In a tight trading range, the dollar maintained its position on Tuesday as investors eagerly awaited the Federal Reserve’s imminent decision following their two-day meeting and the impending release of the latest U.S. jobs data.

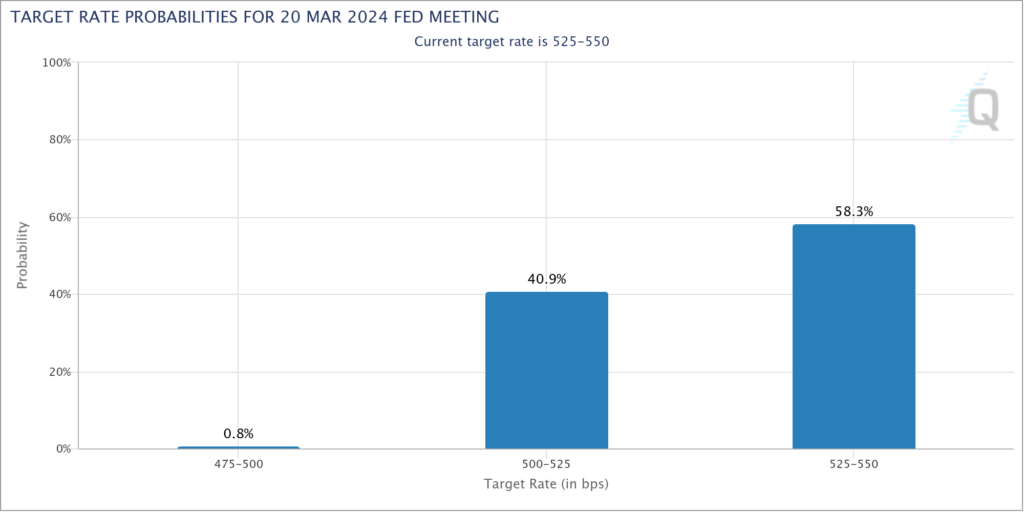

Analysts widely anticipate the Fed to maintain steady rates during Wednesday’s announcement. Despite a sharp decline from 88.5% a month ago, the probability of a March rate cut currently stands at 41.7%. This shift is attributed to a notable improvement in U.S. economic data.

Some experts speculate that the Fed might consider a rate cut to prevent a substantial gap between inflation and the fed funds rate, potentially leading to tighter financial conditions than desired.

Dollar Falls Against the Euro But Rallies Against the Yen

The dollar, which had weakened after Fed Chair Jerome Powell hinted at an easing cycle in December, has since exhibited signs of recovery. The dollar index, measured against six major currencies, remained relatively flat at 103.40, reflecting stability.

The euro experienced a marginal increase after data indicated the eurozone economy avoided contraction in the fourth quarter of 2023, despite a shrinkage in the German economy. The euro stood at $1.0843, up by 0.12%.

Although the eurozone’s GDP showed stagnation in Q4, the dollar has witnessed a 1.75% gain against the euro this year, fueled by expectations of superior U.S. economic performance compared to the eurozone.

Market expectations suggest the European Central Bank might enact rate cuts in April, contributing to the dollar’s overall strength.

Against the yen, the dollar saw a 0.10% increase at 147.63 yen as the Japanese currency weakened amid a growing risk appetite.

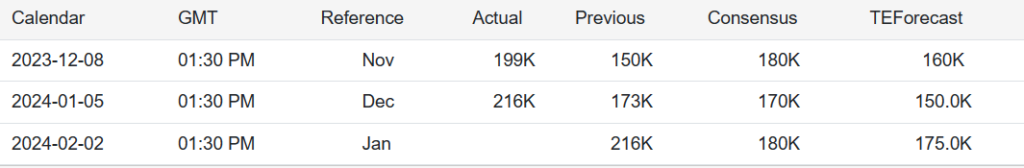

The dollar’s future trajectory hinges on the Federal Reserve’s statement and the impending U.S. jobs report for January, scheduled for release on Friday. Analysts predict an addition of 180,000 non-farm jobs, a slight dip from December’s 216,000.

For those keen on navigating the dynamics of the dollar and engaging in strategic trading, our forex signals service offers daily updates, insightful analysis, and valuable tips to optimize your gains in the currency market. To benefit from this resource, click here to join now.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.