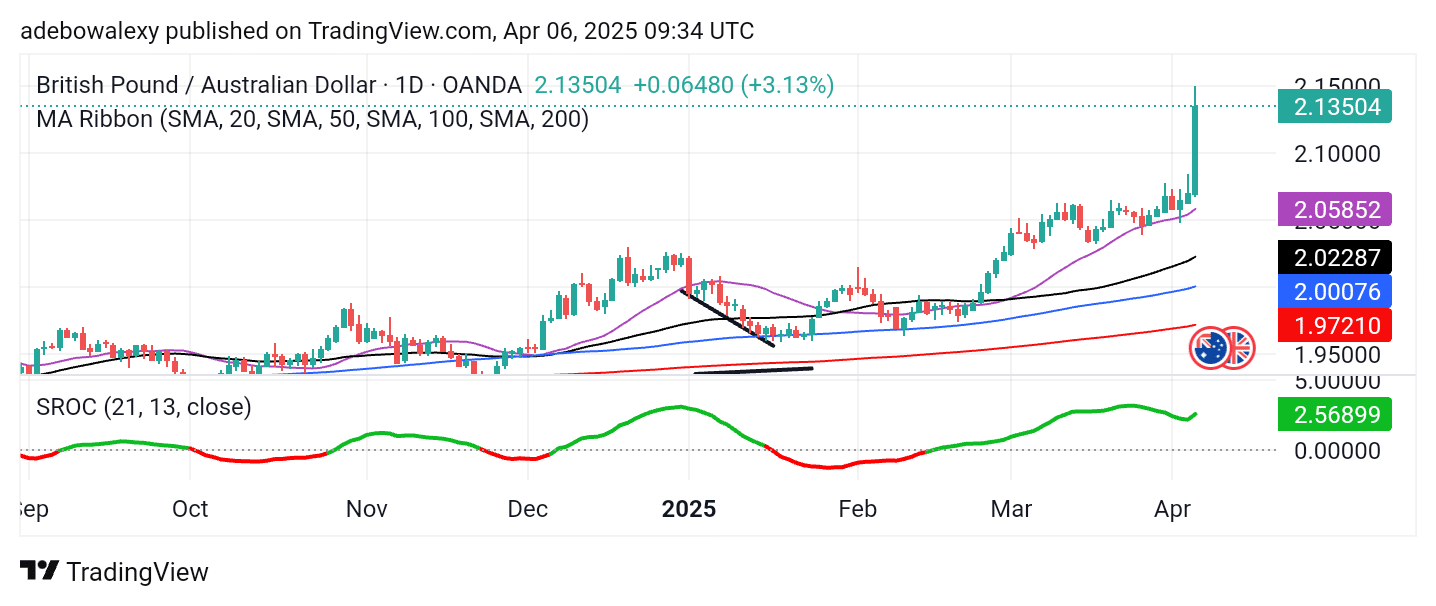

While the British pound remains calmer, the Australian dollar appears to be more active—but on a negative front. This contrast led to a significant price surge in the GBPAUD market on Friday. The surge can be attributed to the negative impact of the U.S. tariff plan and plummeting oil prices on the Australian economy, which has also caused a drop in stock prices.

Key Price Levels

Resistance Levels: 2.1500, 2.2000, 2.2500

Support Levels: 2.1000, 2.0000, 1.9500

GBPAUD Bulls Break Forth

Although the GBPAUD market has been in a general uptrend, few anticipated such a strong boost in a single session. As a result, price action is now testing a long-term resistance at the 2.1500 level. At this point, the pair trades well above all the Moving Average (MA) lines, as well as multiple psychological resistance levels.

Additionally, the Stochastic Rate of Change (ROC) indicator line is above the 0.00 level and has taken a new upward path in response to the recent price movement. The upward trajectory of this indicator suggests that bullish momentum is likely to propel the market further.

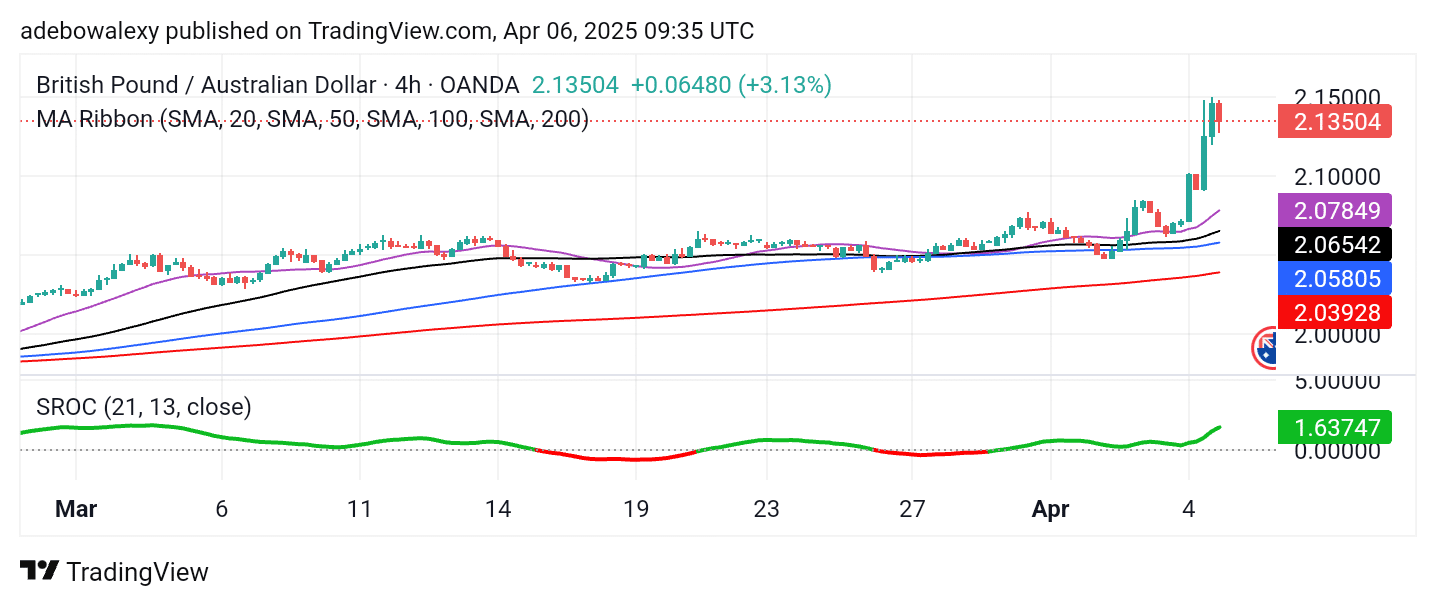

GBPAUD Consolidates at the 2.1500 Level

The 4-hour GBPAUD chart reveals that price action reached the 2.1500 level two sessions ago. However, it has since struggled to break through this resistance. That said, the Stochastic ROC line remains on an upward trajectory.

The latest candlestick on the 4-hour chart shows a downward retracement, but the pair continues to trade above all the MA lines. Consequently, despite the short-term pullback, the pair still shows potential to advance higher toward the 2.2000 level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.