Bitcoin, the world’s leading cryptocurrency, has recovered from a sharp dip to $38,500 triggered by the wear-off of the effect of the introduction of the first U.S. spot bitcoin ETFs two weeks ago. According to a JPMorgan research report, profit-taking by investors who had previously acquired shares of the Grayscale Bitcoin Trust (GBTC) at a discount played a pivotal role in the downturn.

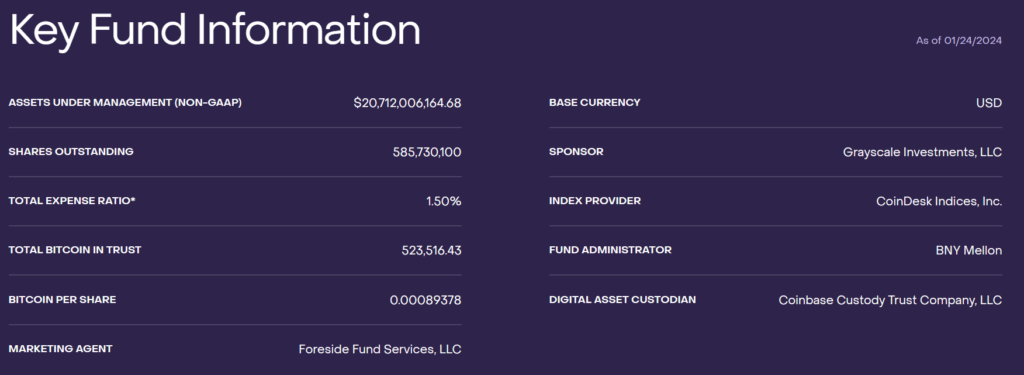

GBTC, a crypto investment vehicle facilitating exposure to Bitcoin without direct coin ownership, boasts over $20 billion in assets under management, holding the position of the largest Bitcoin product. However, despite its prominence, GBTC has consistently traded at a discount to its net asset value (NAV), meaning its shares hold a value lower than the bitcoin it represents.

What Did JP Morgan Have to Say About the Grayscale Bitcoin Trust?

JPMorgan’s analysis suggests that investors, having initially bought GBTC at a discount, subsequently liquidated their holdings to acquire the more affordable spot bitcoin ETFs, aligning more closely with bitcoin’s market price. This shift resulted in a substantial outflow of approximately $3 billion from GBTC, exerting a downward influence on Bitcoin’s overall valuation.

The bank, however, remains optimistic, stating that the bulk of the selling pressure may be in the past, with $4.3 billion already withdrawn from GBTC. Analysts at JPMorgan noted, “This would imply that most of the downward pressure on bitcoin from that channel should be largely behind us.”

Nevertheless, JPMorgan cautioned about potential increased competition for GBTC from alternative spot bitcoin ETFs, armed with lower fees and heightened liquidity. This competition could prompt additional outflows from GBTC unless Grayscale takes strategic measures such as fee reductions or fund conversion into an ETF.

As of the latest update, Bitcoin has stabilized around the $40,000 mark, prompting a watchful stance among crypto signal providers and traders, such as Learn 2 Trade, awaiting further clarity on the cryptocurrency’s price direction.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.