In a turbulent Thursday session, the euro touched a six-week low at $1.08215, marking a 0.58% decline. The dip came as the European Central Bank (ECB) decided to maintain its interest rates at an unprecedented 4%, causing concern about the eurozone’s economic trajectory.

ECB President Christine Lagarde, addressing the media, emphasized that it was premature to discuss rate cuts despite the looming downside risks to economic growth in the region.

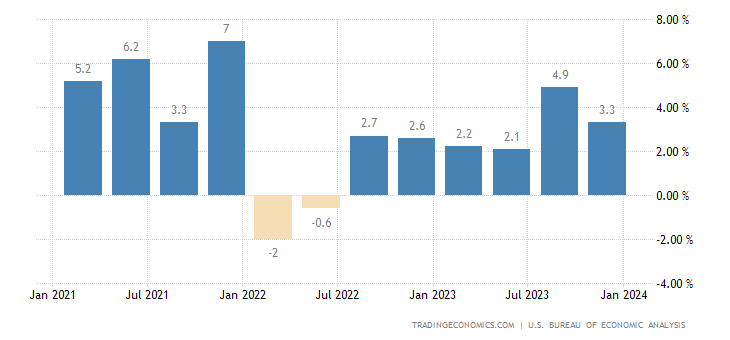

Simultaneously, the U.S. dollar surged on the back of robust economic data. The latest figures from the Commerce Department revealed stronger-than-expected 3.3% annualized growth in the U.S. economy for the fourth quarter of 2023, primarily fueled by robust consumer spending. The positive outlook defied recession fears, resulting in a strengthened dollar.

As a consequence, the likelihood of the Federal Reserve implementing interest rate cuts in the near term has diminished. Analysts anticipate the Fed will maintain its existing policy during the upcoming meeting. Investors are eagerly awaiting cues from Fed Chair Jerome Powell for insights into future rate adjustments.

Market dynamics reflect a shifting sentiment, with the U.S. rate futures market reducing the probability of a rate cut in March from 80% to 51% within the past two weeks. The prevalent expectation is for the first rate cut to materialize in May, with a 90% likelihood.

Contrarily, the ECB is grappling with mounting pressure to reduce rates as the eurozone contends with persistently low inflation and feeble growth. The outcome of the ECB’s policy meeting on Thursday failed to alter market expectations for rate cuts in 2024, with investors pricing in 130 basis points of cuts for the coming year.

Euro Further Repressed By Strong U.S. GDP Growth

Adding to the euro’s woes, a separate report from the U.S. Labor Department indicated a slight increase in initial claims for state unemployment benefits to 214,000, surpassing the forecast of 200,000.

However, the impact on the market was limited, overshadowed by robust GDP data, further contributing to the euro’s decline.

The intricacies of global economic developments include keeping investors and forex signal providers, such as Learn2Trade, on edge and closely monitoring central bank decisions and economic indicators for future market movements.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.