The U.S. dollar flexed its muscles against the euro and the yen on Thursday, reaching a one-month peak against the Japanese currency. This surge followed the release of inflation data by the U.S. Bureau of Labor Statistics, defying market expectations and throwing the Federal Reserve’s interest rate cut plans into uncertainty.

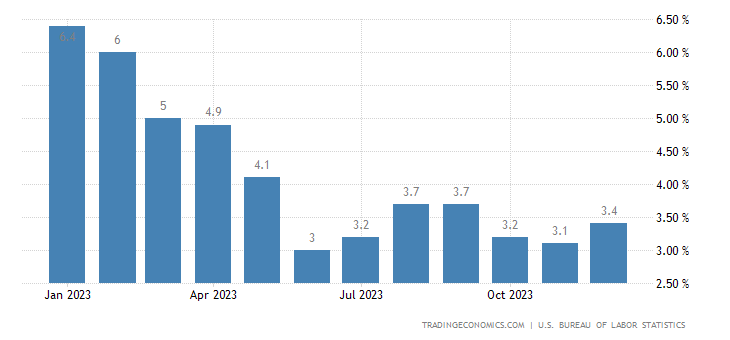

The Consumer Price Index (CPI), a key measure of price changes for goods and services, demonstrated a robust increase of 0.3% in December, surpassing economists’ predictions of a 0.2% rise. On an annual basis, the CPI recorded a noteworthy surge of 3.4%, exceeding the forecast of 3.2%.

The primary impetus behind this inflationary surge was the escalating cost of housing, particularly rents, driven by a scarcity of rental units. Core inflation, excluding food and energy prices, remained resilient at 3.9% year-on-year, albeit slightly down from November’s 4.0%.

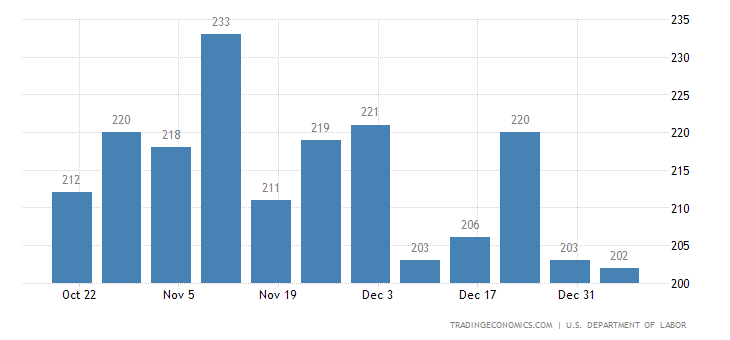

Interestingly, this inflationary surge diverged from the labor market report, revealing a decrease of 1,000 in Americans filing for unemployment benefits, marking the lowest level since mid-October. This resilience in the labor market amid the challenges posed by the pandemic and supply chain disruptions adds complexity to the Federal Reserve’s decision-making.

The mixed economic signals have placed the Federal Reserve in a delicate position, torn between the imperative to curb inflation by raising interest rates and the need to support economic recovery and the labor market.

Markets are increasingly speculating that the central bank may have to act sooner than anticipated, with futures pricing in a high probability of a rate cut in March, followed by subsequent cuts throughout the year.

Dollar Index Performance

The dollar index, gauging the greenback against six major currencies, saw a robust 0.44% increase to 102.76 on Thursday, up from approximately 102.20 before the data release. Among the major currencies, the euro, constituting the largest weight in the dollar index, experienced a 0.13% dip to $1.0958.

Simultaneously, the yen, typically viewed as a safe-haven currency in times of uncertainty, ceded ground to the dollar, sliding 0.14% to 145.55, hitting its lowest level since December 11.

The intricate dance between economic indicators leaves markets eagerly anticipating the Federal Reserve’s next move in the coming months.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.