The cryptocurrency market is poised for significant growth in the latter half of 2024, according to CCData’s latest Outlook Report. The report highlights several key trends that could shape the future of digital assets.

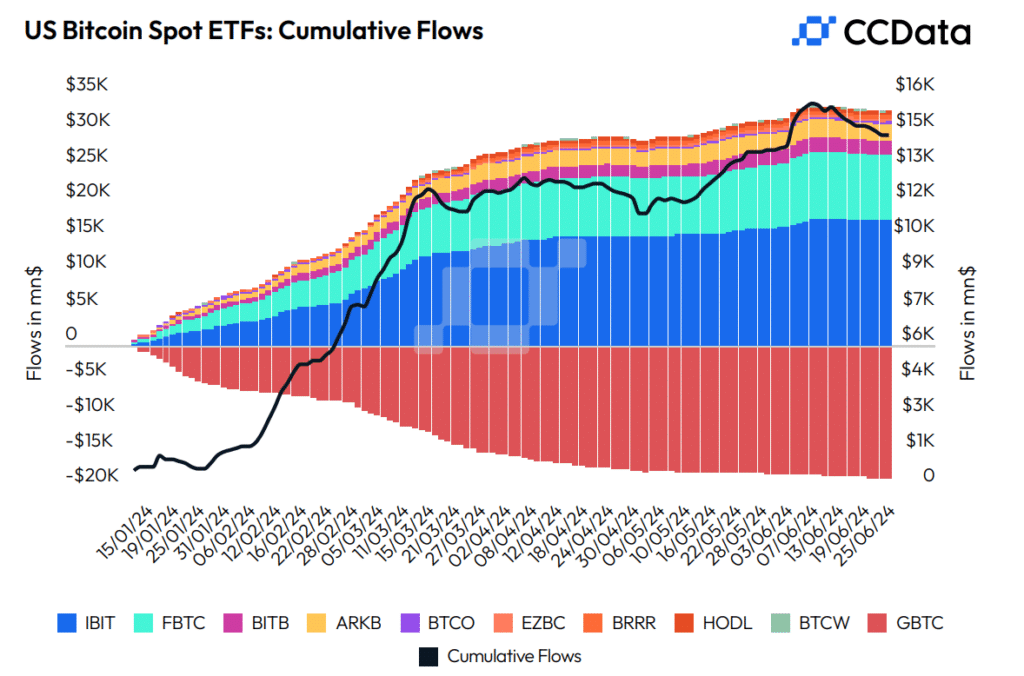

One of the most exciting developments is the approval of spot Bitcoin and Ethereum ETFs in the United States. This move has brought a surge of institutional interest to the crypto space.

Since their launch, spot Bitcoin ETFs have accumulated over $55 billion in net assets. This influx of institutional money is a strong sign of growing confidence in cryptocurrencies as a legitimate asset class.

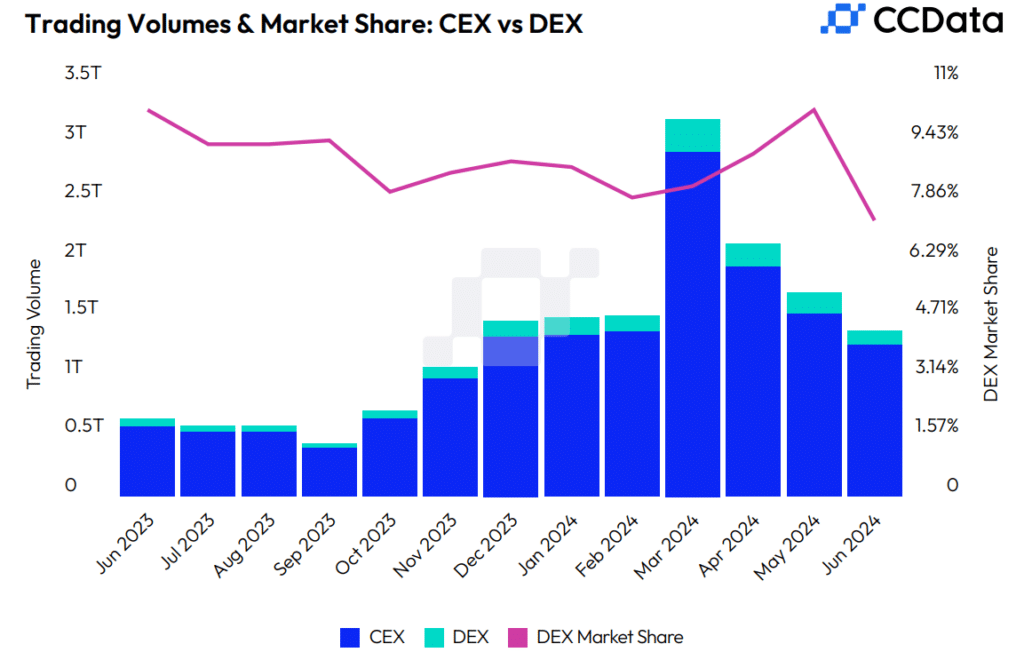

The report also notes a shift in the exchange landscape. Centralized exchanges (CEXs) have seen a massive 145% increase in trading volumes compared to the second half of 2023. This surge indicates renewed interest from both retail and institutional investors.

At the same time, decentralized exchanges (DEXs) are gaining ground, with a 51% increase in trading volume over the past year.

CCData’s Outlook Report Highlights Growing Entanglement of Crypto and AI

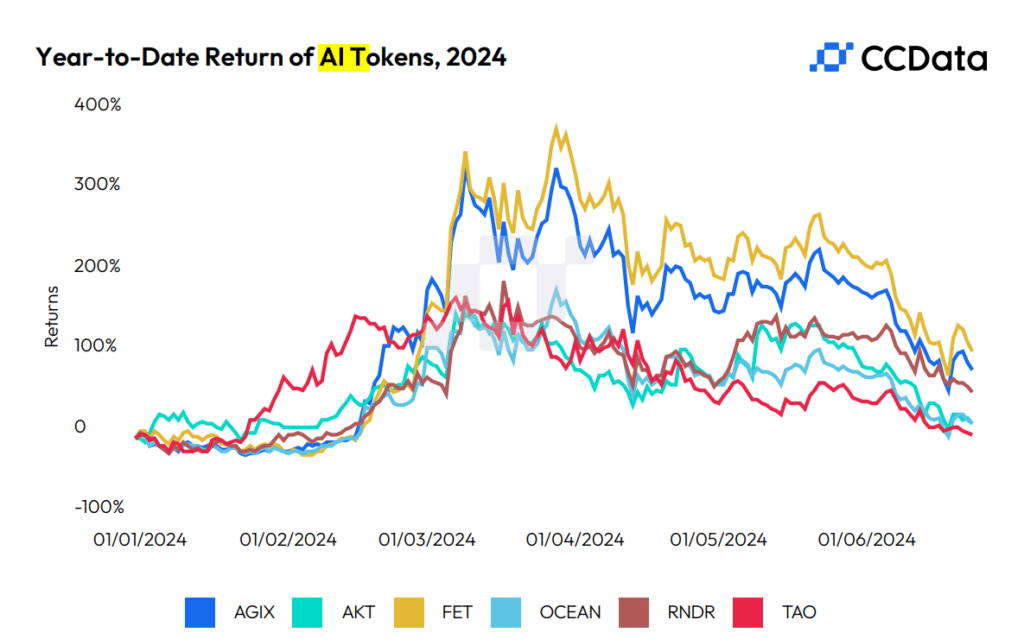

Interestingly, the report highlights the growing intersection of crypto and artificial intelligence (AI). As AI continues to dominate tech headlines, crypto projects focusing on decentralized GPUs, cloud storage, and computing are gaining traction. These projects aim to provide the infrastructure needed for AI development in a decentralized manner.

Here’s a look at the year-to-date performance of AI tokens.

Another trend to watch is the rise of Real-World Assets (RWA) in the crypto space. Major traditional finance players like BlackRock and JP Morgan are exploring the tokenization of real-world assets. This trend could bring a new wave of institutional adoption to the crypto market.

The report also touches on the memecoin phenomenon. Despite their volatility, memecoins have outperformed other crypto categories, rising by nearly 300% since the start of the year. While risky, these assets continue to attract significant retail interest.

What Next?

Looking ahead, CCData expects the current crypto cycle to extend into 2025. The report suggests that Bitcoin has yet to display its anticipated parabolic growth this cycle, hinting at potential significant price appreciation in the coming months.

Regulatory developments are also shaping the crypto landscape. The introduction of comprehensive stablecoin regulations in the U.S. and the implementation of MiCA regulations in Europe are expected to provide much-needed clarity for institutional investors.

Final Word: CCData’s Latest Outlook Report

CCData’s report paints a bullish picture for the crypto market in the latter half of 2024. With increased institutional adoption, technological advancements, and regulatory clarity, the stage seems set for a potential crypto surge.

However, as always in the volatile world of cryptocurrencies, investors should approach these opportunities with caution and thorough research.

Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.