The cryptocurrency industry saw $1.49 billion in losses from hacks and scams in 2024, according to a new report from blockchain security firm Immunefi. While this marks a 15% drop from 2023’s $1.76 billion in crypto losses, the numbers highlight ongoing security challenges in the crypto space.

Analyzing Crypto Losses: Key Trends and Statistics

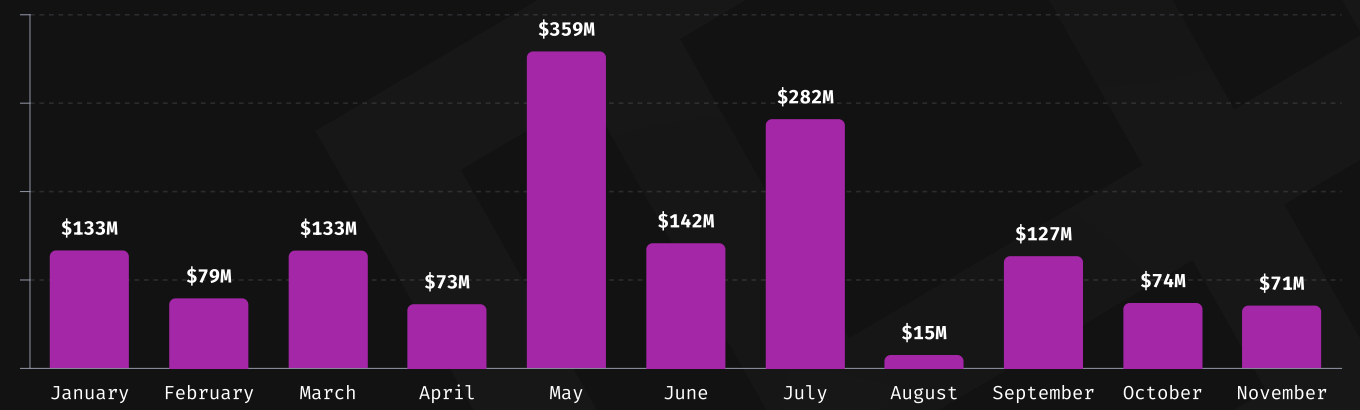

November 2024 emerged as one of the year’s better months for crypto security, with losses totaling $71 million across 26 incidents. This represents the second-lowest monthly figure in 2024 and a significant 79% decrease from November 2023’s $343 million in losses.

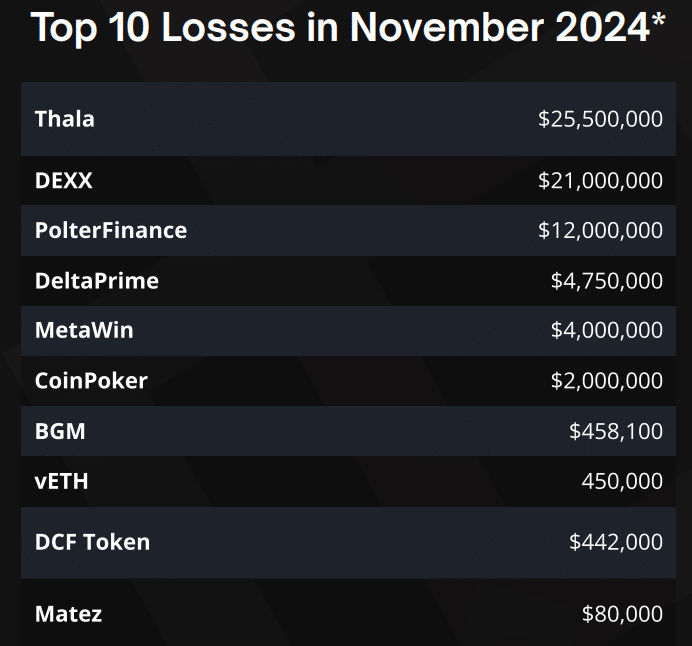

Two major attacks dominated November’s statistics: decentralized finance platform Thala Labs lost $25.5 million, while memecoin trading platform DEXX suffered a $21 million breach. However, Thala Labs later recovered its stolen funds after law enforcement tracked down the hacker.

The Immunefi report reveals that DeFi platforms remain the primary target for attackers, accounting for 100% of November’s incidents. Hackers showed a particular interest in the BNB Chain, which suffered 14 separate attacks, representing 46.7% of all targeted networks. Ethereum followed with 9 incidents, while other chains like Solana, Polygon, and Arbitrum each experienced single attacks.

The data shows a clear dominance of hacking over fraud in 2024’s crypto losses. Of November’s $71 million total, nearly all ($71 million) came from 24 hacking incidents, while only $25,300 was lost to two rug pulls. This pattern suggests that while outright fraud has decreased, sophisticated attacks on technical vulnerabilities remain a serious threat.

May and July proved to be the most damaging months of 2024, with losses of $359 million and $282 million, respectively. These spikes demonstrate how single, large-scale attacks can significantly impact overall industry losses.

Looking Ahead

The findings underscore the critical importance of security in the cryptocurrency sector. While the overall decrease in losses compared to 2023 might suggest improving security measures, the continued success of major hacks indicates that platforms must remain vigilant.

The concentration of attacks on DeFi protocols and specific blockchain networks like BNB Chain points to areas where the industry needs to focus its security efforts.

These statistics serve as a reminder that despite the industry’s growth and maturation, cryptocurrency platforms must continue strengthening their security infrastructure to protect user funds and maintain trust in the ecosystem.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.