EURUSD Price Analysis – May 3

Euro remains on the defensive after dips were contained above the 1.2000 level early during Monday European session. The EURUSD holds low at 1.2013 as buyers struggle to retake control of the trend. Concerns about Europe’s recovery, as well as hawkish Fed remarks, may hold the pair under pressure.

Key Levels

Resistance Levels: 1.2190, 1.2150, 1.2100

Support Levels: 1.2000, 1.1950, 1.1900

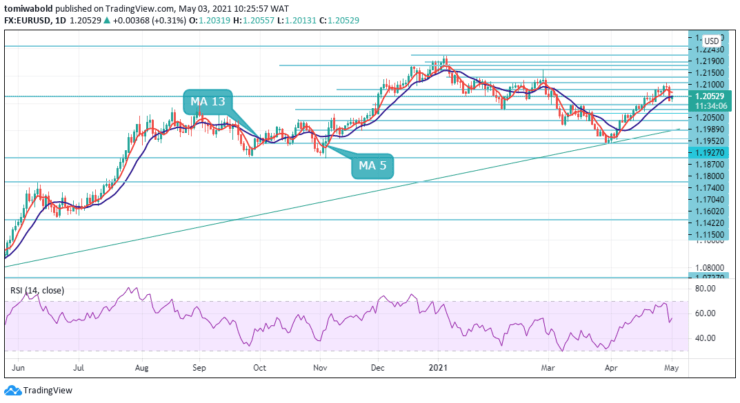

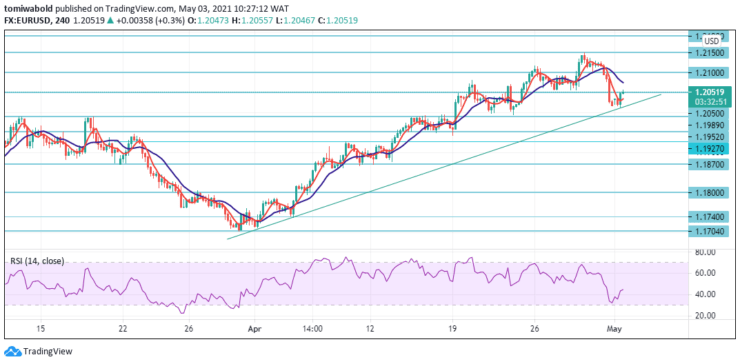

On a daily time frame, the EURUSD looks fragile, and a consolidation beneath 1.2000 could set the stage for more losses. Deviation from levels above 1.2100, which marks the upper limit of a broad range, can pick up speed. The 1.2000 level could be approached if the daily close is below the moving averages of 13.

Following the drop, the EURUSD may encounter relative resistance in the 1.2075 moving average 5 price range, where it had made intraday highs on April 20 before a pullback. If the pair continues to rise above the listed resistance area, it could attempt to flip the April 29 resistance into support and reach year-over-year highs of 1.2243 to 1.2350.

Further to the withdrawal from the 1.2150 and 1.2100 regions, EURUSD’s corrective downside could extend to new lows beneath the 1.2000 regions until reaching the 1.1870 level’s contention field. The EURUSD intraday bias remains in a range as the earlier rebound from the 1.1702 level continues even though weak.

On the plus hand, a break of the 1.2100 level could confirm that the consolidation from the 1.1702 level may continue from 1.2050. A further rise is expected to retest the 1.2150 high level. Meanwhile, a break of the 1.2000 support level might move the bias to the downside, extending the range and triggering a new declining period.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.