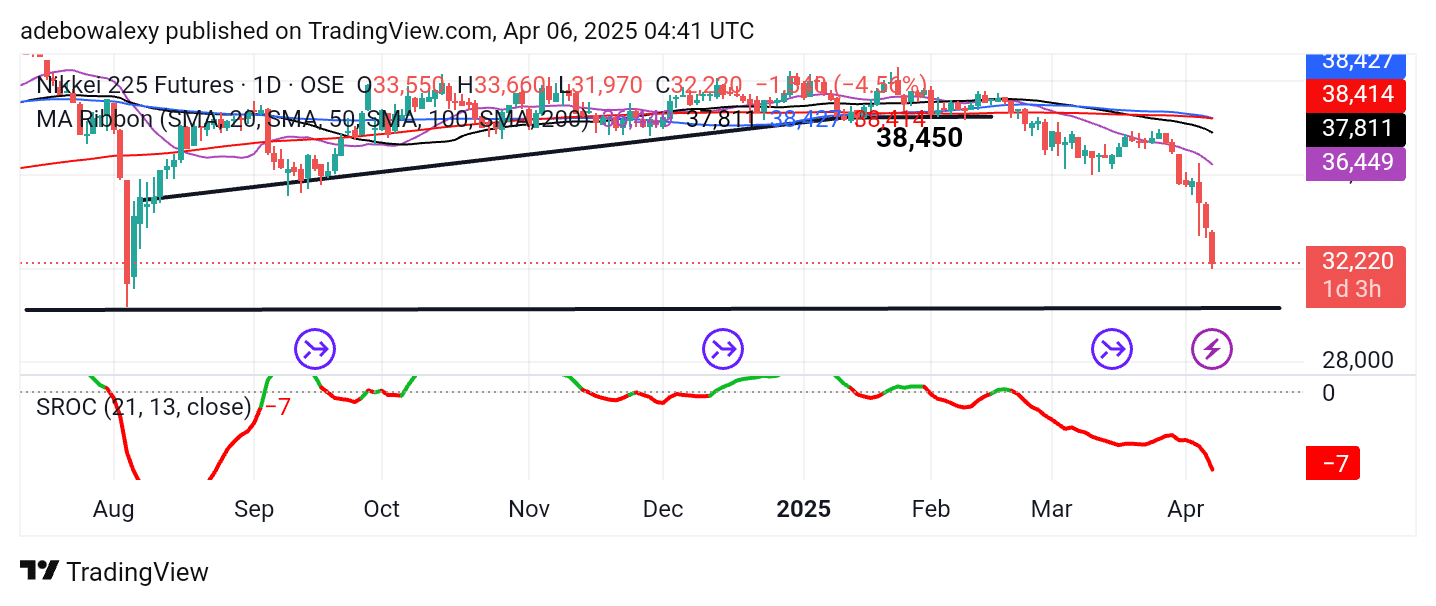

The downward correction in the Japan 225 market has continued. The bearish momentum hasn’t dwindled, judging by the appearance of the price action on the daily chart. The ongoing trend in the market seems to be aided by the impact of Trump’s tariffs, which have incited a significant selloff.

Key Price Levels

Resistance Levels: 34,000, 36,000, 38,000

Support Levels: 32,000, 30,000, 28,000

Nikkei 225 Continues to Plummet

Bears in the Japan 225 market continue to dominate. This can be seen on the daily chart through the appearance of large red price candles progressing downward, even after falling below all the Moving Average (MA) lines.

Likewise, the Stochastic Rate of Change (ROC) indicator lines have also fallen below the equilibrium level. Furthermore, the terminal end of this indicator maintains a downward trajectory, suggesting a continued oversold condition. This keeps the market falling toward a previous low that was tested last August.

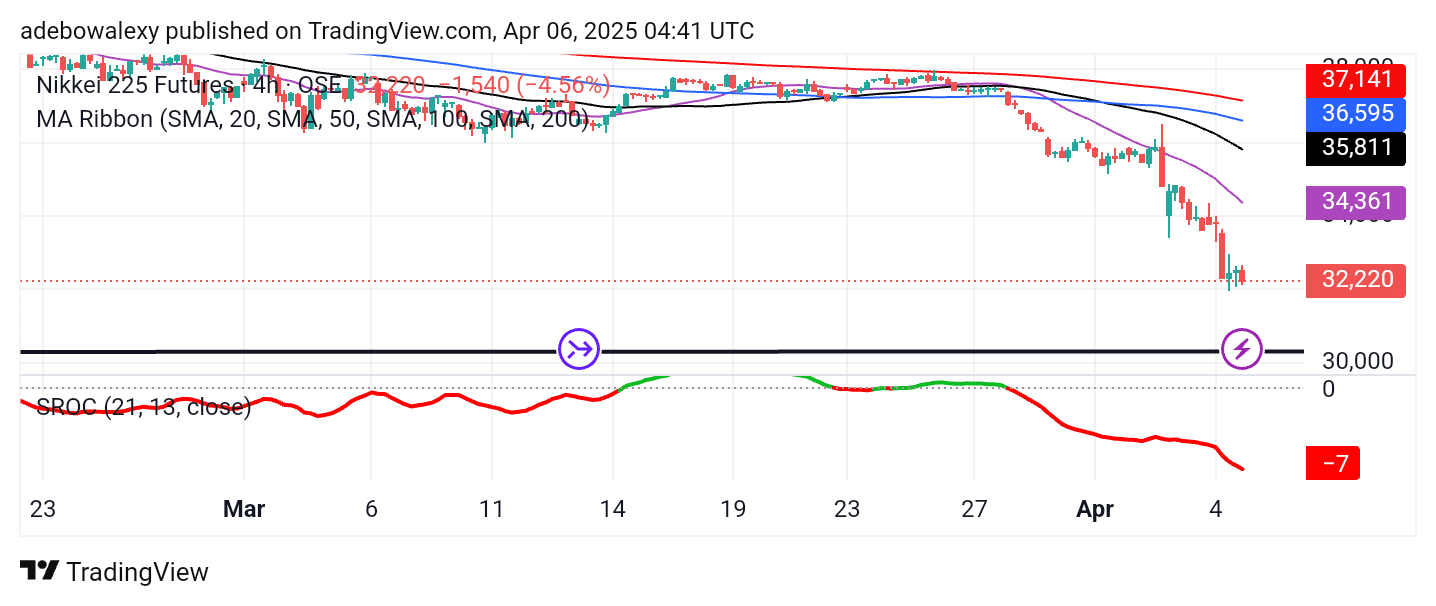

Japan 225 Bears Take a Break at the 32,000 Mark

On the 4-hour Japan 225 chart, it can be seen that price action had previously tested the 32,000 price threshold and rebounded slightly upward. However, this was only enough to keep the market consolidating briefly before resuming its downward retracement on Friday.

The last price candle on this chart remains red and significant enough to indicate that downward forces are resuming activity. Also, the market trades below all the MA lines, while the Stochastic ROC indicator line remains consistent with its downward bearing. Consequently, traders can aim at 31,000 and 30,500 targets ahead of any pending changes on the fundamental front.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.