Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Pepe, though far from what could be called a chief of crypto, has displayed some audacity by displacing the king of crypto from the top of trending coins. Meanwhile, there have been some new additions to this list, as some coins that have been seen here for a while have appeared on it. Let’s see how the price action of these tokens may develop shortly.

Pepe (PEPE)

Major Bias: Bearish

Pepe has regained the top spot on the weekly trending coins list, dethroning Bitcoin from that spot last week. PEPE has moved more significantly today than in the past 7 days. This token has printed a price increase of 11.63% today while recording a loss of just above 0.60% over the past 7 days. Its market capitalization has also reached a value of $268.40 million and a trading volume of $152.98 million. On the daily chart, price action in the Pepe market has trickled into the price range of $0.0000007723 and $0.0000005917.

However, in the previous session, there was a rebound, and price action corrected toward the resistance at the $0.0000007723 mark. Nevertheless, the ongoing session has brought the price of this token back below the middle limit of the Bollinger Bands. On the contrary, the Relative Strength Index (RSI) lines remain pointed towards the overbought zone. Consequently, there is a possibility of price action resuming an upside correction towards the $0.0000007723 mark.

Current Price: $0.0000006875

Market Capitalization: $268.40 million

Trading Volume: $152.98

7-Day Gain/Loss: 0.60%

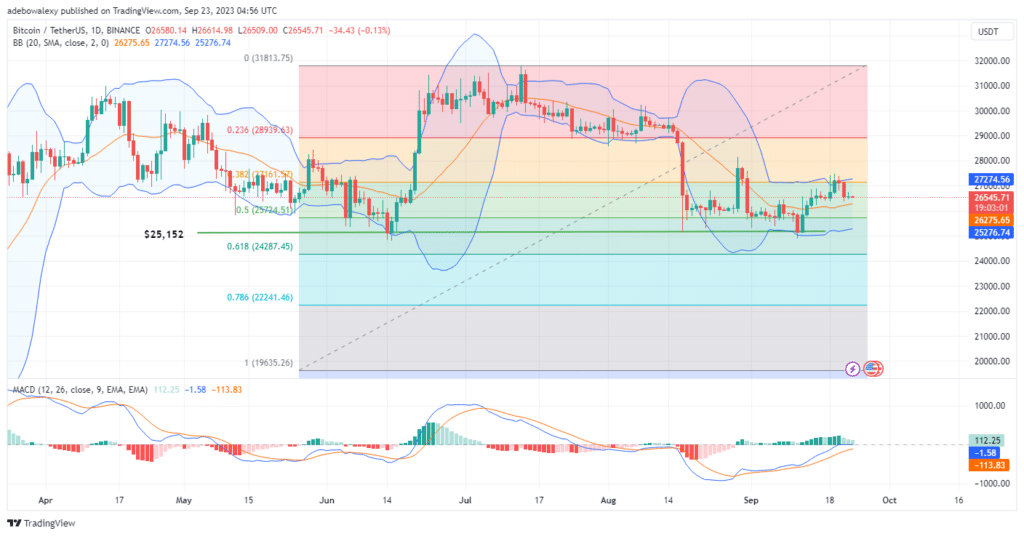

Bitcoin (BTC)

Major Bias: Bearish

Bitcoin stands in the second position on this list of trending coins. As of today, the king of crypto has seen a price decline of 0.37% while printing a loss of 0.23% over the week. Meanwhile, the token’s market capitalization stands at $517.55 billion, with a trading volume of $10.21 billion. The daily chart for this coin showed that price action had retraced the 38.20 Fibonacci Retracement level as a resistance but corrected towards support after just pipping through that level.

This caused the token to trade below the $27,000 mark. Additionally, the Moving Average Convergence Divergence MACD is showing that headwinds may be getting stronger in this market. This is revealed as the bars of the indicator are now pale green and are getting shorter. Consequently, it is reasonable to anticipate a downward correction towards the $26,000 mark in this market.

Current Price: $26,545

Market Capitalization: $517.55 billion

Trading Volume: $10.21 billion

7-Day Gain/Loss: 0.23%

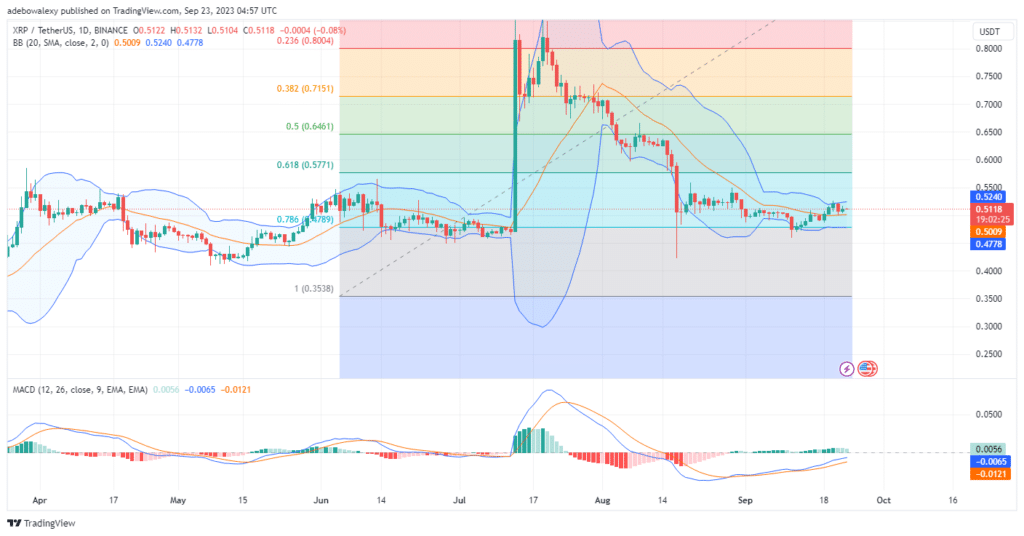

XRP

Major Bias: Bearish

And in the third position comes XRP, with a market capitalization of $27.27 billion and a trading volume of $668.38 million. However, the token has only printed a loss of 0.17% today and a profit of 2.20% over the past 7 days. The price action of this token crossed above the middle limit of the Bollinger Bands about four trading sessions ago.

But shortly after it touched the ceiling of the Bollinger Bands, it rebounded downward towards the middle of the Bollinger Bands. Also, it could be observed that the Bollinger Bands have narrowed significantly. Combining this with the current position of price action in this market, it could be inferred that this token may gain some considerable upside traction towards the $0.5500 mark.

Current price: $0.5118

Market Capitalization: $27.27 billion

Trading Volume: $66838 billion

7-Day Gain/Loss: 2.20%

LOOM Network (LOOM)

Major Bias: Bullish

LOOM Network token, a token entering the list of trending coins perhaps for the first time in a long time. This token possesses a market capitalization of $134.96 million and a 24-hour trading volume of $445.76 million. Meanwhile, it has seen a price increase of 136.43% over the past 7 days, while it has seen an additional 57.29% in today’s trading session.

The token’s daily chart has revealed that the token is massively bullish, as its price continues to rise upwards even outside the uppermost band of the Bollinger Bands indicator. However, the ongoing session has seen some strong restraints as the body of the last price candle has contracted significantly. This is pointing out that price action is facing some opposition. But on the contrary, we can see that the MACD indicator maintains that the upside retracement may continue towards the $0.1200 mark.

Current price: $0.1102

Market capitalization: $134.96 million

Trading volume: $445.76 million

7-Day Gain/Loss: 136.43%

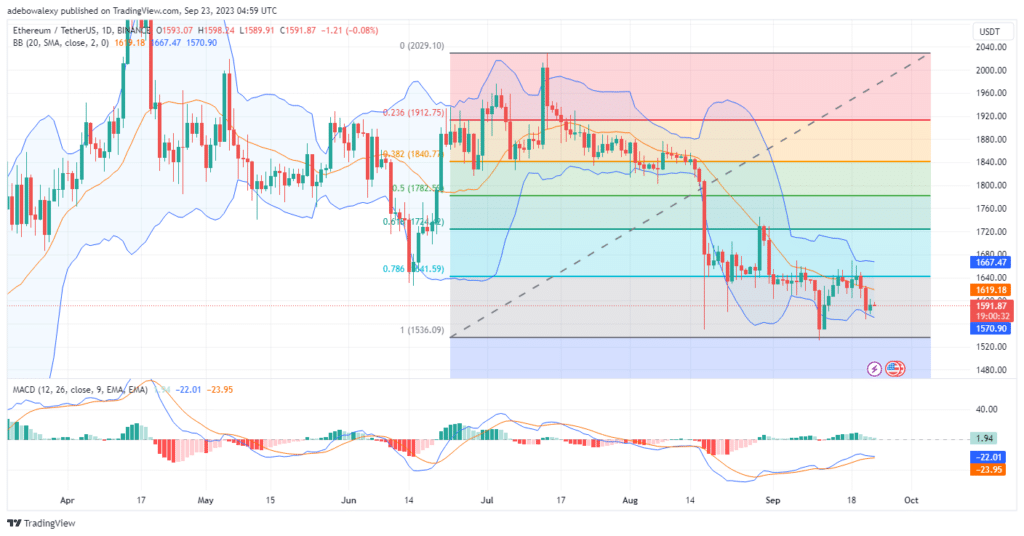

Ethereum (ETH)

Major Bias: Bearish

Ethereum comes last on this week’s list of trending coins. This is happening when crypto has remained largely bearish over the past seven days. This is revealed through its statistics, as it has seen a price decline of roughly 3% over the past seven days and an additional 0.12% today. Nevertheless, this token has one of the largest market capitalizations at $191.44 billion, second only to that of Bitcoin. It also has a daily trading volume of $3.24 billion.

On the daily market, its price action has touched down on the lowest limit of the Bollinger Bands, but there was only a very minimal correction off that part of the indicator. While trading activities in this market remain below the MA line of the Bollinger Bands, another bearish price candle has appeared, signaling that the lowest limit of the Bollinger Bands at $1,570 may yet be reached.

Current Price: $1,592

Market Capitalization: $191.44 billion

Trading Volume: $3.24 billion

7-Day Gain/Loss: 2.99%

Do you want to take your trading to the next level? Join the best platform for that here.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.