NAS100 analysis – November 30

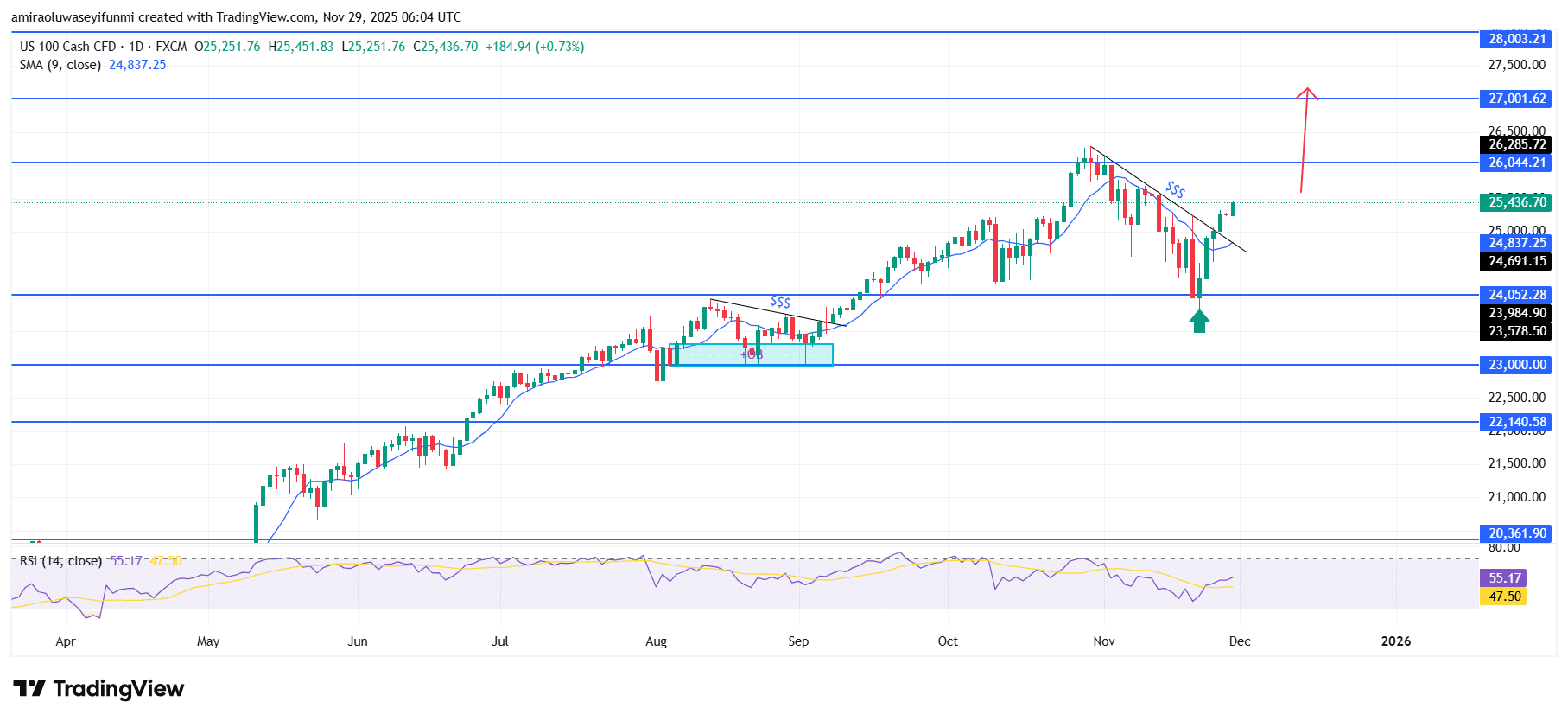

NAS100 outlook strengthens as buyers consolidate directional advantage. The NAS100 continues to display a constructive bullish profile as price trades firmly above the 9-period SMA near $24,840. The RSI also stabilizes around the mid-50s, reflecting balanced yet upward-tilted momentum conditions. This combination of moving-average strength and improving sentiment supports the market’s ability to maintain a medium-term upward trajectory following November’s recovery pivot.

NAS100 Key Levels

Resistance Levels: $26040, $27000, $28000

Support Levels: $24050, $23000, $22140

NAS100 Long-Term Trend: Bullish

Structurally, price has broken above the descending trendline extending from the previous swing high near $26,280, confirming renewed bullish commitment. The solid rebound from the $23,980 support area established a higher low on the daily chart, while the subsequent close above $25,000 signals sustained bullish continuation and positions the index back within an expansionary range.

With momentum holding firm, NAS100 appears prepared to approach the next upside liquidity pocket at $26,040, with an extended target near $27,000 if buyer strength remains intact. A consistent daily close above $25,500 would further increase the likelihood of a move toward the broader macro-resistance zone at $28,000 in the coming sessions.

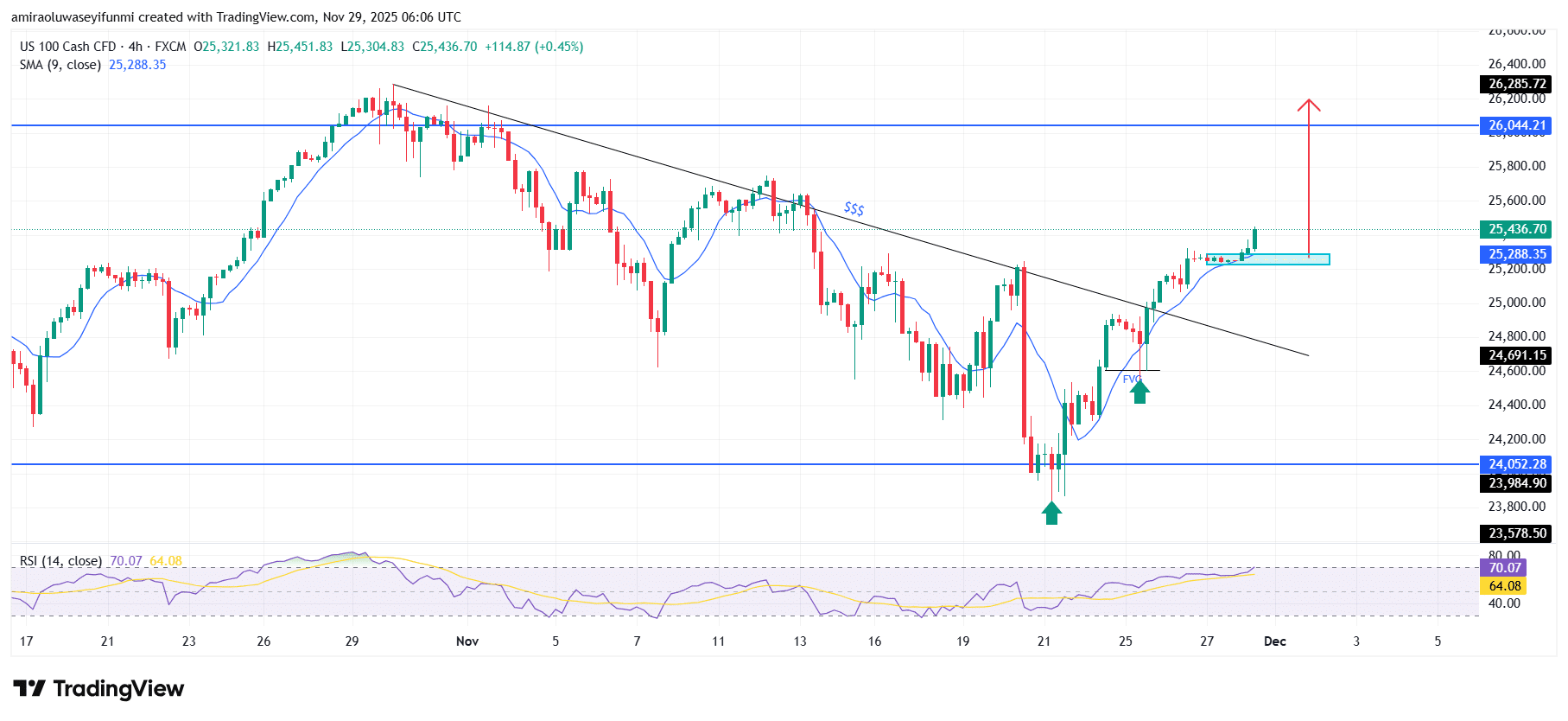

NAS100 Short-Term Trend: Bullish

NAS100 maintains a bullish structure on the four-hour chart as price holds above the broken trendline and the 9-period SMA. Buyers continue to defend the $25,200–$25,300 demand block, allowing momentum to build after the latest breakout. The clean formation of higher lows and higher highs reinforces growing upside sentiment. If buyers sustain control above $25,300, price is positioned to advance into the $26,000–$26,280 resistance zone, aligning with current short-term expectations supported by forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.