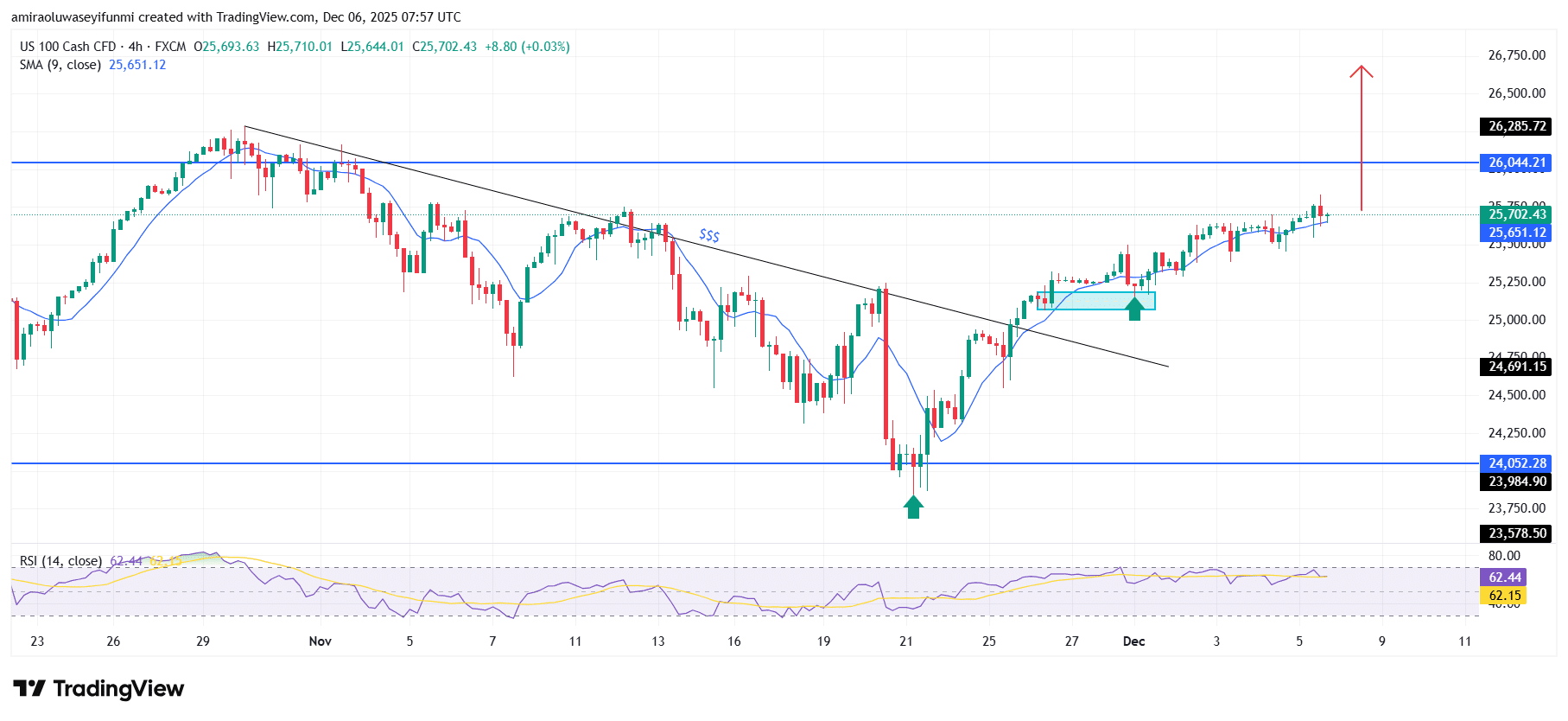

NAS100 preserves a firm bullish tone on the four-hour chart as price trades consistently above the 9-period SMA near $25,650. The breakout above the descending trendline has shifted momentum decisively in favour of buyers, with higher lows developing above the $24,690 support region.

RSI remains elevated around 62, reflecting sustained upward pressure rather than excessive extension. A decisive move above $26,040 is likely to accelerate bullish continuation toward the $26,280 region, providing additional clarity for traders who rely on forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.