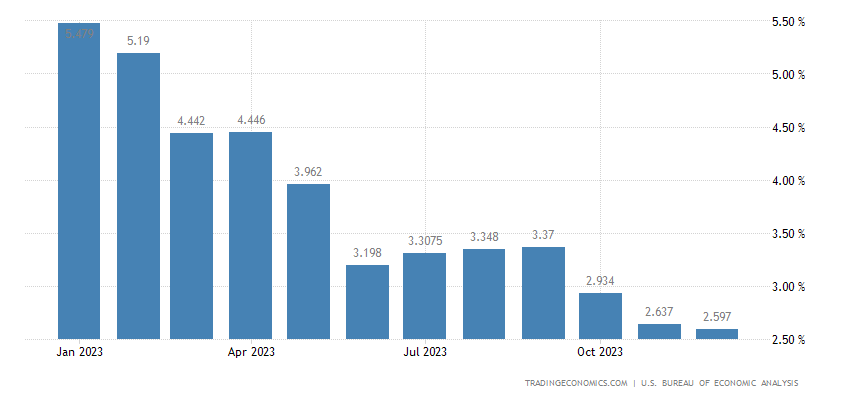

The dollar held its ground on Friday as the latest data showed that inflation in the US is gradually slowing down to the Federal Reserve’s target of 2%. The core Personal Consumption Expenditures (PCE) index, which excludes food and energy prices, dropped to its lowest level since the first quarter of 2021, reaching 2.6% in December.

The PCE index is the Fed’s preferred measure of inflation, and it has been running above its target for most of last year, fueling concerns about rising costs and eroding purchasing power. However, the Fed has maintained that the inflation surge is transitory and largely driven by supply chain disruptions and pandemic-related factors.

The December data confirmed that some of the inflationary pressures are easing, as the PCE index remained unchanged from the previous month, indicating that the pace of price increases has stabilized. The Fed expects inflation to moderate further in the coming months as the base effects from last year’s low readings fade away.

The market reaction to the inflation data was muted, as the dollar index, which measures the greenback against a basket of six major currencies, edged slightly higher before retreating to trade within a narrow range.

Big Week Ahead for the Dollar

Investors and dollar traders are looking ahead to next week’s busy economic calendar, which will feature policy meetings from the Fed and the Bank of England as well as earnings reports from some of the biggest US tech companies.

The week will also end with the closely watched non-farm payrolls report, which will provide an update on the state of the US labor market.

If you want to learn more about the forex market and how to trade the dollar and other currencies, you can sign up for our forex signals service.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.