Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Market Analysis – February 10

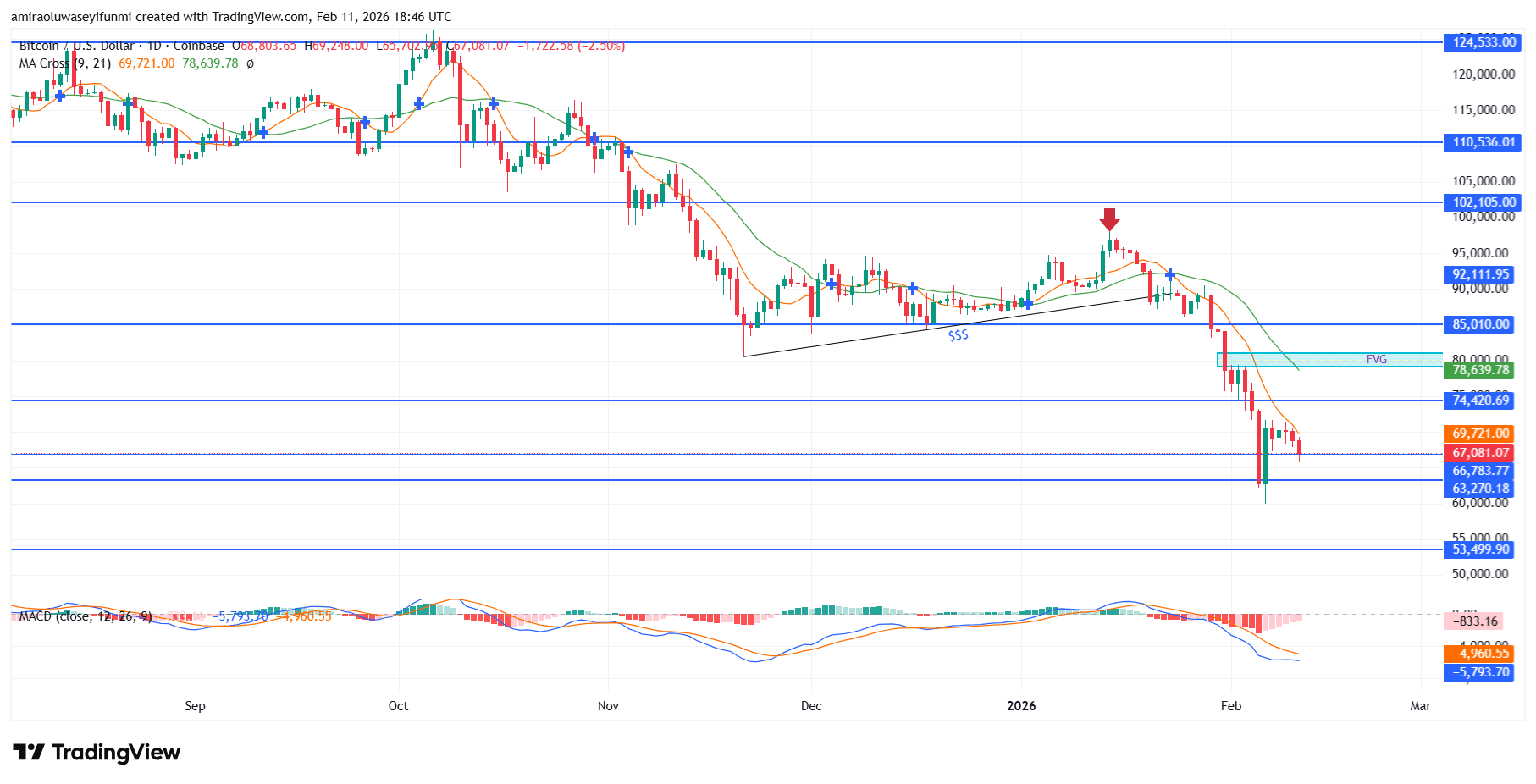

BTCUSD remains structurally bearish as selling pressure increases. BTCUSD continues to operate within a firmly established bearish regime on the daily timeframe, with price action positioned decisively below the declining 9- and 21-period moving averages. The short-term average is negatively aligned beneath the medium-term average, reinforcing a sustained downside bias. Current trading near $67,130 reflects persistent supply dominance following the breakdown from the $85,010 structural shelf. Momentum studies corroborate this posture, with MACD entrenched in negative territory and histogram expansion reflecting an accelerating bearish impulse. The inability to reclaim $74,420 and $78,640 confirms that rallies remain corrective rather than accumulative in nature.

BTCUSD Key Levels

Supply Levels: $85,010, $102,110

Demand Levels: $63,260, $53,500

BTCUSD Long-Term Trend: Bearish

Technically, the pair has transitioned from distribution to markdown after repeated rejections near $92,110 and the failed breakout attempt toward $102,110. The rejection around $96,000–$97,000 marked the exhaustion of bullish rotation, triggering impulsive downside expansion through layered support at $85,010 and $74,420. The recent displacement leg pierced liquidity below $66,780, printing a swing low near $63,270 before modest stabilization. Prior demand around $69,730 has now flipped into near-term supply, while the fair value gap region between roughly $78,600 and $80,000 remains an unmitigated overhead imbalance. Market structure presently reflects lower highs and lower lows, indicative of systematic distribution rather than consolidation.

Forward guidance favors continuation toward deeper liquidity pools unless $74,420 is reclaimed on a closing basis. Immediate downside exposure targets a retest of $63,270, with extension risk toward $60,000 psychological support and potentially $53,500 if macro pressure persists. Any corrective retracement into $74,420–$78,640 is likely to encounter renewed sell-side participation, preserving the prevailing bearish structure. Only sustained acceptance above $85,010 would materially neutralize the current downside thesis; absent that development, the path of least resistance remains to the downside.

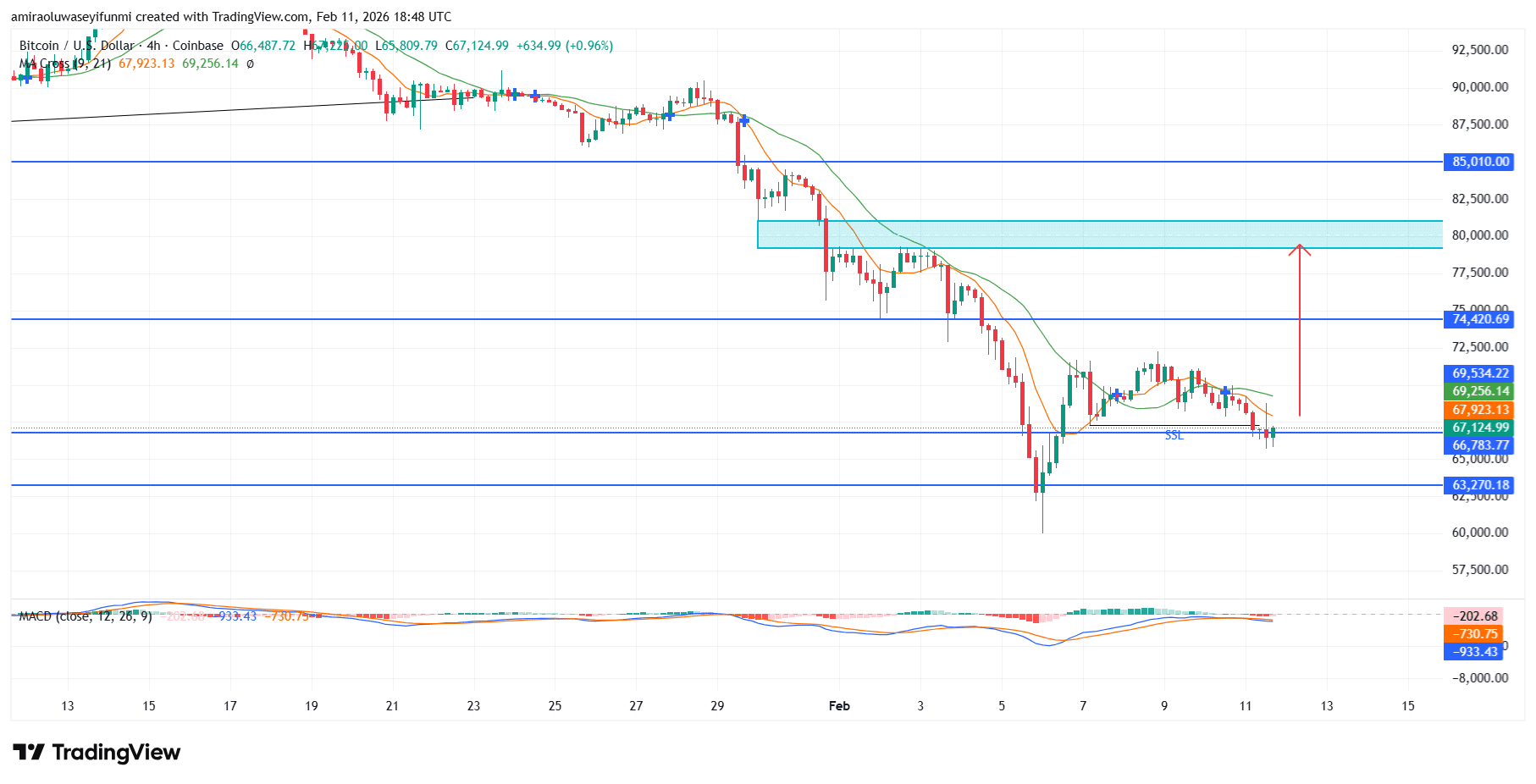

BTCUSD Short-Term Trend: Bullish

On the four-hour chart, BTCUSD is attempting a constructive reversal after defending liquidity around $63,270 and reclaiming ground above $66,780. Price is stabilizing near $67,130, with short-term moving averages flattening and beginning to curl upward, signaling early momentum rotation that traders tracking crypto signals may interpret as emerging corrective strength.

A sustained push above $69,530 would expose $74,420 as the next structural resistance, confirming higher-low formation. If bullish pressure persists, price could extend toward the $80,000 imbalance zone, reinforcing short-term upside continuation.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.