In a recent announcement reported by Reuters, Bank of Japan (BOJ) Governor Kazuo Ueda revealed the central bank’s cautious stance on withdrawing its ultra-easy monetary policy. The move is aimed at preventing potential disruptions in the bond market.

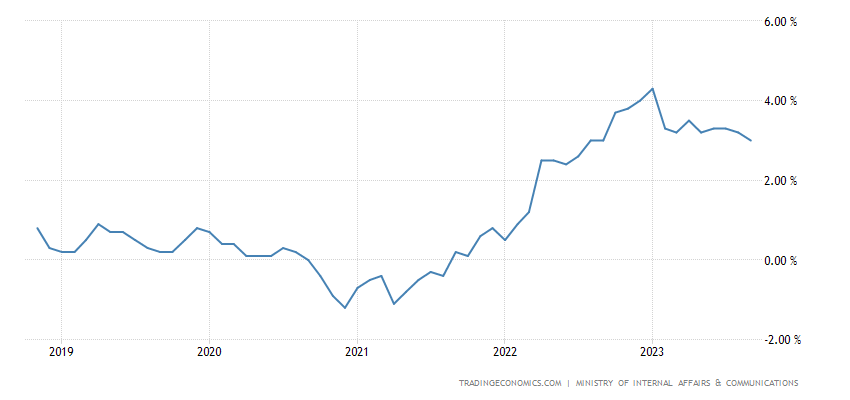

Ueda acknowledged Japan’s progress towards the BOJ’s 2% inflation target, citing rising wages and domestic demand-driven inflation gaining momentum. Despite the positive signs, he highlighted the existing gap between current inflation levels and the targeted 2%, emphasizing that the BOJ has not finalized its strategy for ending policy measures.

The BOJ’s yield curve control (YCC) framework, designed to maintain a 0% 10-year government bond yield and -0.1% short-term interest rates, has recently fueled speculation about a potential unwind of the massive stimulus program.

Ueda stressed the need for a careful approach to avoid causing significant volatility in the bond market during the exit. Speaking at an online conference hosted by the Financial Times, he expressed the BOJ’s desire to navigate the exit without creating disruptions.

The governor also highlighted the consideration of the impact on financial institutions, borrowers, and aggregate demand when normalizing short-term interest rates. Ueda noted that Japan’s underlying inflation, excluding temporary factors, still slightly lags below 2%, indicating that sustained inflation would require wages to surpass the 2% mark.

BOJ Is Keeping an Eye on Currency-Inflation Dynamic

Addressing potential risks to the inflation outlook, Ueda mentioned factors such as the U.S. economic situation and the fate of China’s economy. In response to inquiries about exchange-rate movements, he stated that the BOJ would analyze how currency rates impact inflation and output and respond accordingly.

As the BOJ revises its inflation forecasts upward, Ueda’s careful and deliberate approach signals a commitment to economic stability amidst the evolving financial landscape. Investors and stakeholders are keenly watching for further developments as Japan navigates the delicate balance between economic recovery and policy adjustments.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.