The euro has gained some ground against the dollar and other major currencies after a Reuters report revealed that the European Central Bank (ECB) may soon start discussing how to reduce the huge amount of excess cash in the banking system.

Citing insights from six reliable sources, the report forecasts that deliberations concerning the multi-trillion-euro surplus liquidity pool will likely commence next month. The ramifications of this surplus liquidity are substantial, as it dampens the impact of the ECB’s interest rate hikes. This surplus liquidity reduces the demand for deposits, subsequently leading to higher interest payments and potential losses for select central banks.

Analysts Are Skeptical About a Recovery for the Euro

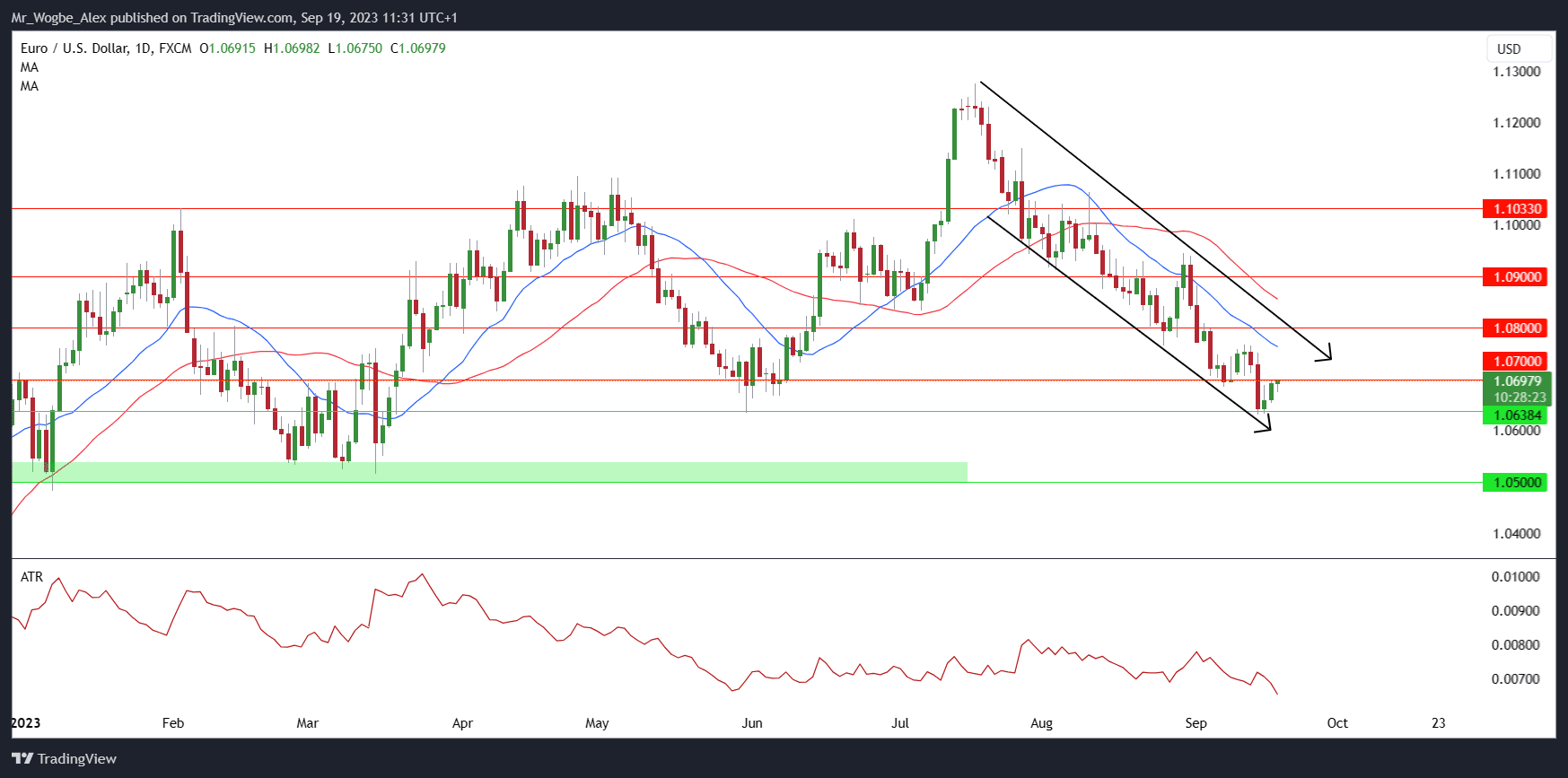

As a result of this news, the euro briefly climbed 0.4% on Monday, touching $1.0698, and remained steady at $1.0688 on Tuesday. Despite this positive development, some market analysts harbor reservations about the euro’s ability to fully reverse its recent weakening trend.

The euro has been steadily losing ground since reaching a 15-month high of 1.1275 two months ago, coinciding with the conclusion of the ECB’s current cycle of rate hikes. Current data from the US regulator reveals that speculators have scaled back their bullish euro positions to the lowest level in a decade.

A Barrage of Possible Central Bank Actions

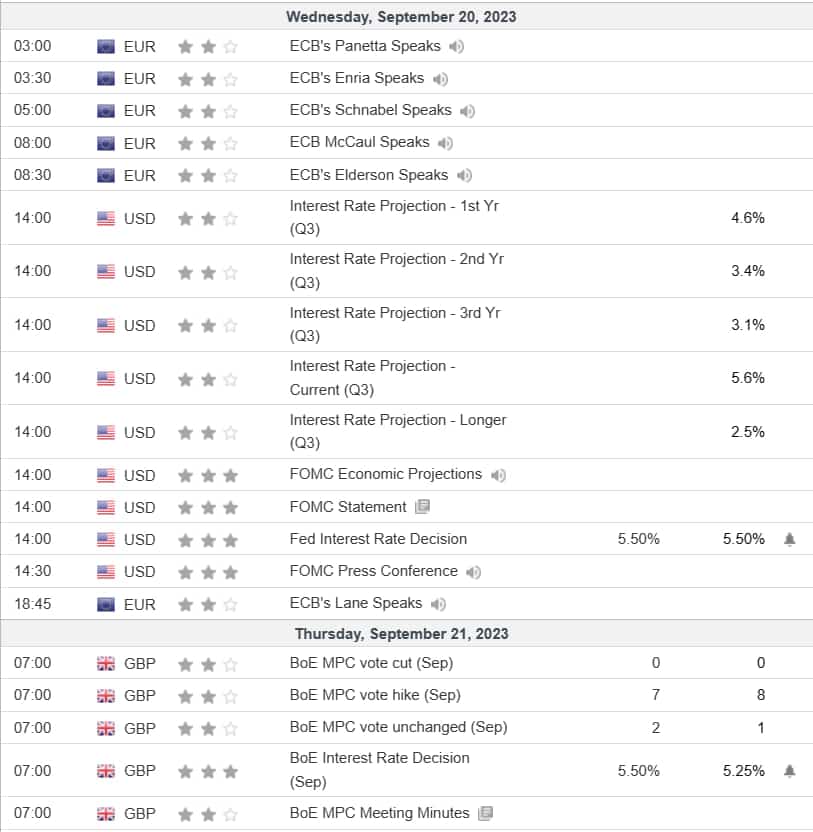

This week is set to be eventful for the euro, with central bank meetings on the horizon, including those of the Federal Reserve, the Bank of Japan (BOJ), the Bank of England (BoE), and the Swiss National Bank, among others. These meetings have contributed to a relatively low level of currency volatility.

The Japanese yen is under particular scrutiny as the BOJ gears up for its meeting later this week. It recently hit a 10-month low against the dollar, hovering at 147.71. Despite speculation of a policy shift by Governor Kazuo Ueda, the BOJ is anticipated to maintain its ultra-low interest rates and monetary stimulus.

Meanwhile, the US dollar remains resilient, with the dollar index holding steady at 105.06, in proximity to its six-month high of 105.43, achieved last week. The Federal Reserve is expected to maintain the status quo regarding interest rates, but investors will be keenly attuned to any hints regarding future guidance.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.