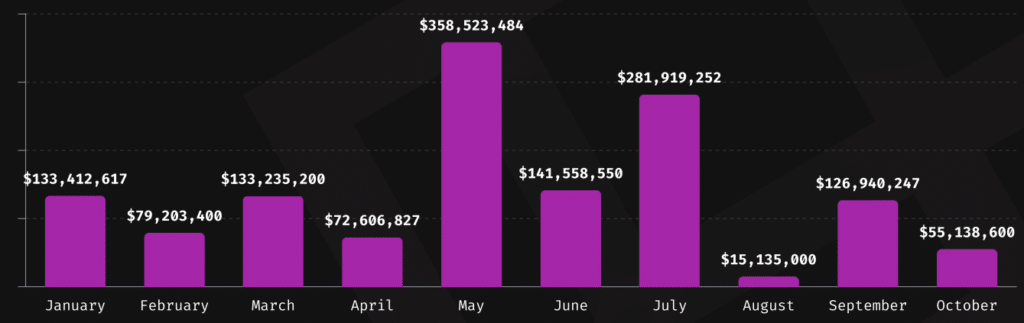

The crypto industry saw $55.1 million in crypto losses during October 2024, marking the second-lowest monthly total of the year, according to a new report from blockchain security firm Immunefi. This figure represents a significant 56.6% decrease from September’s losses of $126.9 million, though it’s still higher than October 2023’s $25.7 million.

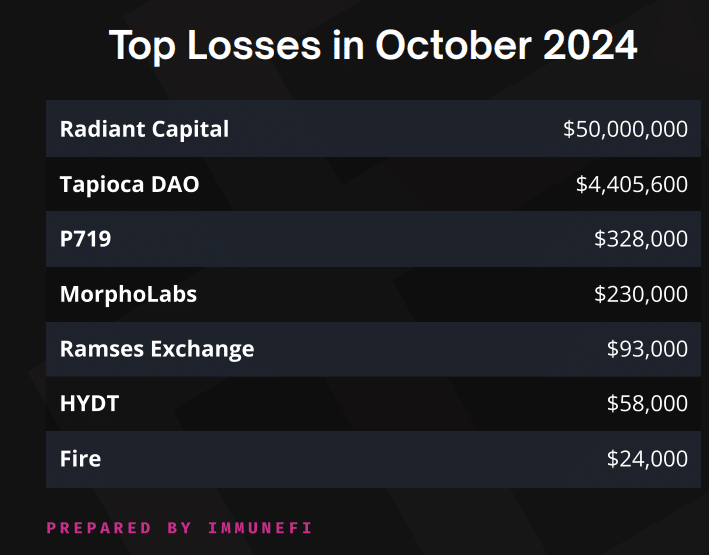

Two major security breaches dominated October’s losses. DeFi lending protocol Radiant Capital suffered a $50 million hack, while Tapioca DAO lost $4.4 million. These two incidents accounted for nearly 99% of all crypto losses during the month.

Understanding the Pattern of Crypto Losses in 2024

The year 2024 has seen total crypto losses reach $1.4 billion across 179 separate incidents. This represents a slight 1% improvement compared to the same period in 2023.

May 2024 proved particularly challenging for the industry, with losses exceeding $358 million, followed by July’s $281 million in losses.

Security Threats Analysis

October’s security landscape revealed several key trends:

- Hackers focused entirely on DeFi platforms, with no attacks reported on centralized finance (CeFi) services

- The BNB Chain became hackers’ primary target, suffering four separate attacks

- Ethereum and Arbitrum networks each experienced two security incidents

- All losses came from hacks rather than fraud schemes, suggesting improved fraud prevention but ongoing technical vulnerabilities

The report highlights a concerning pattern in the DeFi sector. While smaller protocols like P719 ($328,000 loss) and MorphoLabs ($230,000 loss) faced attacks, larger protocols remained the primary targets due to their substantial locked value.

Looking at the broader picture, 2024’s monthly loss pattern shows high variability. The year began with January recording $133.4 million in losses, followed by fluctuating months. August marked the year’s lowest point with $15.1 million, in losses, before September saw a significant uptick to $126.9 million.

For investors and users, these findings suggest that while overall security measures might be improving slightly year-over-year, significant risks remain, particularly in the DeFi sector. The concentration of losses in larger protocols also indicates that hackers are becoming more strategic in targeting platforms with substantial financial resources.

The decrease in October’s losses might signal improving security measures, but the persistent targeting of DeFi platforms suggests that users should remain cautious and protocols should continue strengthening their security infrastructure.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.