A combination of adverse fundamentals continues to weigh on the broader stock market, including the Australia 200 index. From escalating tariffs on U.S. goods to declining oil prices, bearish sentiment dominates the landscape. Let’s take a closer look at the ASX 200 market in more detail below.

Key Price Levels

Resistance Levels: 7,500, 7,750, 8,000

Support Levels: 7,000, 6,750, 6,500

Australia 200 Continues Bearish Movement

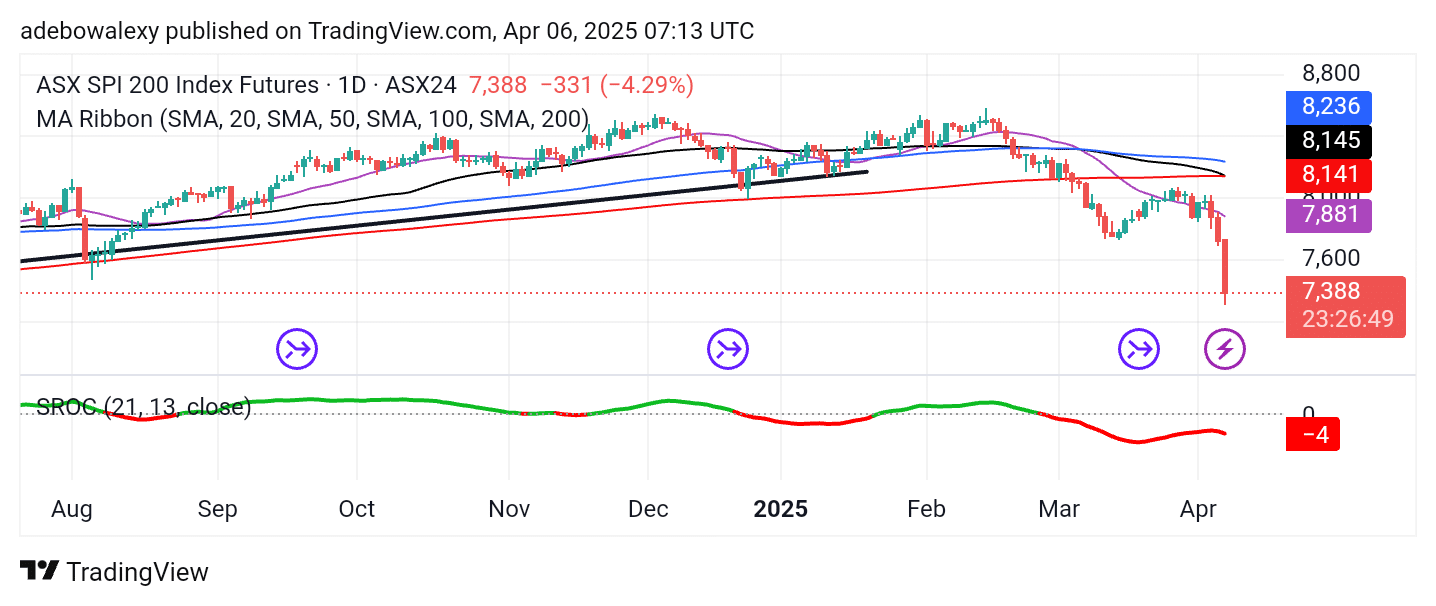

Bearish momentum appears to be intensifying in the ASX 200 daily chart. Consequently, price action is trending further downward following a brief upward retracement. The downtrend gained strength on Friday, pushing the market below the 7,600 level. The 50-day and 200-day Moving Averages (MA) are converging, potentially signaling a bearish crossover near current price activity—further supporting bearish sentiment.

Additionally, the Stochastic Rate of Change (ROC) indicator lines are sloping downward, reinforcing the prevailing downtrend. Technically, these indicators suggest that bearish pressure remains dominant and could drive prices lower in the near term.

ASX 200 Poised to Test the 7,000 Support Level

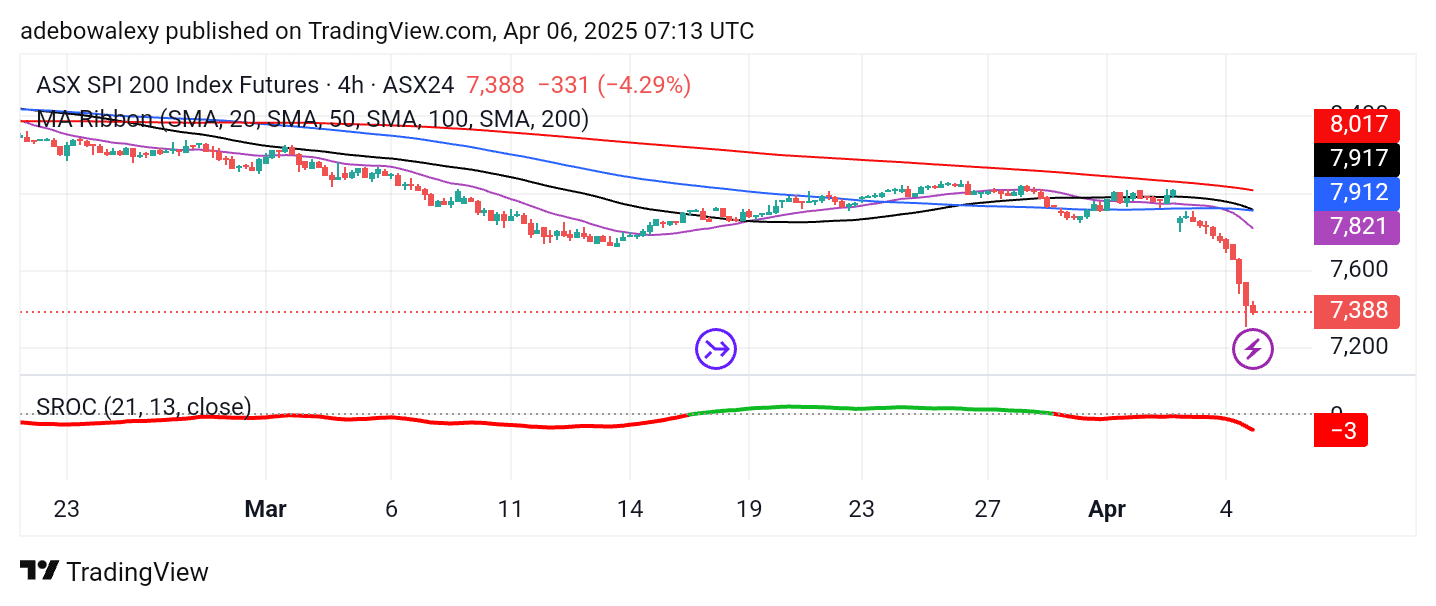

The Australia 200 market continues to show pronounced bearish progression. Price action has steadily declined with moderate momentum over an extended period and is now trading below all significant MA lines. The most recent 4-hour candlestick indicates further downward movement following a brief upward correction.

The Stochastic ROC has dipped below the equilibrium level, with both indicator lines displaying a smooth downward trajectory—signaling sustained bearish control. Traders may target the 7,200 level for short-term gains or the 7,000 mark for more extended bearish opportunities.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.