Investors are closely monitoring the Euro’s movements as anticipation builds around the European Central Bank’s (ECB) imminent decision on interest rates. The Euro managed to gain ground against the US Dollar, reflecting the keen interest in the ECB’s upcoming announcement.

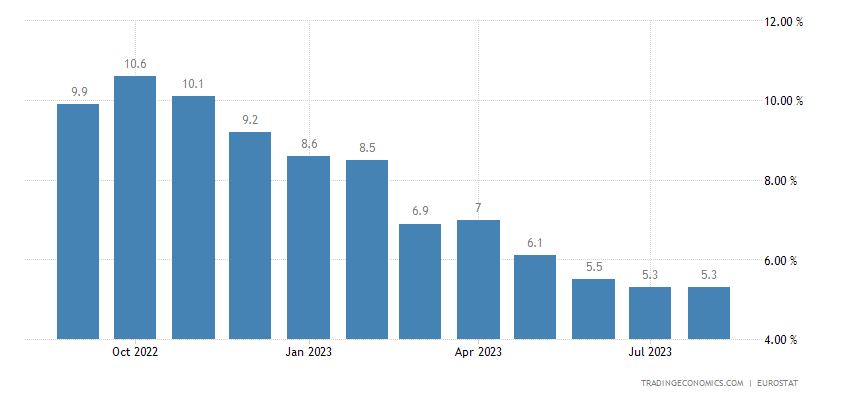

The ECB faces a challenging situation, torn between the surging inflation rate in the Eurozone, which currently sits at the 5.3% mark, surpassing the 2% ECB target.

Analysts’ predictions vary; some foresee a 25-basis-point rate hike, spurred by a Reuters report hinting at a revision of next year’s inflation forecast. Conversely, others advocate caution, suggesting the ECB may delay any rate increase until it observes more robust, sustainable economic growth and inflationary pressures.

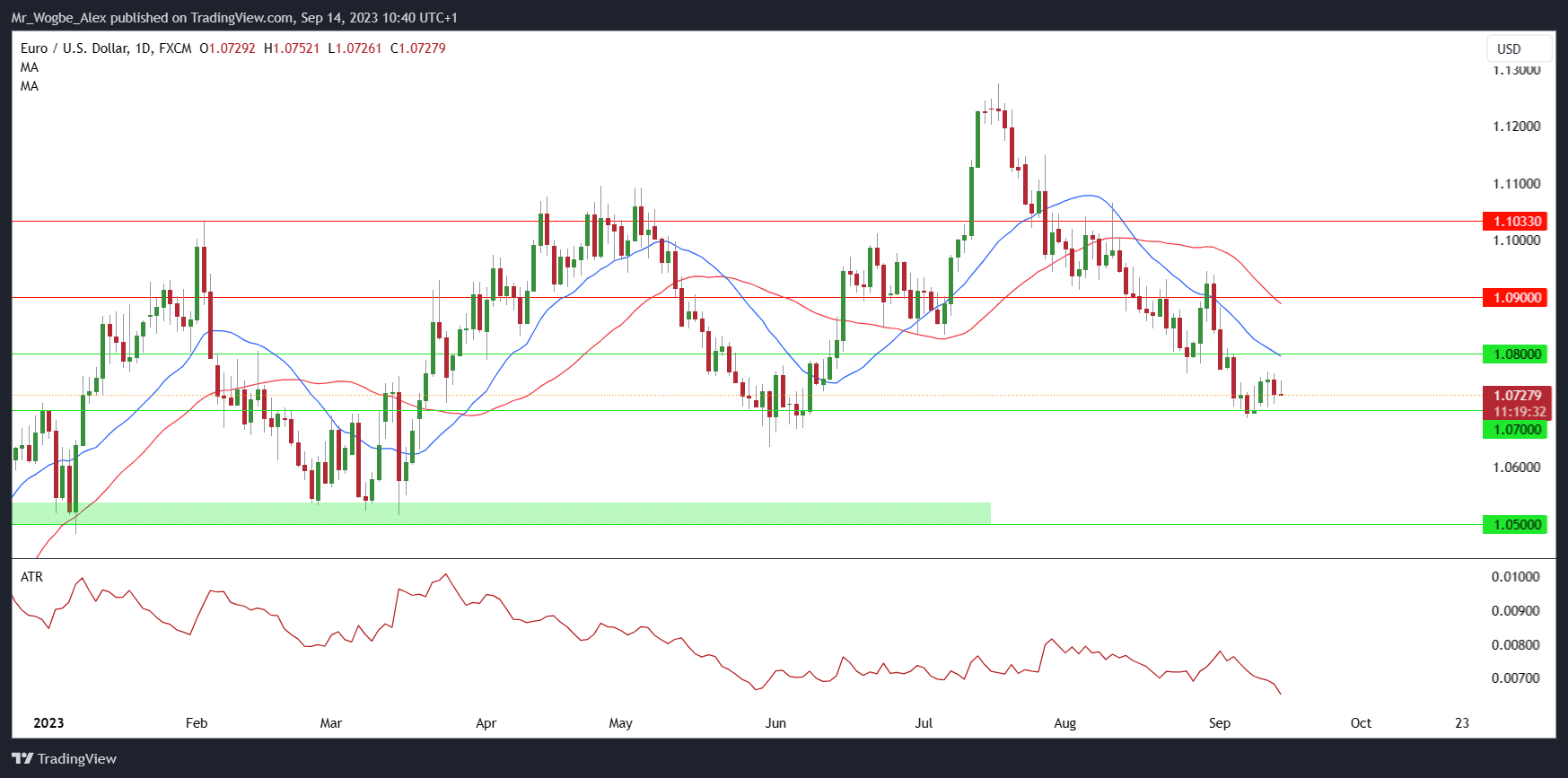

Euro Rebounds from Weekly Low

As of now, the Euro is trading at $1.0733, a modest 0.04% rise compared to its close on Wednesday. Earlier in the session, it touched $1.0752, rebounding from a three-month low of $1.0685 recorded just last Thursday.

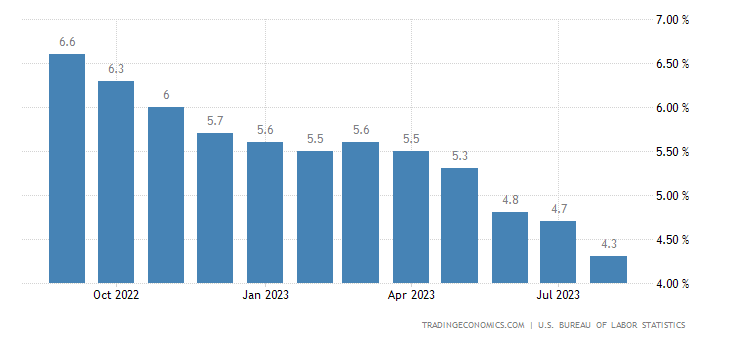

On the other side of the Atlantic, the US Dollar maintained relative stability against other major currencies. This came despite the release of US inflation data, which seemingly didn’t sway expectations for the Federal Reserve’s monetary policy.

The consensus points toward the Fed maintaining its current interest rates during its meeting on September 20th, with an announcement regarding a gradual reduction of its bond-buying program expected later in the year.

In August, the US consumer price index witnessed a notable 0.6% increase, the most significant jump since June 2022. This uptick was primarily driven by escalated costs of energy, food, and transportation. Nevertheless, core inflation, which excludes volatile items, decelerated slightly to 4.3% year-on-year from 4.7% in July.

The dollar index, which gauges the greenback against a basket of six major currencies, remained steady at 104.73.

As the ECB’s decision looms and economic data continues to unfold, the Euro’s fate remains in the balance, with traders and investors watching closely for cues on the path of Eurozone monetary policy.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.