In a week marked by robust U.S. economic performance, the dollar has continued its upward trajectory, showcasing resilience in contrast to its global counterparts. Central bankers’ cautious approach to rapid interest rate cuts has tempered market expectations, fostering the greenback’s ascent.

Dollar Index Surges to 1.92% YTD

The dollar index, a gauge measuring the currency against six major counterparts, has marked a 0.88% gain this week, contributing to an overall increase of 1.92% for the year. Closing the week at a steady 103.32, the index underscores the dollar’s robust standing in international markets.

The euro, constituting a significant portion of the dollar index, faced a 0.55% loss this week, attributed to the eurozone’s struggle with sluggish growth and inflation. As of Friday, the euro showed marginal improvement at $1.0889.

Japan’s yen, grappling with economic challenges and a recent earthquake, recorded a 5.07% loss against the dollar this year. On Friday, the yen remained unchanged at 148.18 following data revealing a dip in Japan’s core inflation rate to 2.6%, the lowest since June 2022.

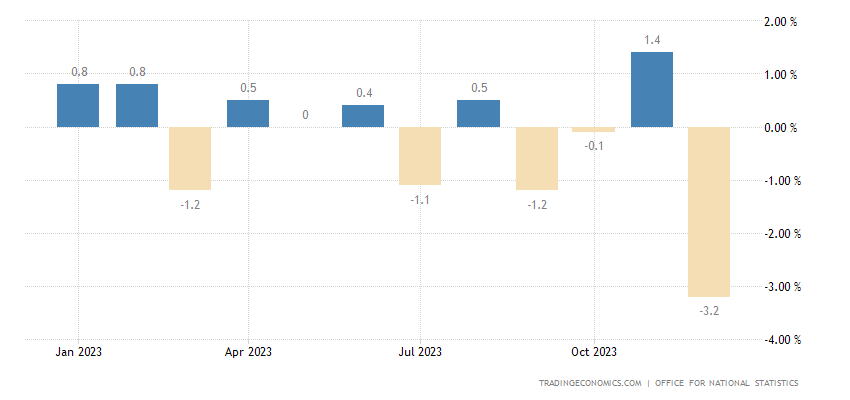

The pound also experienced a decline this week, dropping 0.16% to $1.2684 on Friday. U.K. retail sales plummeted by 3.2% in December, amplifying concerns about the British economy.

Fed’s Rate Cut Projections Get Shaky

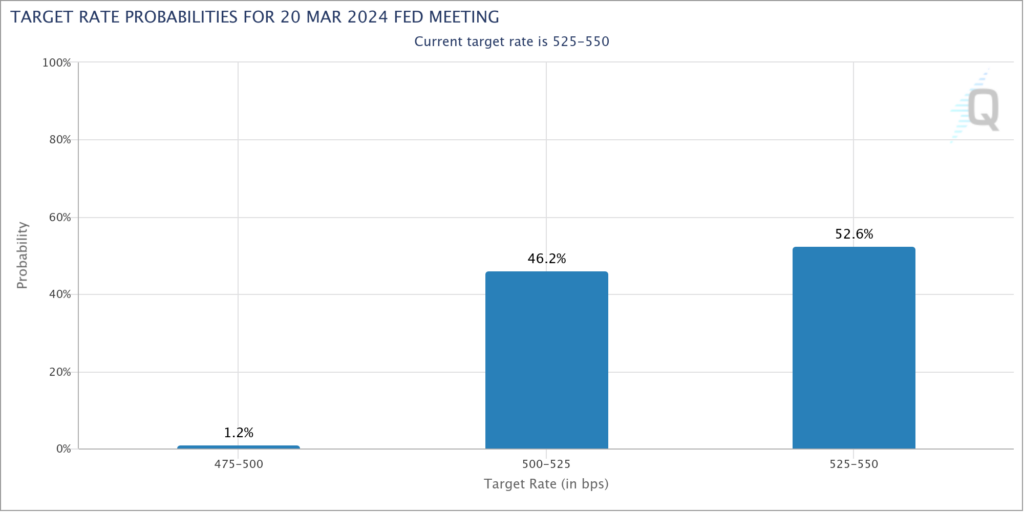

Amidst these global shifts, investors have recalibrated expectations for aggressive Federal Reserve rate cuts. Anticipating 140 basis points of cuts this year, down from 165 a week ago, and revising the probability of a March cut from 77% to 46%, investors respond to the outperformance of the U.S. economy.

Thursday’s U.S. labor market data, revealing the lowest weekly jobless claims in 1 1/2 years, has reinforced the case for a robust American economy. Federal Reserve official Christopher Waller emphasized the need for a cautious and deliberate approach in light of the economy’s strength, countering expectations of precipitous rate declines.

Meanwhile, the Australian dollar, typically buoyed by increased risk appetite, experienced a 1.45% decline this week, landing at $0.6588 and remaining 3.26% lower for the year. The market continues to navigate uncertainties, closely monitoring global economic dynamics that influence the dollar’s performance.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.