In a remarkable display of strength, the U.S. dollar is scaling new heights, leaving its global counterparts struggling to keep pace. This surge is driven by a combination of factors, creating ripples across international markets.

At the core of the dollar’s ascent are real interest rates. Unlike nominal rates, these account for inflation, and they are declining faster in Europe than in the United States. This makes the dollar an increasingly attractive choice for investors.

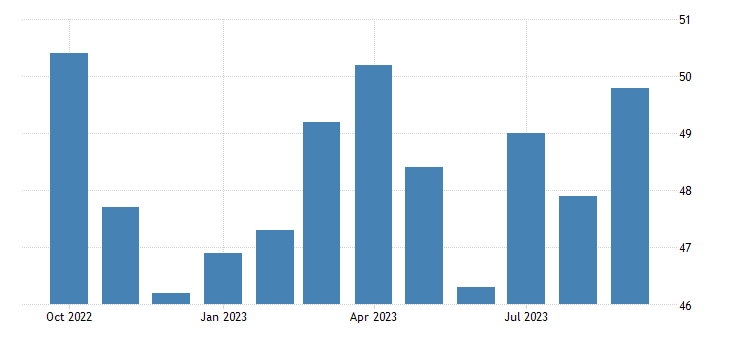

The dollar’s momentum is further bolstered by robust U.S. economic data. Recent manufacturing data has been particularly impressive, reinforcing market confidence. Federal Reserve officials have also signaled a commitment to maintaining tight monetary policies for the foreseeable future.

Euro, Pound, and Yen Suffer

The euro has tumbled to $1.0448, its lowest point since December 2022, following indications from the Federal Reserve that it intends to keep monetary policy stringent. Similarly, the pound has weakened to 1.2052, its lowest level since March.

Across the pond, the yen teeters near 150 per dollar, a precarious threshold that could trigger intervention by Japanese authorities to curb its depreciation. Earlier today, the single currency protruded above the 150 mark but was swiftly rejected.

Dollar Index Hits Multi-Month High

The Dollar Index, measuring the greenback against six major currencies, reached 107.348, a peak unseen since November 2022. Market focus now shifts to the eagerly anticipated U.S. labor market data, which could provide further fuel to the dollar’s rally if it exceeds expectations.

Emerging markets are feeling the squeeze as higher borrowing costs and capital outflows become a reality. Additionally, the strong dollar is bearing down on commodity prices, which are primarily denominated in dollars.

The greenback’s strength is a testament to the resilience of the American economy and its ability to outperform its rivals.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.