The U.S. dollar has shown its mettle once again, staging a remarkable recovery from a recent one-week low on Monday. This resurgence follows a nuanced U.S. jobs report that graced headlines on Friday, deftly redirecting market attention toward the imminent release of inflation data from the globe’s two largest economies.

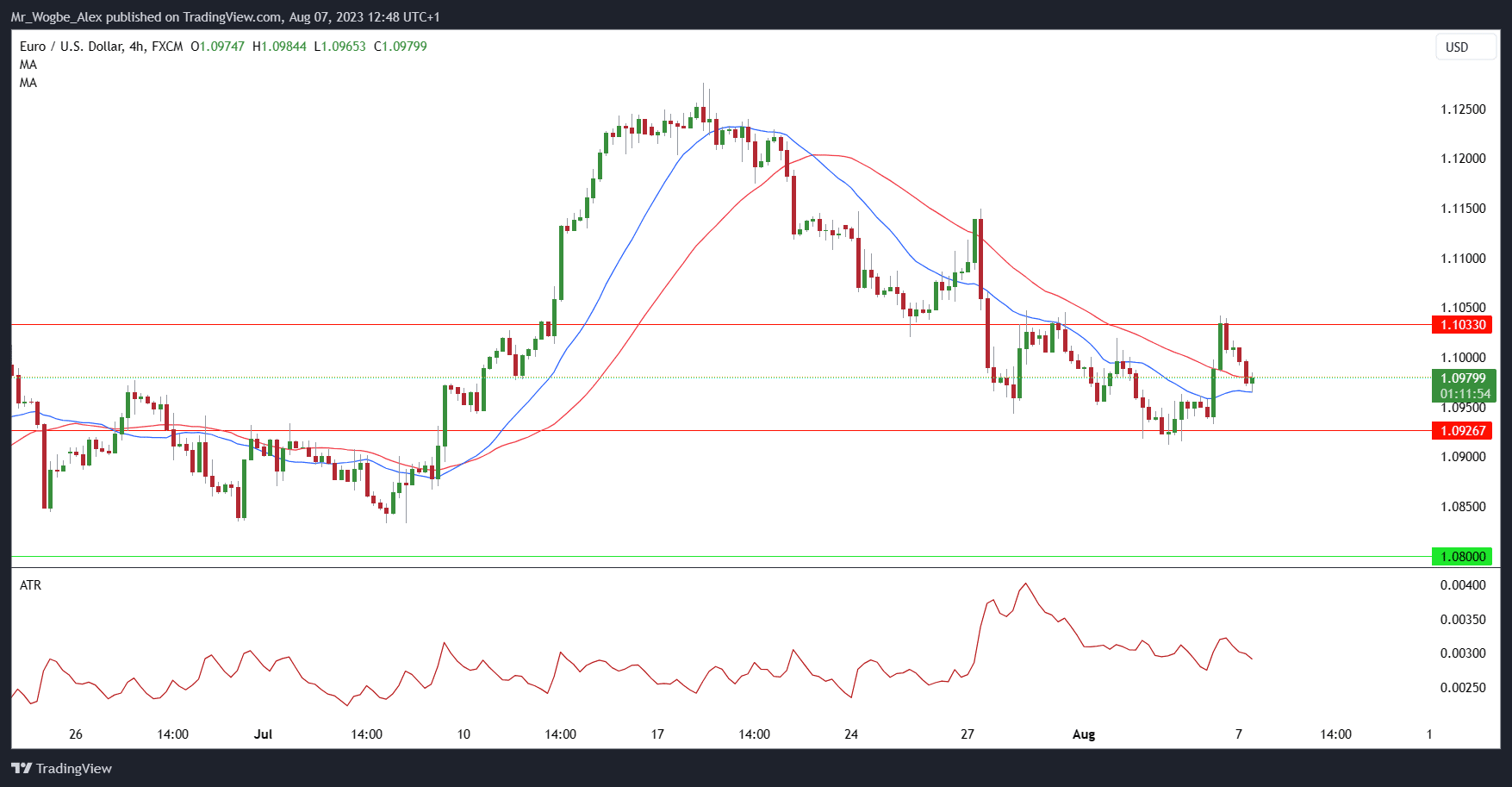

The euro, on the other hand, encountered headwinds as it weakened in the wake of Monday’s revelations. Emerging data painted a less-than-rosy picture for Germany, with industrial production for June plummeting more steeply than analysts had previously envisaged. According to Reuters, this setback underscored the formidable challenges confronting the manufacturing sector, set against the backdrop of a broader downturn within Europe’s largest economy.

Dollar Stages Mild Reversal on Monday

The U.S. dollar orchestrated a rebound today despite the less-than-stellar job growth figures for July. These figures, while below expectations, contained encouraging elements in the form of sturdy wage gains and a simultaneous dip in the unemployment rate. Such favorable nuances could potentially steer the Federal Reserve toward contemplation of an extended period of elevated interest rates.

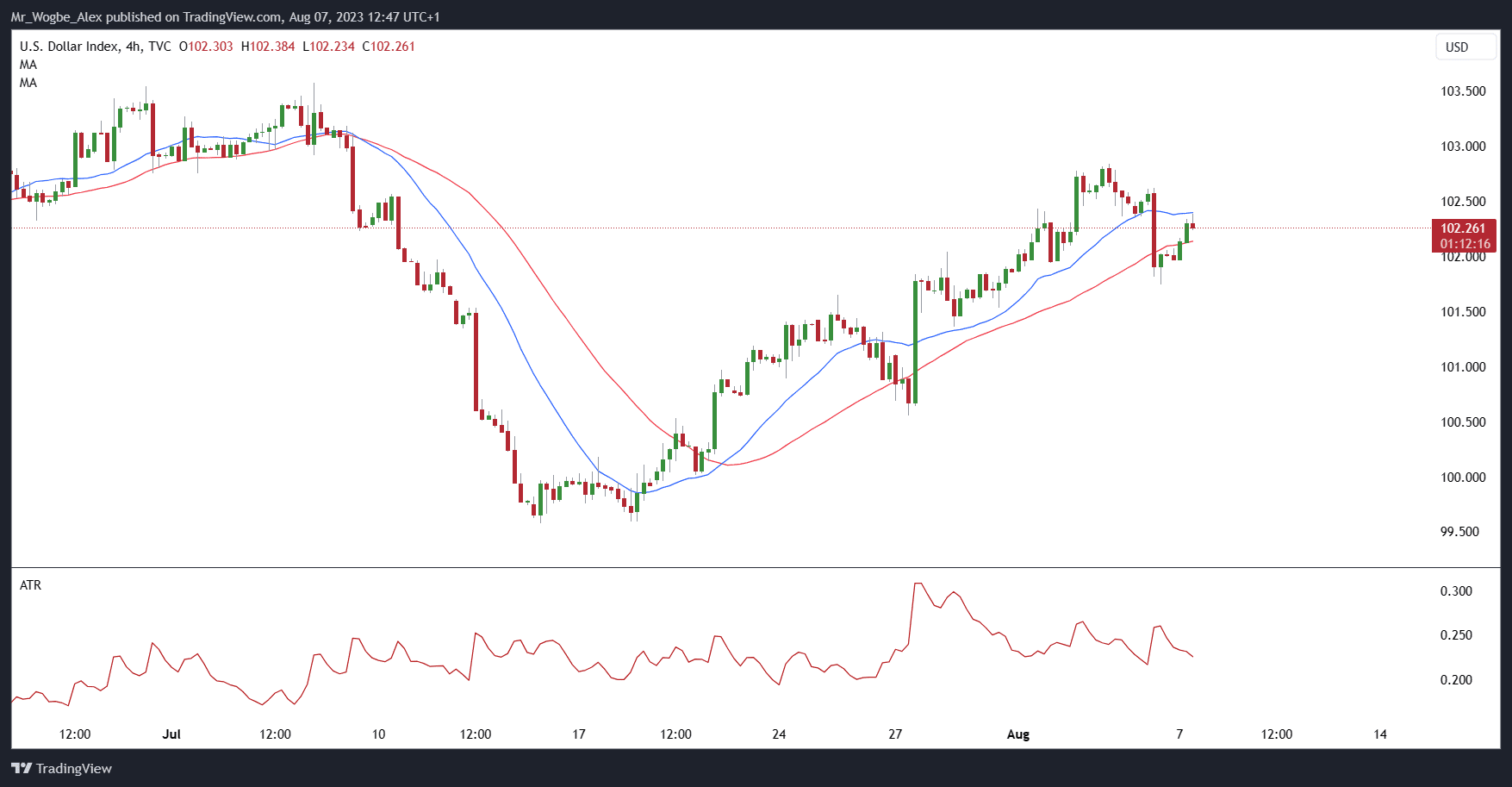

Stepping back to survey the larger canvas, the U.S. Dollar Index, a yardstick that measures the greenback’s strength against a basket of prominent currencies, demonstrated an impressive resurgence. This notable uptick of 0.25%, propelling the index to 102.38, signifies a clear departure from the nadir witnessed at 101.74 last week.

In juxtaposition, the euro faced headwinds, ceding ground against the dollar with a 0.30% dip, bringing it tantalizingly close to a one-month low at $1.0965.

Traders Turn Focus to U.S. Inflation Data

Eager eyes are now trained on Thursday’s horizon, awaiting the release of U.S. inflation data for July. Early projections coalesce around an annual core inflation rate of approximately 4.7%, adding a palpable layer of intrigue to the unfolding financial narrative.

As we traverse the week, all ears and screens will also remain attuned to China’s impending inflation figures for July, slated for unveiling on Wednesday. This event holds considerable significance, as the global community keeps a watchful eye for potential signals of deflation within the world’s second-largest economy.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.