Real-world asset (RWA) tokenization has emerged as a transformative force in the world of investing. This innovative concept involves converting tangible assets into digital tokens on a blockchain, enabling fractional ownership and enhanced liquidity.

Although RWA tokenization has been around since 2017, it has only recently gained significant traction, particularly with the entry of BlackRock, the world’s largest asset manager, into the space.

What Is Real-World Asset Tokenization?

So, what exactly is RWA tokenization, and how does it work?

In simple terms, it is the process of dividing a real-world asset, such as real estate, commodities, or precious metals, into multiple digital tokens. These tokens represent ownership shares in the underlying asset and can be bought, sold, or traded on a blockchain platform.

This fractional ownership model allows a wider range of investors to participate in the asset class at a lower cost.

Benefits of Real-World Asset Tokenization

The benefits of RWA tokenization are manifold. Let’s take a look at a few of them

1. Real-world asset tokenization offers enhanced liquidity. This makes it easier for investors to buy and sell their shares in the asset. Traditional real estate investments, for example, can be lengthy and complex, often requiring the sale of an entire property. With tokenization, investors can quickly and easily trade their tokens, representing fractional ownership.

2. RWA tokenization improves accessibility. While traditional real estate investments can be prohibitively expensive, tokenization allows investors to participate for a fraction of the cost. This democratization of investment opportunities opens up the market to a broader range of investors.

3. Tokenization helps reduce fees and overhead costs. By digitizing the ownership and transaction process, many of the costs associated with traditional investments, such as shipping, documentation, and intermediary fees, can be eliminated.

4. RWA tokenization offers increased transparency. Blockchain technology provides an immutable record of transaction history and asset ownership, reducing the risk of fraud, forgery, and disputes. This transparency fosters trust and confidence among investors.

5. Tokenization unlocks new possibilities for composability. RWA tokens can be seamlessly integrated into the wider decentralized finance (DeFi) ecosystem, serving as building blocks for various financial applications. For instance, investors can use their RWA tokens as collateral to borrow funds or participate in other DeFi protocols.

BlackRock’s RWA Tokenization (BUIDL)

BlackRock’s entry into the RWA tokenization space with its BUIDL fund has been a game-changer.

BUIDL invests in US treasury bills, repurchase agreements, and cash, issuing tokens on the Ethereum blockchain. Investors can purchase these tokens to gain exposure to the entire portfolio, enjoying enhanced liquidity and immediate settlement.

BUIDL’s success, attracting $244.8 million in deposits from seven investors in its first week, has paved the way for other financial institutions to explore RWA tokenization.

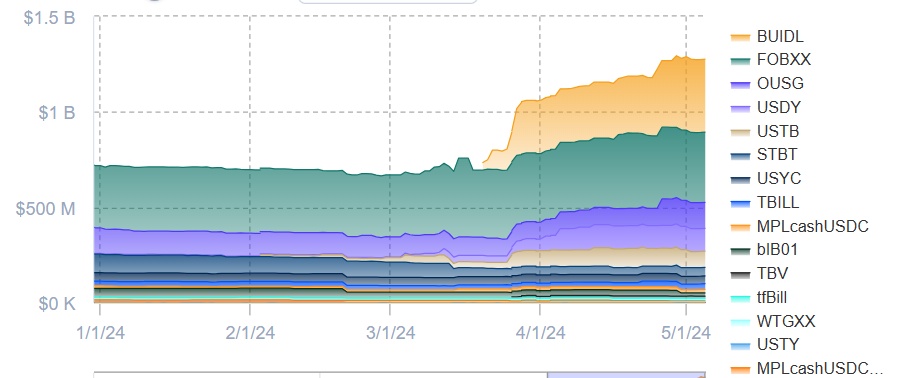

As of the time of this writing, BUIDL has a total valuation of over $381 million, and is the largest RWA token by market valuation, per rwa.xyz data. BUIDL is followed closely by the Franklin OnChain U.S. Government Money Fund (FOBXX) with $367 million, and the Ondo Short-Term U.S. Government Bond Fund with $136 million in third place.

Top Crypto Projects Tokenizing Real-world Assets

Several crypto projects are already leading the charge in RWA tokenization. Some of the popular ones include:

- Polymesh (POLYX): Polymesh has launched Polymesh Private, a permission-based blockchain for financial institutions embarking on RWA tokenization.

- Ondo Finance (ONDO): Ondo Finance has partnered with Noble to bring tokenized US Treasury offerings to the Cosmos blockchain ecosystem.

- Realio Network (RIO): This project offers a DeFi marketplace for tokenized real estate investments.

- Landshare (LAND): Landshare provides accessible real estate investment opportunities on the Binance Smart Chain.

The potential impact of RWA tokenization on the crypto landscape cannot be overstated. By bringing more capital into the industry and unlocking the transfer of trillions of dollars, tokenization is poised to form the backbone of the next bull run.

The improved efficiency, liquidity, transparency, accessibility, and cost-effectiveness of tokenized assets are attracting a growing number of investors to the crypto market.

Final Word

In conclusion, real-world asset tokenization is revolutionizing the way we invest. By breaking down barriers and democratizing access to a wide range of assets, it is opening up new opportunities for investors of all sizes.

As more financial institutions and investors embrace this transformative technology, we can expect to see a surge in the adoption of tokenized assets, driving the growth and evolution of the crypto industry as a whole.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.