The U.S. dollar showcased a resilient performance on Friday, bolstered by a noteworthy uptick in producer prices during July. This development triggered an interesting interplay with the ongoing speculation surrounding the Federal Reserve’s stance on interest rate adjustments.

The Producer Price Index (PPI), a key metric gauging the cost of services, surprised markets with its robust acceleration, marking the sharpest climb in nearly a year. According to Reuters, this unexpected surge created a ripple of uncertainty among traders, notably highlighted by the Japanese yen crossing the crucial threshold of 145 yen for 1 U.S. dollar—a level that had previously prompted Japan’s intervention in September 2022.

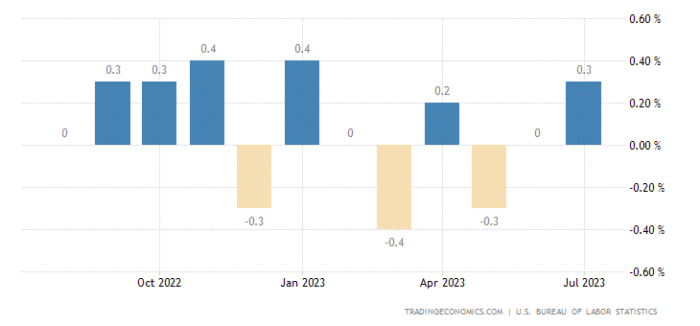

According to insights from the Labor Department, the PPI for final demand demonstrated a 0.3% increase. Interestingly, this figure was accompanied by a revision for June’s data, revealing that the PPI remained unchanged instead of the initially reported 0.1% uptick.

In a broader time frame, the PPI showcased a notable 0.8% gain over the 12 months leading up to July. This growth marked a substantial leap from the prior month’s 0.2% increase. Intriguingly, economists’ predictions, as gathered by Reuters, closely aligned with these figures, foreseeing a monthly climb of 0.2% and a year-on-year advancement of 0.7%.

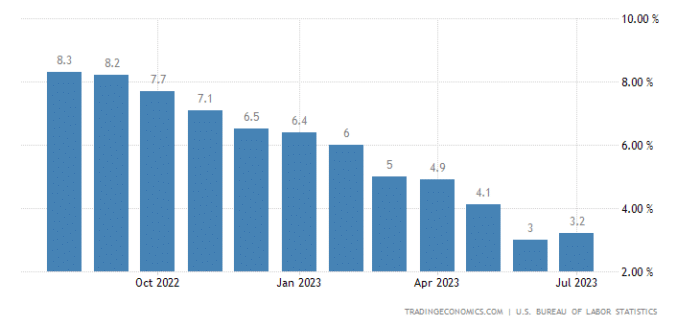

Turning our attention to the Consumer Price Index (CPI) data unveiled on Thursday, we find that consumer inflation maintained a steady trajectory, with a 0.2% increase for the previous month, mirroring June’s growth rate. However, the year-long span leading up to July bore witness to a more significant upswing, with the CPI registering an impressive 3.2% increase.

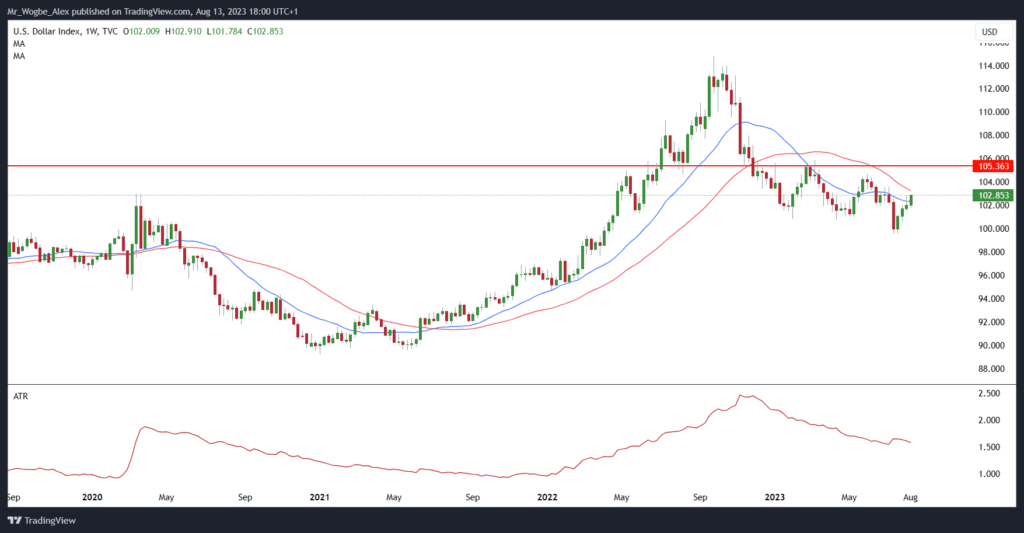

Dollar Records Fourth Straight Weekly Gains

Propelling this upward momentum, the dollar index (DXY), a measure of the dollar’s performance against six major international currencies, posted a commendable 0.21% ascent. Remarkably, this surge marked the fourth consecutive week of gains, amassing an overall rise of about 2.9% following its recovery from a 15-month low observed in mid-July. This resurgence was notably underpinned by robust indicators emanating from the U.S. labor market.

As we take stock of the situation, traders are already predicting an 82.5% probability that the Fed will retain its benchmark interest rate within the existing range of 5.25–5.5% during the forthcoming September policy meeting. This is according to data from the CME Group FedWatch tool.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.