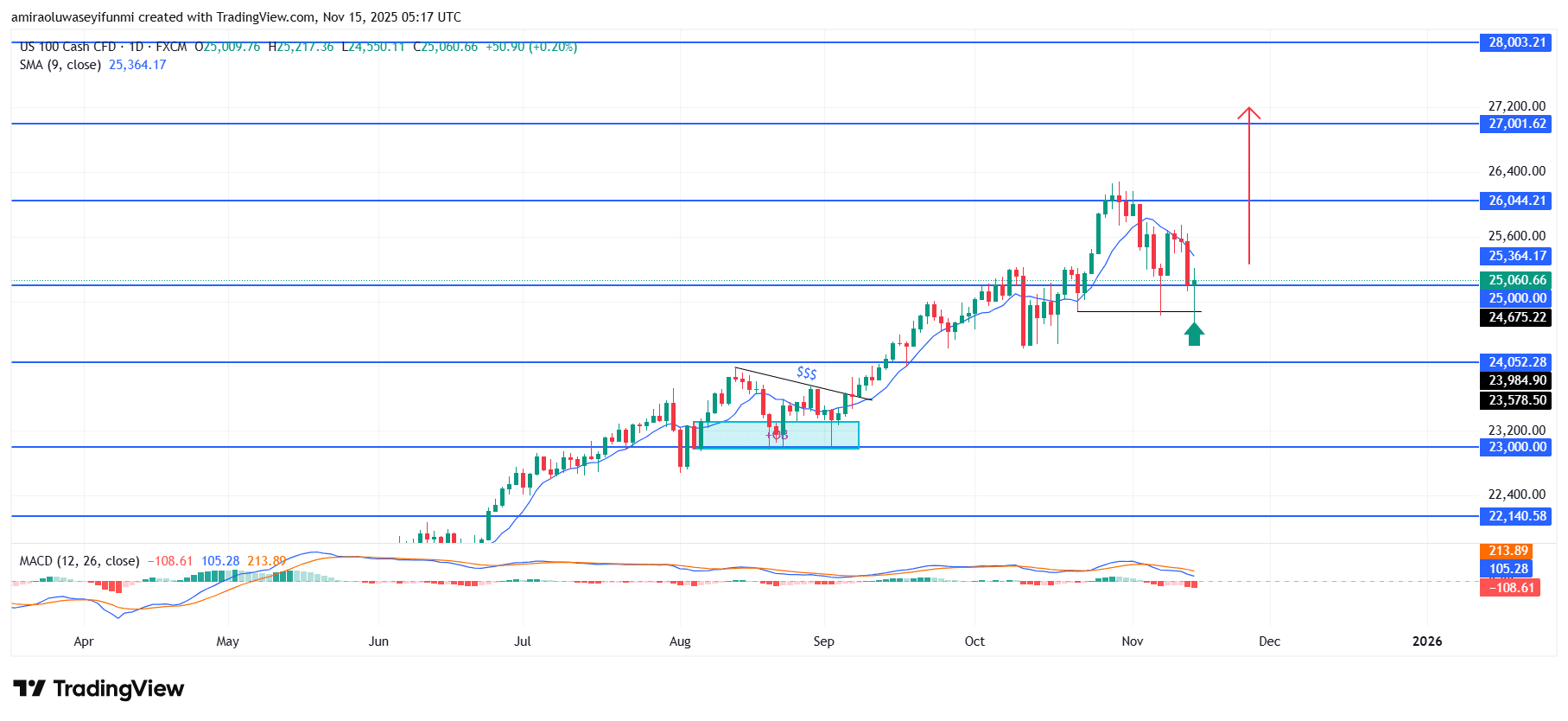

NAS100 Analysis – November 16

NAS100 shows strength as buyers respond to the strategic support zone. The index continues to maintain a constructive upward outlook, with price action holding above the 9-day Simple Moving Average near $25,360.

Although the market recently encountered a pullback, the MACD continues to reflect recovering upside momentum, suggesting that bullish forces are gradually reasserting influence. This alignment between price behavior and indicator signals supports expectations of sustained upward participation in the medium term.

NAS100 Key Levels

Resistance Levels: $26040, $27000, $28000

Support Levels: $25000, $24050, $23000

NAS100 Long-Term Trend: Bullish

Structurally, the index has strongly defended the $25,000 support region, where significant buying interest re-emerged. Price movements continue to hold above previous swing lows, and the sharp rejection around $24,680 highlights a robust response from demand. The broader upward trajectory established earlier in the year remains valid, as each corrective phase has produced higher lows despite periods of volatility.

Looking ahead, the NAS100 appears positioned to retest the $26,040 resistance level, and a successful break could open a pathway toward the $27,000 supply region. If buyers maintain current momentum, an extension into the $28,000 range becomes achievable within the prevailing trend. As long as price sustains levels above the $25,000 floor, the bullish structure is expected to remain dominant. Traders may also monitor forex signals for added confirmation during key breakout phases.

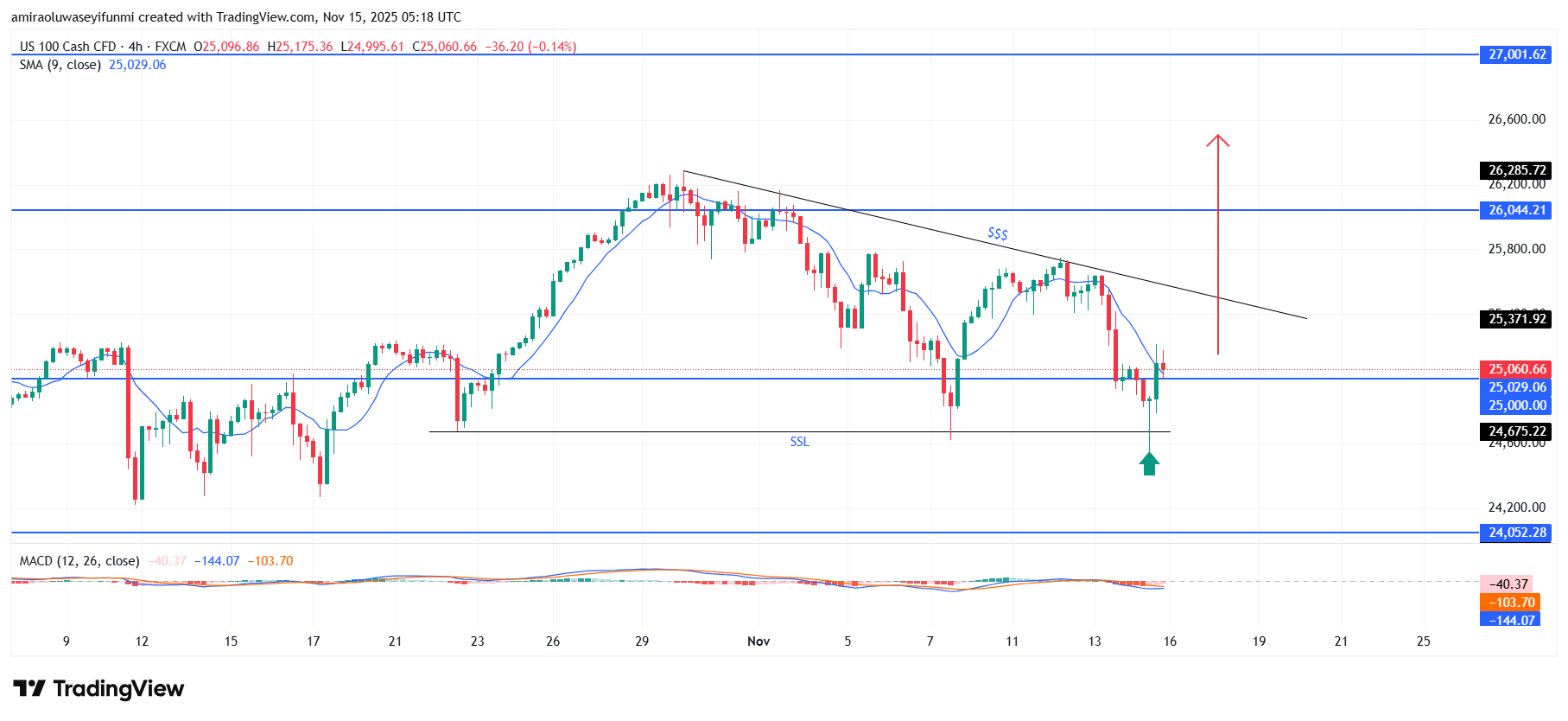

NAS100 Short-Term Trend: Bullish

NAS100 is displaying early signs of short-term bullish momentum on the four-hour chart after a sharp rebound from the $25,000 demand zone. Price has reclaimed the 9-period moving average, signalling renewed buyer activity and a recovery of the short-term trend. Rejection wicks around $24,680 further validate strong downside absorption and an improving market sentiment. If buyers continue to apply pressure, price is likely to advance toward the $26,040 resistance region in the near term.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.