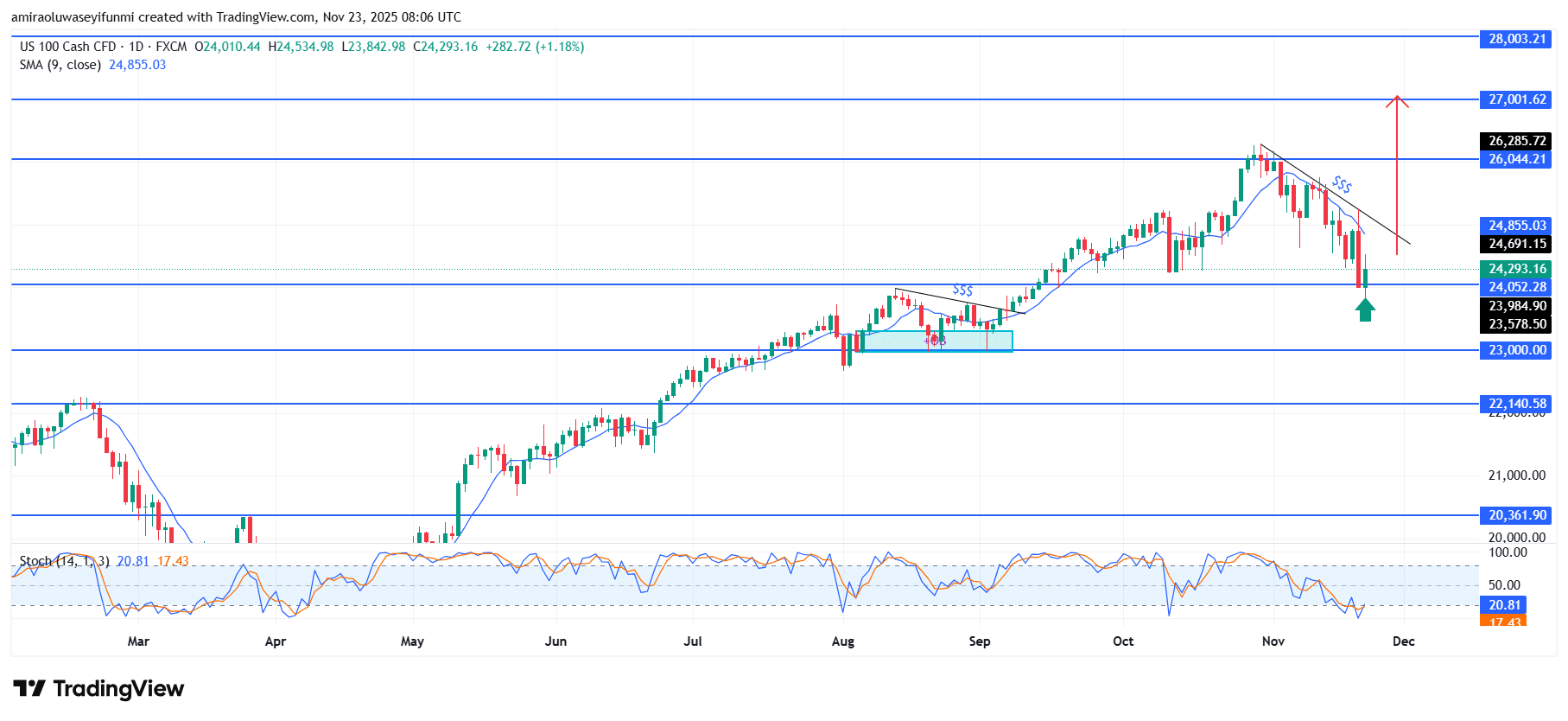

NAS100 Analysis – November 23

NAS100 builds upward traction as buyers regain control. The index is beginning to reestablish bullish intent as price responds constructively to deeply compressed stochastic readings and gradually climbs back above the short-term moving average near $24,860. This renewed alignment between strengthening momentum signals and early structural recovery suggests that buyers are steadily regaining control after the recent decline. Market sentiment is shifting as investors show a growing willingness to accumulate at discounted levels, reinforcing the potential for sustained upward progression.

NAS100 Key Levels

Resistance Levels: $26040, $27000, $28000

Support Levels: $24050, $23000, $22140

NAS100 Long-Term Trend: Bullish

Structurally, the index has rebounded strongly from the $23,580–$24,050 demand region, producing a notable rejection candle that signals increasing buying strength. Price is now approaching the descending trendline drawn from earlier monthly highs, a technical barrier that, once surpassed, could trigger a broader continuation of the recovery. The rebound also emerges from an area previously shaped by consolidation, indicating that deeper-liquidity participants may be defending this region as a strategic accumulation zone.

Forward expectations point toward a potential break above $24,860, which would open a pathway toward the $26,040 supply zone. Sustained movement above this area could drive price toward $27,000, with additional bullish extension allowing NAS100 to challenge the wider $28,000 region. Overall, the chart outlook supports the development of a bullish cycle, provided the $23,580 support level continues to hold.

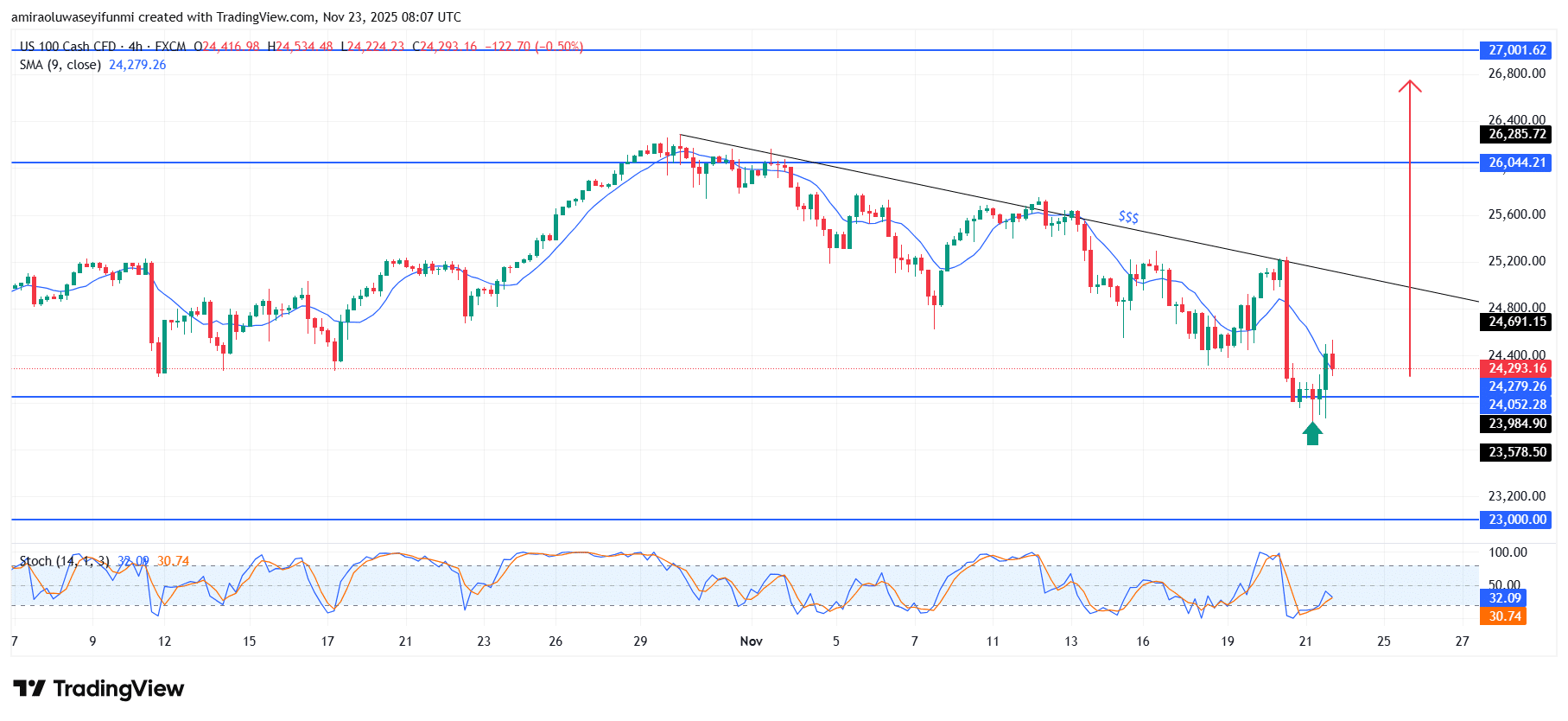

NAS100 Short-Term Trend: Bullish

NAS100 is turning bullish on the four-hour timeframe as price rebounds sharply from the $24,050–$23,980 support region. Buyers have reacted strongly at this zone, pushing candles back above the 9-period SMA and signaling a shift in short-term sentiment. The Stochastic Oscillator is rising from oversold conditions, reinforcing renewed upward momentum. If this progression continues, price may target the $24,690 zone and potentially retest the $26,040 resistance area, offering valuable insight for traders monitoring forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.