Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Bitcoin has reclaimed its rightful position as king on this week’s list of trending coins. This occurred after the token recorded considerable gains off a three-month low at the $25,152 price level. To that effect, let’s examine all of these coins on this week’s list one after the other.

Bitcoin (BTC)

Major Bias: Bearish

BTC has experienced considerable price increases over the past seven days. This brought the crypto to the top of this week’s list of trending coins after its price increased by 2.63%, while today’s trading has, as of the time of writing, brought a loss of 0.24%. Additionally, the token has a market capitalization of $517 billion and a trading volume of $11.62 billion.

Despite the recorded losses in today’s trading, BTC maintains a fair chance of rising further. This is so because price action in this market has retraced above the 9- and 21-day Smooth Moving Average lines. However, traders should note that the Relative Strength Index indicator seems to be approaching a bearish crossover in the overbought region. Therefore, while making projections toward the $27,500 mark, they should make the necessary preparations for a downward correction.

Current Price: $26,533

Market Capitalization: $517 billion

Trading Volume: $11.62 billion

7-Day Gain/Loss: 2.63%

Hifi Finance (HIFI)

Major Bias: Bullish

The Hifi Finance token has experienced massive bullishness as its price ramped significantly by 321.09% over the past seven days and further by 86.73% today. Also, the token has a market capitalization of $202 million today and a trading volume of $758 million.

Looking at the daily chart, it could be seen that price action has stayed bullish while the upside momentum grew stronger considering the size of recent price candles. The appearance of the last price candle suggests that buyers are still strong enough to keep the upside retracement going. Meanwhile, the RSI is flat out at the 100 mark of the indicator, as the leading and lagging lines are now merged and trending sideways at this point. Therefore, the market may extend its retracement towards the $2.350 mark.

Current Price:

Market Capitalization: $202 million

Trading Volume: $758 million

7-Day Gain/Loss: 321.09%

Pepe (PEPE)

Major Bias: Bearish

Pepe has stayed bearish over the past seven days, as it recorded a price decline of 12.66%. Meanwhile, today’s trading activities have seen the token print a price increase of just $0.88%. The token has, as of the time of writing, a market capitalization of $269 million and a trading volume of $41.85 million, while sitting in the third position on this week’s list of trending coins.

The daily chart reveals that the token can still be considered to be maintaining the downward retracement that started around mid-July. However, recent trading activities have seen the token correct minimally upwards of the lowest limit of the Bollinger Bands. At the same time, the RSI curves are now rising out of the oversold region. Nevertheless, traders can only anticipate a correction to occur toward the $0.0000007700 mark.

Current price: $0.0000006868

Market Capitalization: $269 million

Trading Volume: $41.85 million

7-Day Gain/Loss: 12.66%

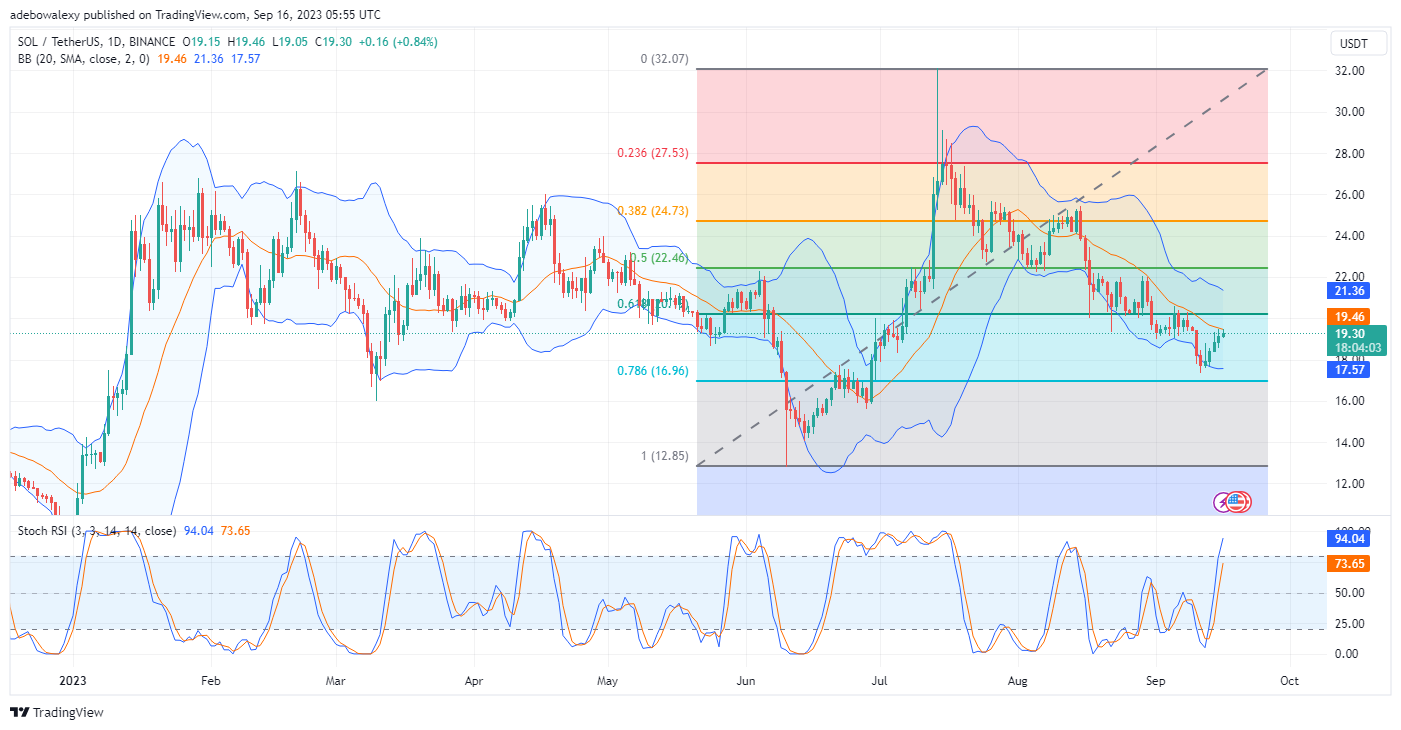

Solana (SOL)

Major Bias: Bullish

Solana has visited this week’s list of trending coins, as the token resides in the 4th position. Solana has posted a price decline of 1.47% during the week’s trading activity. However, today’s trading session, as of the time of writing, has seen a price increase of just 0.27% while printing a market capitalization of roughly $8 billion and a trading volume of $209.2 million.

On the daily chart, price action has corrected off the lowest limit of the Bollinger Bands, lifting up toward the middle band of the indicator. The middle limit of the Bollinger Bands may prove to be a strong resistance level, as the RSI indicator lines seem hypersensitive. Therefore, traders may anticipate a downward correction at the $19.46 mark.

Current price: $19.30

Market capitalization: $8 billion

Trading volume: $209.2 million

7-Day Gain/Loss: 1.47%

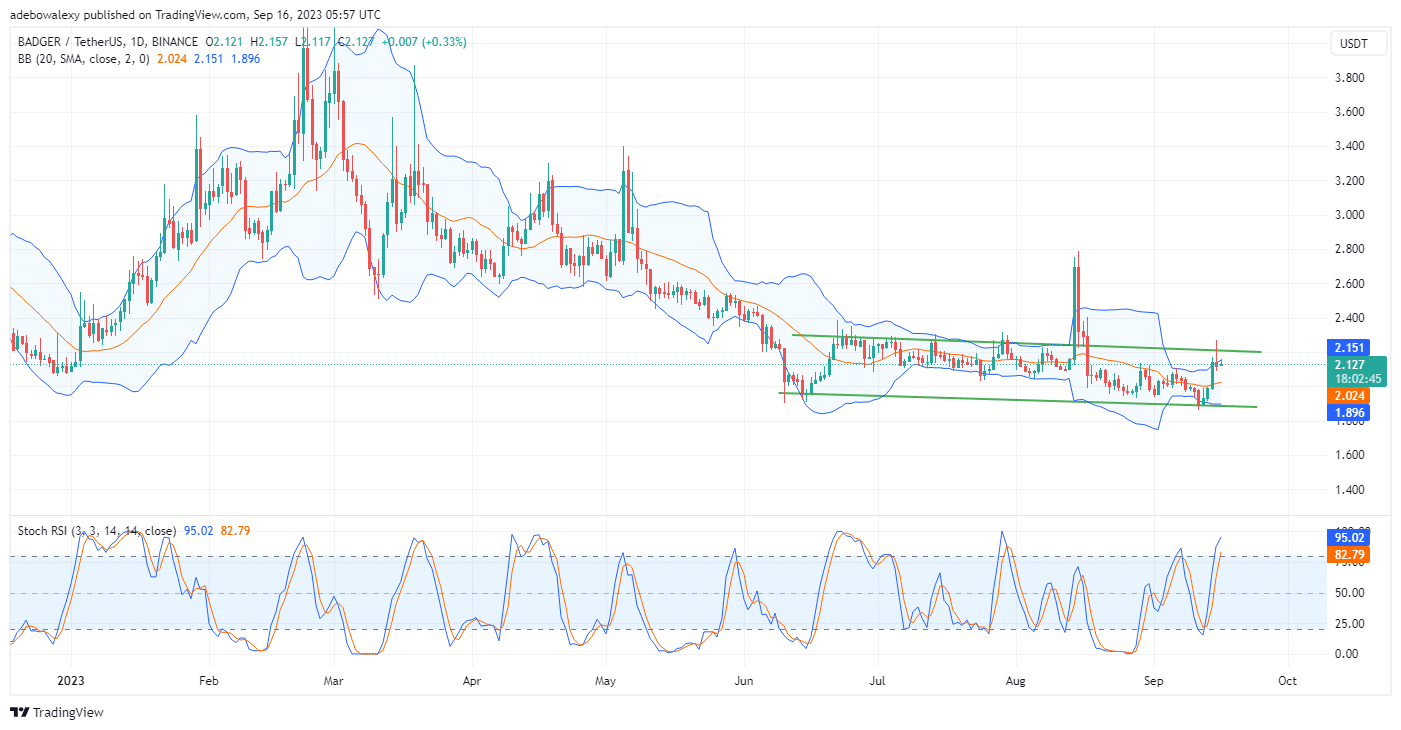

Badger DAO (BADGER)

Major Bias: Bullish

The Badger DAO token has made it to the last position on this week’s trending coin list. This has seen a price increase of 6.29% over the past 7 days, while today’s activities have caused the token to print a loss of 0.08% as of the time of writing. It has also seen a market capitalization of $43 million. And a trading volume of $8.42 million.

The daily market showed that the token had corrected off the floor of the Bollinger Bands four trading sessions ago. In the ongoing session, the market seems to have challenged the highest limit of the Bollinger Bands once more after price action corrected minimally. The RSI indicator lines are now in the overbought region. It appears that buyers may have just a little rope to pull towards the $2.200 mark.

Current Price: $2.127

Market Capitalization: $43 million

Trading Volume: $8.42 million

7-Day Gain/Loss: 6.29%

Do you want to take your trading to the next level? Join the best platform for that here.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.