In response to disappointing Chinese economic data and mixed signals from global central banks, the dollar experienced a robust surge against major currencies on Wednesday, reaching its highest level in a month.

The dollar index, gauging the greenback against a basket of six currencies, climbed by 0.32% to 103.69, marking its zenith since December 13. Today’s surge marks the dollar’s fifth consecutive bullish daily performance this month.

According to Reuters, this upswing in the dollar’s value is partly attributed to remarks made by Christopher Waller, a Federal Reserve official, who emphasized the proximity of the U.S. economy to the Fed’s 2% inflation target.

Waller advised against hastily lowering the benchmark interest rate, instigating a shift in market expectations of a Fed rate cut in March from 75% to 60%, according to CME’s FedWatch Tool.

Higher interest rates often attract investors seeking superior returns, fostering an environment conducive to the dollar’s appreciation.

Dollar Gains Support from Weak Chinese Economic Data

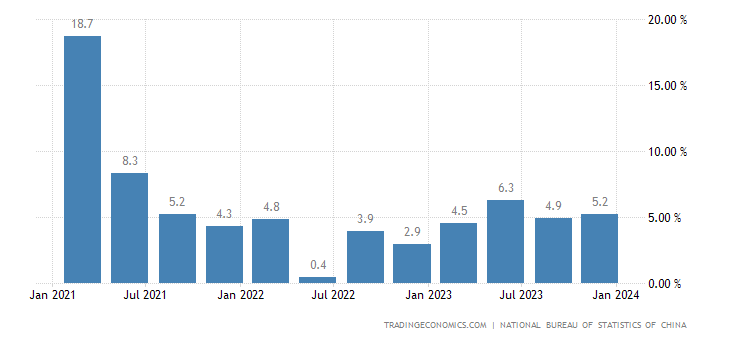

Simultaneously, the dollar found support in weak economic data from China, the world’s second-largest economy. Indicating a growth rate slowdown to 5.2% in 2023, slightly above the official target but below market expectations, China’s economic indicators, including declining industrial production and retail sales, contributed to the dollar’s ascent.

Against the Japanese yen, sensitive to interest rate fluctuations, the dollar reached its highest point since early December, trading at 148.52, marking a 0.77% increase. Similarly, the Australian dollar, linked to the Chinese economy, dipped to its lowest level since December 7, trading at $0.6538, a 0.7% decline.

The offshore yuan also faced the dollar’s prowess, reaching a two-month high of 7.2321. Likewise, the euro, the European Union’s currency, dropped to $1.0845, continuing yesterday’s 0.7% drop.

Amid uncertainties in the eurozone characterized by sluggish growth and low inflation, the dollar is poised to maintain its strength in the short term.

Meanwhile, investors keenly await more clarity from global central banks and a clearer economic outlook for 2024.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.