With a handful of economic news on the way, the GBPAUD has regressed to a lower support level. Based on the behavior of price action, it appears that investors are anticipating key impetus from the RBA. The outcome of the meeting will determine whether the pair will move lower or rebound upward. Let’s examine the market further below.

Key Price Levels

Resistance Levels: 2.1500, 2.2000, 2.2500

Support Levels: 2.0000, 1.9500, 1.9000

GBPAUD Finds Solid Support

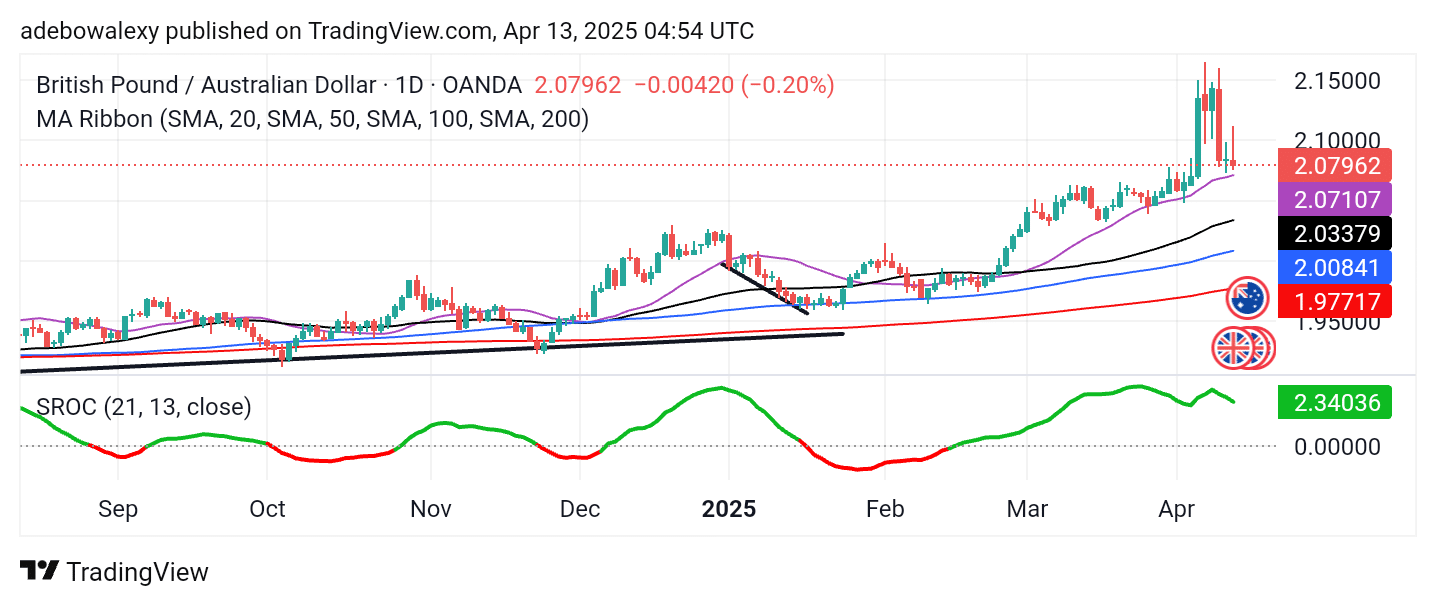

The GBPAUD market has experienced some significant price swings in recent times. This saw the market climb toward 2.1600. However, price activity soon reversed back below the 2.1500 level but currently appears to be pausing just above the 20-day Moving Average (MA) line.

Notably, this is still above all the other MA lines. Furthermore, the Stochastic Rate of Change (SROC) indicator remains above the 0.00 level, and its line stays green despite showing a slight downward trajectory. Nonetheless, upside momentum still has the potential to push prices higher.

GBPAUD Has a Short-term Bearish Path

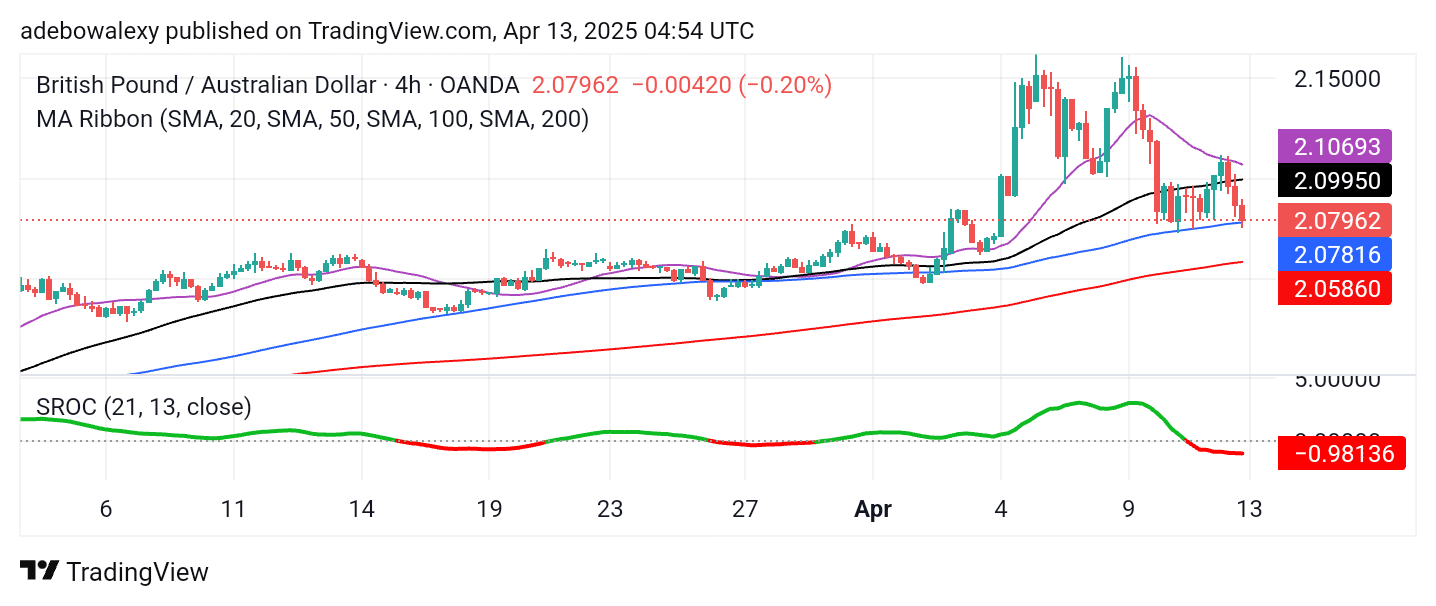

Price activity in the GBPAUD market has been trending downward with moderate momentum. As a result, price action seems to be targeting lower price levels. The pair is currently trading below the 20-day and 50-day MA lines, while the last price candle stands just above the 100-day MA line.

In addition, the SROC indicator line has fallen below the 0.00 level, and the end of the indicator line is now red, indicating prevailing bearish market forces. Therefore, prices may soon retrace toward the 2.0500 price level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.