NAS100 Analysis – November 9

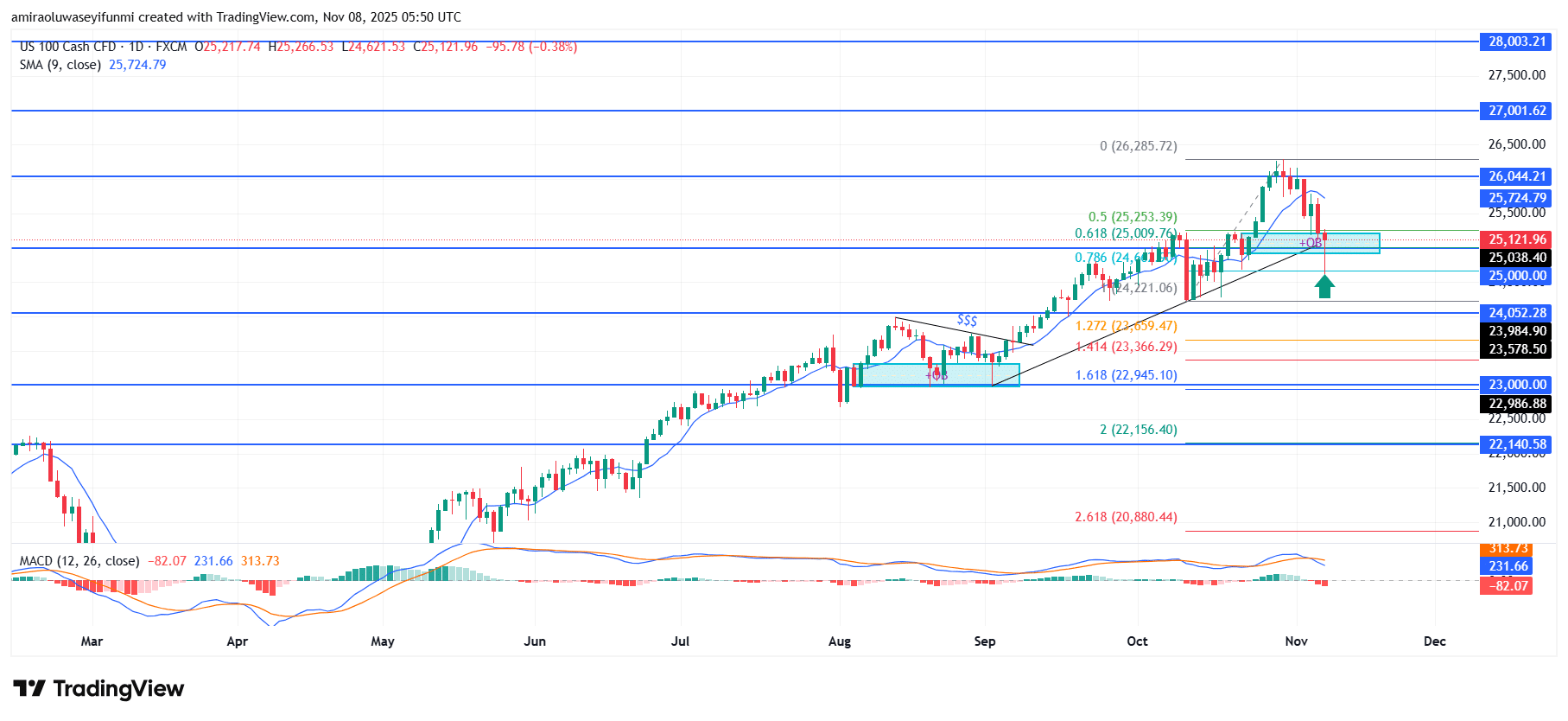

NAS100 sustains its bullish drive from a key price base. The NAS100 index maintains a steady upward tone, holding above the 9-day Simple Moving Average positioned around $25,720. Market momentum indicators support this positive sentiment, with the MACD histogram narrowing after a recent bearish phase—indicating a decline in selling pressure. Overall, the index aligns with a medium-term bullish outlook as buyers gradually regain control following the recent correction from the $26,040 region.

NAS100 Key Levels

Resistance Levels: $26040, $27000, $28000

Support Levels: $25000, $24050, $23000

NAS100 Long-Term Trend: Bullish

From a technical perspective, price action has remained firm above the $25,000–$25,040 support zone, which corresponds with the 0.786 Fibonacci retracement level. This region has consistently served as a launch point for renewed upward movements, as reflected by the latest bullish candle response. The market’s ability to defend this structure highlights steady institutional accumulation, while short-term bearish momentum continues to fade amid ongoing profit-taking from previous advances.

Looking forward, NAS100 appears well-positioned for a potential climb toward the nearby resistance around $25,720 and possibly another retest of the $26,040 ceiling. A confirmed breakout above this level could strengthen bullish momentum, paving the way for an extension toward $27,000 and $28,000 in the medium term. Maintaining support above the $25,000 base remains essential for preserving this positive bias, as a drop below it might trigger brief consolidation rather than a full trend reversal, with recent forex signals suggesting ongoing buying pressure.

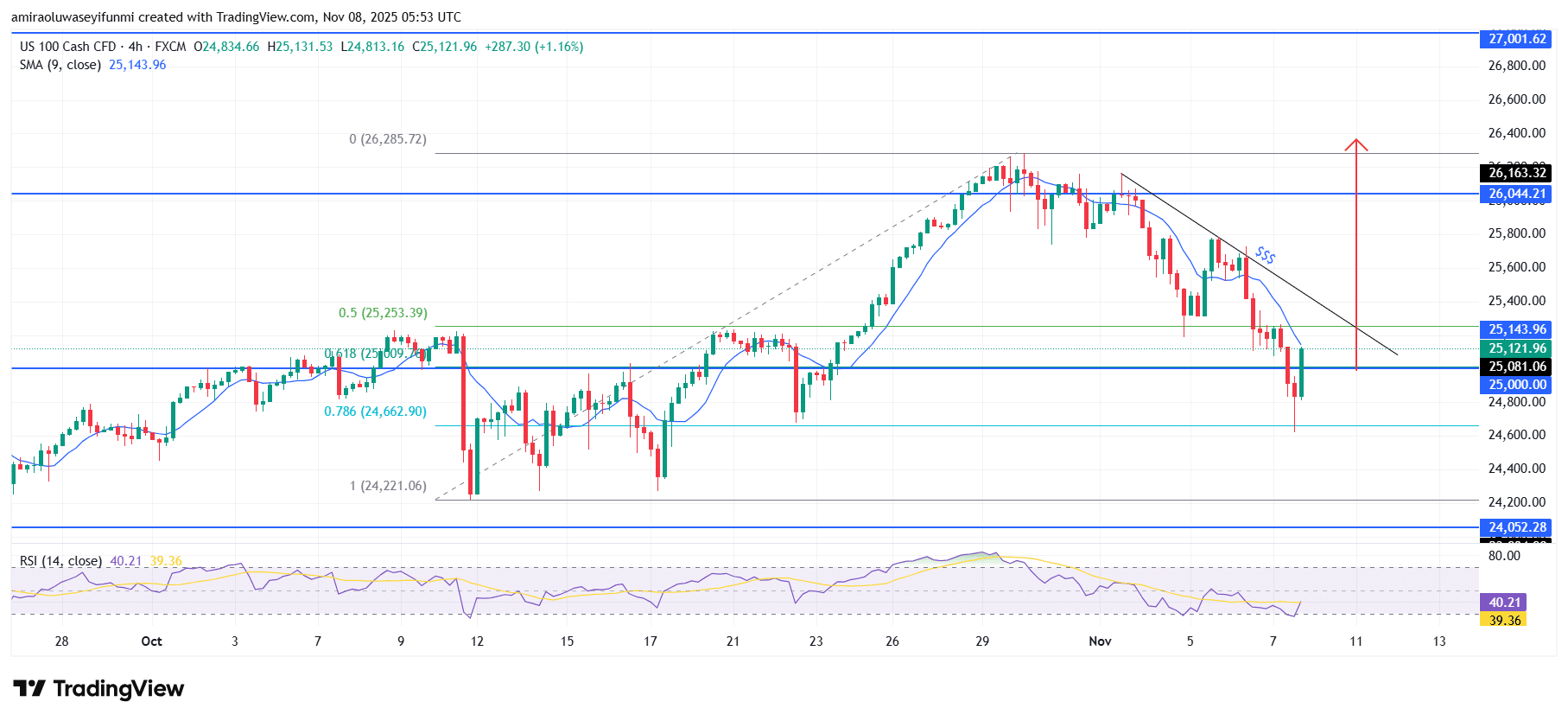

NAS100 Short-Term Trend: Bullish

NAS100 is showing early signs of bullish recovery as price rebounds from the $25,000 support region. The index has broken above the short-term descending trendline and is currently trading near the 9-period SMA around $25,140, reflecting renewed buyer engagement.

RSI has turned upward from the oversold region, indicating strengthening bullish momentum. If price maintains stability above $25,000, further upside toward $25,640 and $26,040 appears likely in the short term.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.