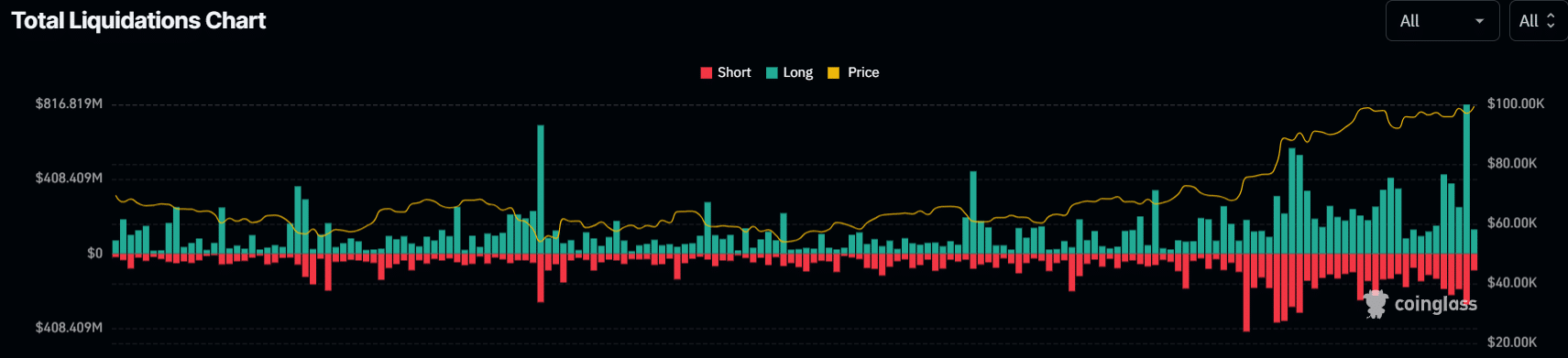

The market experienced its largest wave of crypto liquidations since December 2021, with over $1.1 billion wiped out in just 24 hours. This massive sell-off occurred as Bitcoin’s price briefly fell to $92,000 on Thursday, marking a sharp decline from its recent milestone of $103,650.

Bitcoin’s sudden price drop triggered a chain reaction across crypto exchanges, with long positions making up $817 million of the total liquidations, while short positions accounted for $280 million.

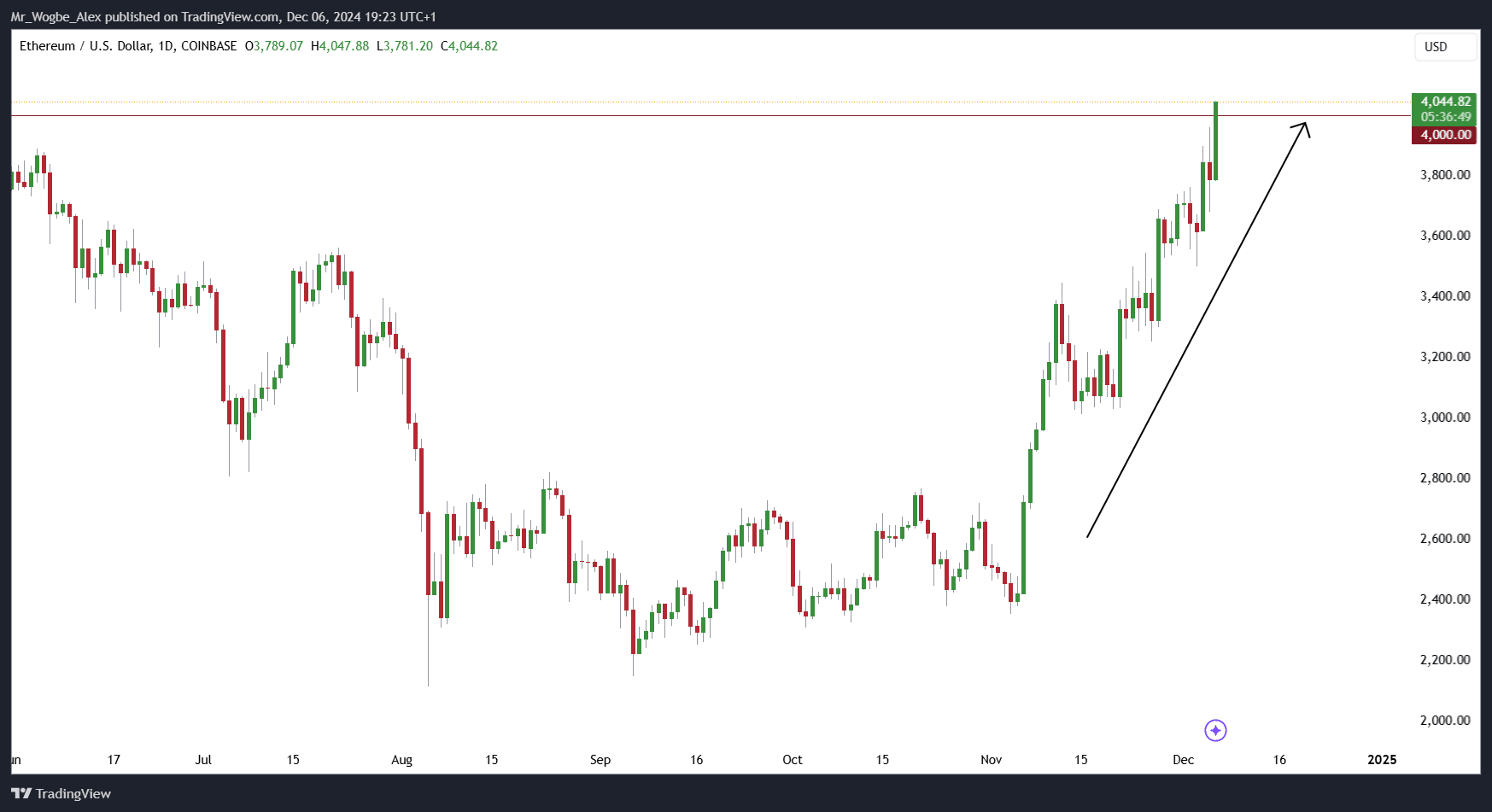

Despite this market turbulence, Ethereum managed to reach $4,000 for the first time since March 2024, showing a 2.8% daily increase and a 12.2% weekly gain.

Understanding the Recent Crypto Liquidations

According to Rachel Lucas, a crypto analyst at BTC Markets, Thursday’s Bitcoin price movement appears to be a “leverage flush”—a” situation where large market players deliberately push prices up to attract retail traders before sharply reversing the trend.

This strategy specifically targets key price levels where stop-losses and liquidations are concentrated.

“Many retail traders fell victim to FOMO (fear of missing out) during Bitcoin’s all-time high, taking long positions at elevated prices,” Lucas explained to The Block. “Meanwhile, larger holders strategically sold their assets, creating this perfect storm of liquidations.”

The broader crypto market has shown remarkable resilience despite Bitcoin’s 15% correction. Ethereum’s strong performance above $4,000 comes after months of disappointing price action and negative sentiment. Other cryptocurrencies also demonstrated strength, with Solana, Dogecoin, Toncoin, and Sui all posting positive returns.

Market experts suggest that such large-scale liquidation events often help reset overheated funding rates and reduce excessive leverage in the market. This natural market correction might lead to more stable conditions and a potential recovery in the coming weeks.

These market movements coincide with significant developments in the Ethereum ecosystem, particularly following March 2024’s Dencun upgrade, which dramatically lowered fees for layer-2 scaling networks. While this initially led to a 99% decrease in Ethereum layer-1 revenues, recent data shows network fees beginning to rebound, with the base layer generating approximately $10.9 million in fees on December 5.

The current market situation highlights the volatile nature of cryptocurrency trading and the significant risks associated with leveraged positions, especially during periods of high market enthusiasm and price discovery.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.