In the third quarter of 2023, the Japanese yen faced significant pressure against the U.S. dollar due to contrasting monetary policies adopted by the Federal Reserve and the Bank of Japan.

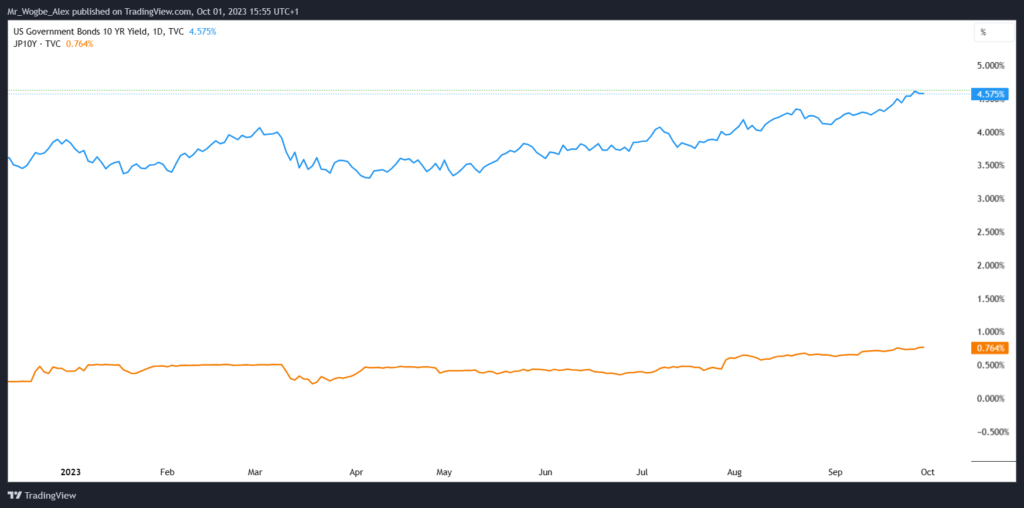

The Federal Reserve has taken a proactive stance in combating inflation by raising interest rates. This aggressive approach has seen its benchmark rate reach its highest point since 2002. Furthermore, U.S. Treasury yields have surged to multi-year highs.

In stark contrast, the Bank of Japan has maintained its ultra-easy monetary policy. Fearing potential disruptions to its efforts to combat deflation, the BoJ has refrained from tightening its policies. Even though the Consumer Price Index (CPI) has consistently exceeded its 2.0% target for over a year, the BoJ remains committed to its negative interest rate policy.

As a result of these divergent policies, the USD/JPY pair soared near the critical 150.00 level in late September. This marked its highest point in nearly a year, underscoring the dominance of the U.S. dollar in the market.

Outlook for the Yen in Q4

Looking ahead to the fourth quarter, analysts believe that the yen may continue to weaken initially. The Fed is poised to hike rates once more and signal a commitment to maintaining higher rates. However, the yen might gain support later in the quarter as the Bank of Japan hints at a potential policy shift by year-end.

According to DailyFX, BoJ Governor Kazuo Ueda has suggested a willingness to consider raising interest rates if stable inflation is confirmed by consumer price data.

This hints at a potentially volatile period for the yen as the market eagerly anticipates and reacts to policy developments from both central banks. Depending on the evolution of the Fed-BoJ policy gap in the coming months, the USD/JPY pair could see new highs or lows.

Interested in becoming a Learn2Trade Affiliate? Join us here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.