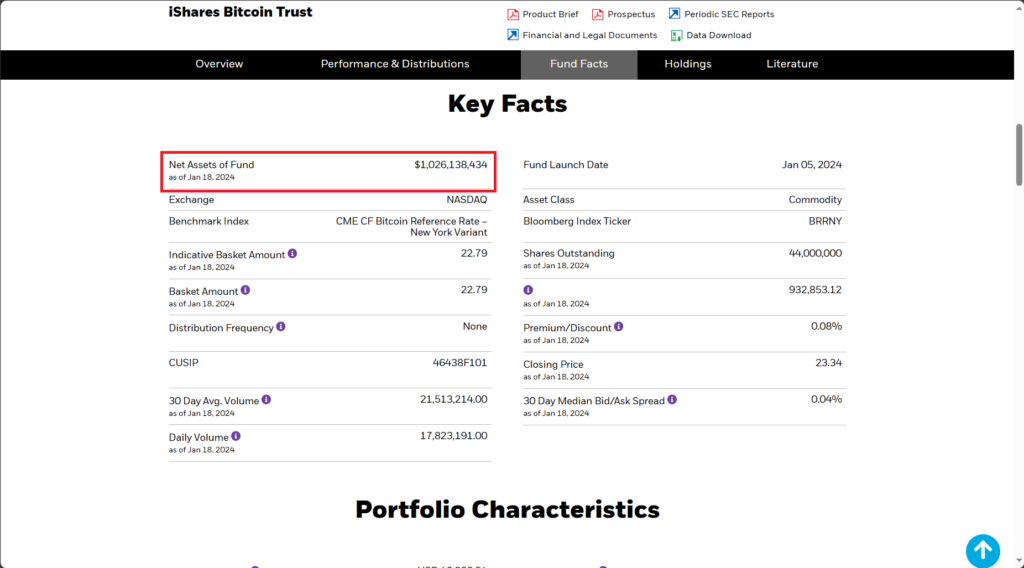

BlackRock, the world’s largest asset manager, has seen its iShares Bitcoin ETF (IBIT) amass a staggering $1 billion in assets under management (AUM) within just four days of hitting the market, as reported by Reuters.

The iShares Bitcoin ETF was quick to capitalize on the U.S. Securities and Exchange Commission’s (SEC) recent approval of nearly a dozen ETFs tracking the spot price of bitcoin, signaling a pivotal moment for the cryptocurrency market.

The SEC’s decision has effectively dissolved years of regulatory ambiguity, providing mainstream investors with a clear avenue into the dynamic world of digital assets.

BlackRock Wins the Race to $1 Billion in Inflows

Leading the charge in attracting investor interest, BlackRock and Fidelity, renowned asset managers, have emerged as frontrunners among the newly approved ETFs. Their appeal lies in lower fees and established reputations, with the iShares Bitcoin ETF securing $1.02 billion in AUM as of January 19, closely followed by Fidelity’s Wise Origin Bitcoin ETF at $875 million.

The collective influx into the nine newly approved ETFs has surpassed expectations, boasting an impressive $2.90 billion in investment flows during the initial four trading days. This surge underscores the resounding demand for these innovative financial products.

However, not all ETFs have experienced similar success. The Grayscale Bitcoin Trust, having transitioned from a closed-end fund to an ETF, faced significant outflows totaling $1.62 billion due to its comparatively higher fees.

U.S. Bitcoin ETFs Usurp Global Market Shares from Europe and Canada

Beyond the financial metrics, the launch of U.S. spot bitcoin ETFs has reverberated globally, affecting European and Canadian bitcoin exchange-traded products (ETPs). The introduction of U.S. products has triggered notable outflows from these regions, as some institutional investors shift strategies to embrace the regulatory clarity and convenience offered by domestic options.

Luke Nolan, a research associate at CoinShares, told The Block that U.S. institutions, previously exploiting price differentials between European ETPs and the bitcoin futures market, may now find executing trades domestically both easier and more cost-effective.

Cointucky Derby – Day 4 Flow Update

No data from the US as trading is still open. Data is available for Europe, where people are switching away from the high fee Bitcoin ETPs

$30m outflow today accross the 4 largest European products and $106m outflow in total pic.twitter.com/syJ6N4KrrD

— BitMEX Research (@BitMEXResearch) January 17, 2024

As the U.S. spot bitcoin ETFs reshape the landscape, providing a regulated pathway for investors to engage with digital currencies, the industry faces both challenges and opportunities. The intense competition and innovation ignited by these developments are poised to redefine the dynamics of the crypto market.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.