Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Going by metrics, most of the trending coins have gained considerable traction both today and over the past 7 days. However, some of these coins have been more profitable than others. Let’s look into each of them.

Bitcoin (BTC)

Major Bias: Bullish

Bitcoin has regained the top spot on this week’s list of trending cryptocurrencies, moving one step upward from the second position on last week’s list of the best-performing cryptocurrencies. BTC has moved by 0.77% today and by a more significant increase of 1.75% over the past two days. Meanwhile, this coin has seen trading volumes of $5.83 billion and $528 billion. On the daily chart, during the past two trading sessions, there was a significant pump off the middle limit of the Bollinger Bands indicator.

There was an instantaneous, minimal downward correction. However, the ongoing trading has seen the recovery of the previously incurred losses, refocusing price movements toward the upside. Also, the Relative Strength Index (RSI) indicator lines are still rising steeply upward, below the 80 mark. Technically, the market’s momentum is near being overextended. Therefore, we can anticipate the market to still trade above the $27,000 mark, but not too far from this support.

Current Price: $26,991

Market Capitalization: $528 billion

Trading Volume: $5.83 billion

7-Day Gain/Loss: 1.75%

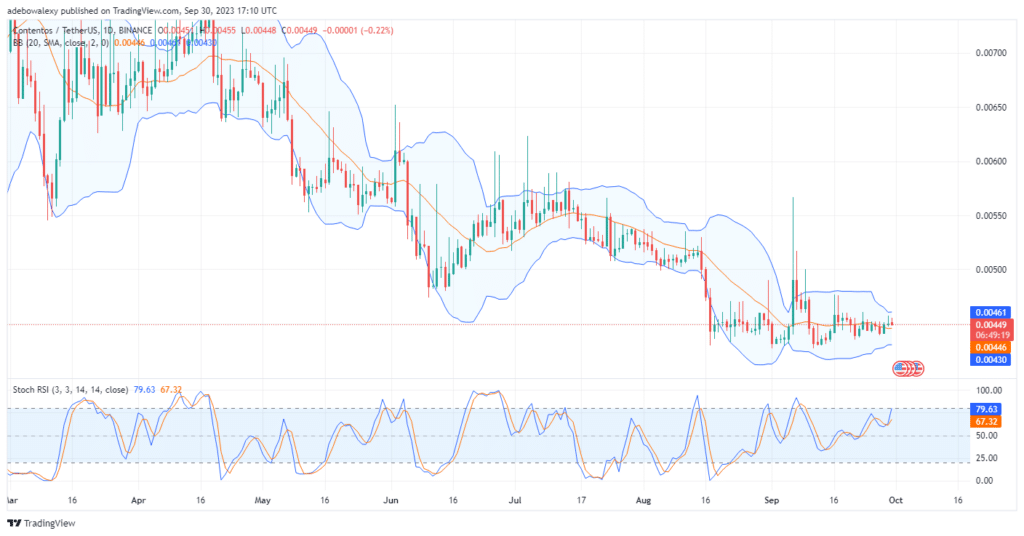

Contentos (COS)

Major Bias: Bearish

Contentos has appeared in the second spot of this week’s trending coin. For a long time, this coin hasn’t appeared here but has been able to make it to the spotlight this week. This coin has seen an additional price increase of 0.52%, while it has seen the same magnitude of price increase over the past seven days. Also, COS has seen a daily trading volume of $1.7 million and a market capitalization of $18.81 million.

On the daily market, price action has crossed above the middle limit of the Bollinger Bands. However, there was an instantaneous rejection, which offered a negative correction to price movements. Nevertheless, the RSI maintains that bullish momentum is still building up. Combined with the position of price action in this market, it is more likely that buyers will regain more upside traction for a continued upside correction towards the $0.004700 mark.

Current Price: $0.00449

Market Capitalization: $18.81 million

Trading Volume: $1.7 million

7-Day Gain/Loss: 0.23%

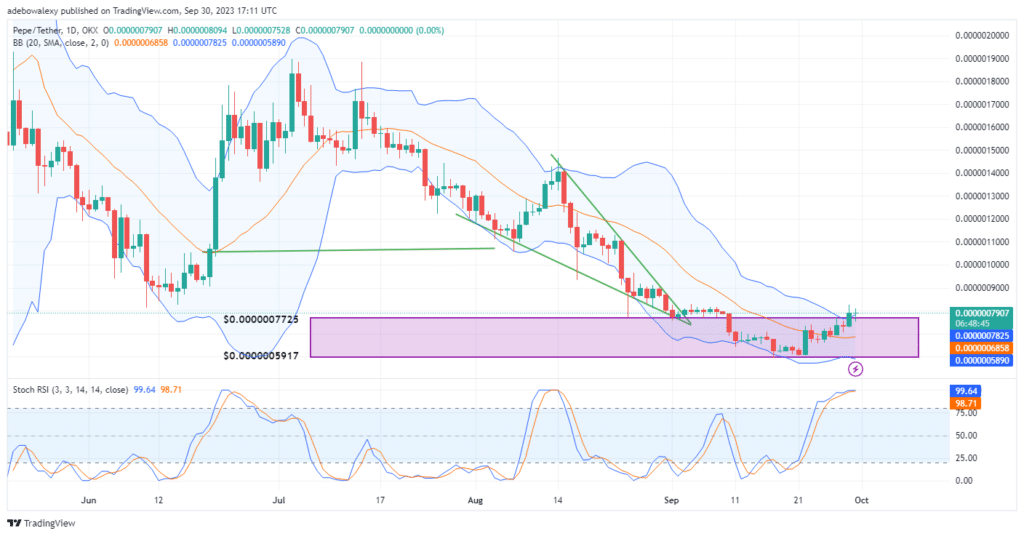

Pepe (PEPE)

Major Bias: Bullish

In the third position comes Pepe, after being able to wrestle up some profits, which saw the market gain about 17.60% while having printed a price increase of just 1.07% today. The market capitalization of this token stands at $310.50 million, with a trading volume of $64.20 million. The price activity of this token on the daily market has been able to exist, trading between $0.0000005917 and $0.0000007725.

Although shaky, another trading session has commenced outside the mentioned price range in favor of continued upside moves. Nevertheless, it should be noted that RSI lines have both reached the overbought region and have a very small distance between them, showing that these bulls can easily be overwhelmed by downward forces at this point. Nevertheless, traders anticipating a continued upside correction towards the $0.0000008000 should set in place a comfortable exit plan.

Current price: $0.0000007907

Market Capitalization: $310.50 billion

Trading Volume: $64.20 million

7-Day Gain/Loss: 17.60%

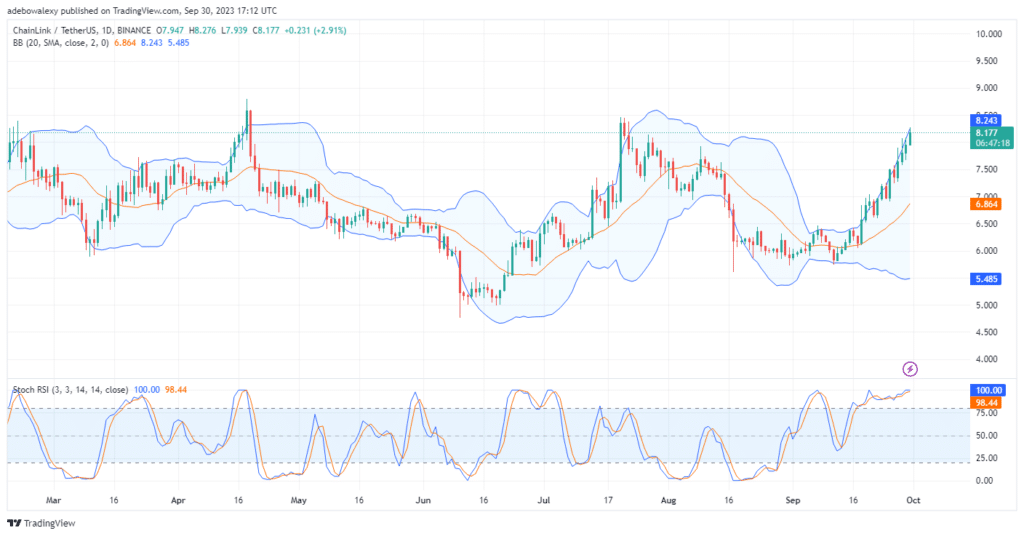

Chainlink (LINK)

Major Bias: Bullish

Chainlink has risen to the 4th position on this week’s list of trending coins. Considering the number of price movements experienced by the token over the past seven days, this token comes in second after its prices increased by 16.38% over the past seven days and an additional movement of 5.36% in today’s trading session. On the daily chart, LINK’s price action has been approaching higher marks in a somewhat moderate and stepwise manner.

Consequently, this has allowed price action to significantly swell the Bollinger Band’s envelope without a significant downward correction. Nevertheless, the lines of the RSI indicator have risen into the overbought region. This showed that the market has witnessed extended bullishness. The RSI lines haven’t indicated that a bearish crossover may occur; therefore, this crypto may continue to trade towards the $8.50 price level.

Current price: $8.18

Market capitalization: $4.56 billion

Trading volume: $299 million

7-Day Gain/Loss: 16.36%

Terra Classic (LUNC)

Major Bias: Bullish

The Terra Classic Token hangs in the fifth position on this list, possessing a market capitalization of $370 million and a trading volume of $12.52 million. Also, LUNC has printed a gain of 2.32% and 7.74% over the week. On the daily market, a downward correction occurred off the upper limit of the Bollinger Bands indicator.

This happened over the past two trading sessions; nevertheless, the ongoing session has shown that buyers may be making a stand above the middle band of the Bollinger Bands indicator, which technically hints that prices may move upwards. Also, the RSI indicator lines are now trending downward, which is contrary to the activities on the daily chart. Therefore, anticipating a continued upside correction towards the $0.0000700 mark seems a bit dicey.

Current Price: $0.00006340

Market Capitalization: $370 million

Trading Volume: $12.52illion

7-Day Gain/Loss: 7.74%

Do you want to take your trading to the next level? Join the best platform for that here.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.