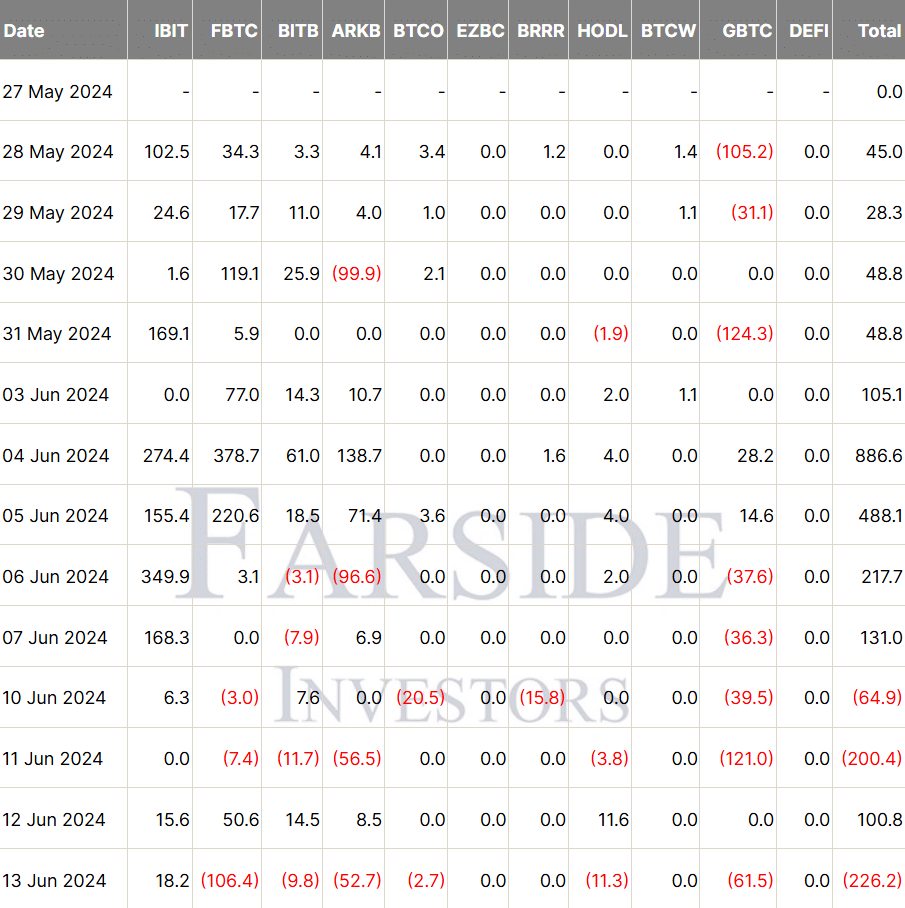

Bitcoin exchange-traded funds (ETFs) have seen a lot of money taken out by investors recently as the crypto market goes through a volatile period. Over $226 million left U.S. Bitcoin ETFs on Thursday alone, marking the third day of big outflows this week. This follows a similar trend seen at the end of April.

Fidelity’s FBTC fund saw the most money pulled out at $106.4 million. Other major Bitcoin ETFs, like Grayscale’s GBTC and Ark Invest’s ARKB, also experienced large withdrawals of $61.5 million and $52.7 million, respectively. The only Bitcoin ETF to gain money on Thursday was BlackRock’s IBIT, which took in $18.2 million.

In total, $564 million has been withdrawn from these Bitcoin ETFs in three days. That’s around half of the $1.2 billion that was left over six days in late April. The outflows come as Bitcoin’s price has swung up and down this week in response to key economic news.

On Wednesday, new data showed U.S. inflation was lower than expected. This briefly pushed Bitcoin’s price up to $70,000 from around $68,000. However, the price quickly fell back below $66,000, likely as traders sold to lock in profits from the upward move.

Bernstein Believes Bitcoin ETFs Could Spur Bitcoin Rally to $1 Million

Despite the recent volatility and ETF outflows, some Bitcoin analysts remain optimistic about the cryptocurrency’s long-term prospects. Earlier this week, analysts from investment bank Bernstein predicted that Bitcoin could potentially reach $1 million by 2033, with a projected price of $200,000 by 2025.

The Bernstein analysts believe unprecedented demand from ETFs, along with Bitcoin’s limited supply, could drive the price significantly higher over time. They now estimate Bitcoin could hit $500,000 by 2029.

However, in the short term, Bitcoin ETFs may continue to experience choppy waters as the market digests the recent economic data and the U.S. Federal Reserve’s next moves.

Still, with major players like Fidelity, BlackRock, and Ark Invest involved in the space, interest in Bitcoin ETFs shows no signs of fading away any time soon. Investors will be closely watching to see how the funds navigate the current market conditions.

Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.