The Esya Centre, a prominent technology policy think tank based in New Delhi, has shed light on the unintended consequences of India’s crypto tax policies, which include a 30% tax on profits and a 1% tax deducted at source (TDS) on all transactions.

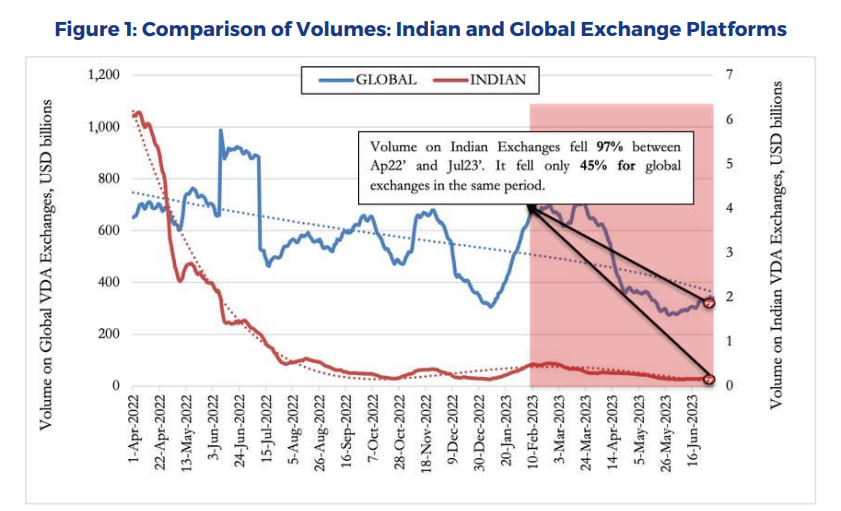

According to their study titled “Impact Assessment of Tax Deducted at Source on the Indian Virtual Digital Asset Market,” the introduced Tax Deducted at Source (TDS) has driven away a staggering 5 million crypto traders from local to international exchanges since its implementation in July 2022.

The study indicates a significant loss of potential revenue, estimating it at a substantial $420 million for the government. Contrary to its intended objectives of curbing speculation and enhancing transparency in the crypto market, the TDS appears to have fallen short, primarily because offshore exchanges remain untouched by the tax and do not share transaction data with Indian authorities.

Esya Centre Proposes Possible Solutions

To address these concerns and revitalize the domestic crypto industry, the study proposes a two-fold solution. Firstly, it recommends a reduction in the TDS rate to a mere 0.01%, aiming to make local platforms more attractive for crypto traders. This, the study suggests, could potentially boost the government’s revenue while fostering a more favorable environment for the industry.

Secondly, the Esya Centre urges the government to clarify the applicability of TDS to offshore platforms, emphasizing the need for international cooperation and agreements. Such clarity would not only benefit the Indian authorities but also contribute to the traceability of transactions.

Since the announcement of Finance Minister Nirmala Sitharaman’s crypto tax plans in February 2022, the domestic crypto industry has vehemently opposed the measures, warning of potential sector collapse and business relocations. Despite this, the Finance Ministry has yet to respond to the study or address the concerns raised by stakeholders, according to CoinDesk

As the crypto landscape in India undergoes significant shifts, the call for urgent reforms echoes through the industry, emphasizing the delicate balance between regulation and fostering a thriving digital asset market.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.