Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Market Analysis – February 6

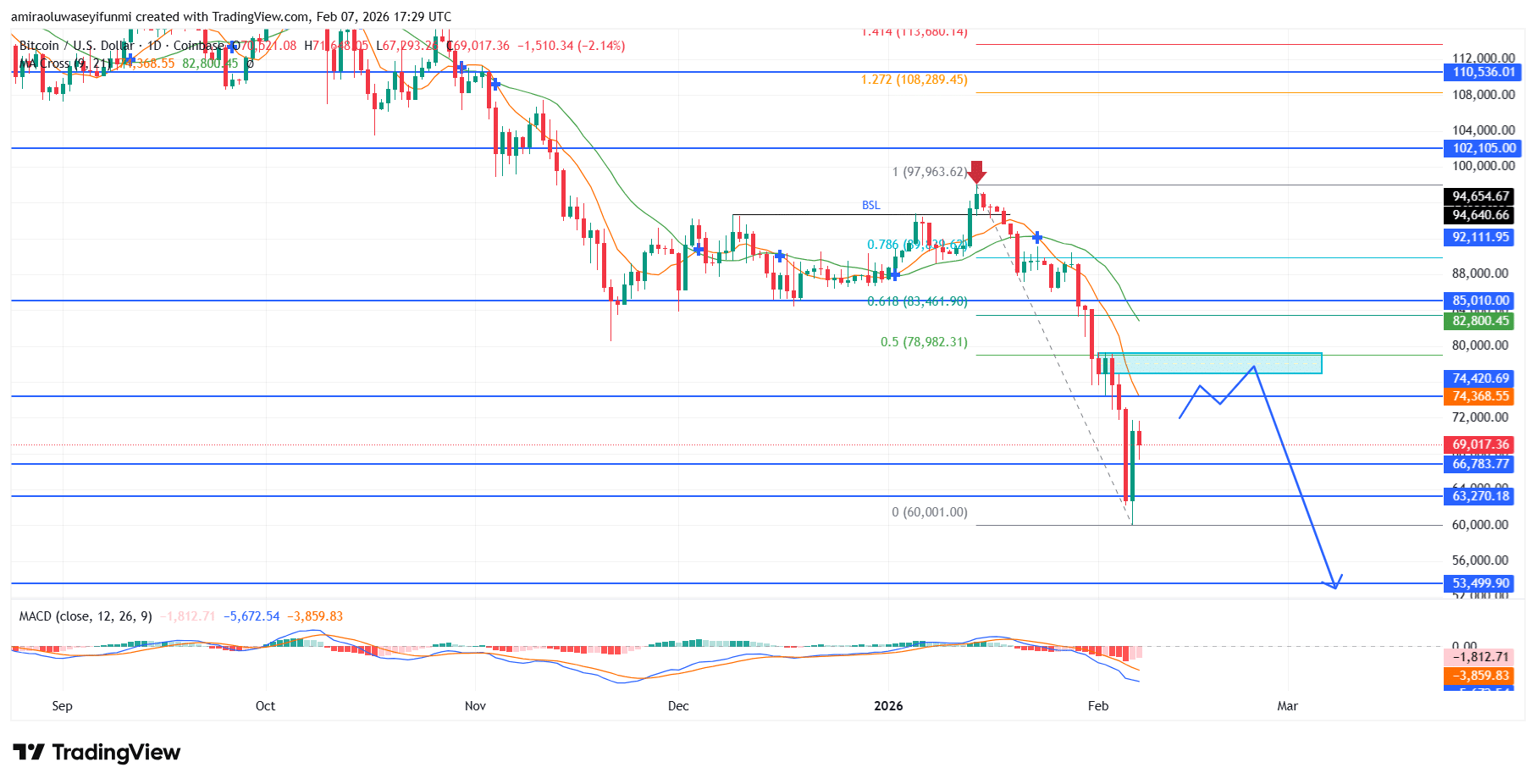

BTCUSD market structure weakens as sellers regain broad directional control. BTCUSD remains entrenched in a pronounced downside orientation, with overall price behavior closely aligned with a deteriorating trend structure and weakening momentum signals. Price continues to trade below its short- and intermediate-term moving averages, highlighting persistent sell-side dominance and a clear absence of sustained bullish participation. Momentum conditions remain firmly negative, as the MACD is positioned well below its signal reference and continues to expand to the downside, reinforcing the prevalence of distributional pressure rather than temporary mean reversion.

BTCUSD Key Levels

Supply Levels: $85,010, $102,110

Demand Levels: $74,420, $63,260

BTCUSD Long-Term Trend: Bearish

From a structural perspective, price has experienced a decisive breakdown from its former consolidation range around the $92,000–$95,000 zone, confirming a significant erosion of underlying support. The subsequent high-velocity selloff through the $85,000 and $74,400 levels reflects aggressive supply expansion, followed by only a shallow reactive bounce that failed to establish trend continuity. Former demand zones have since transitioned into overhead supply, while the persistence of lower highs and lower lows underscores structural fragility and ineffective demand replenishment.

Looking ahead, BTCUSD may attempt a short-lived relief rally toward the $74,000–$78,000 region, now defined by prior demand turned resistance. Failure to reclaim acceptance within this band would likely reignite downside momentum toward the $69,000 level, with a deeper extension potentially targeting the $63,300 zone. Under a more pronounced risk-off scenario, sustained bearish pressure could compress price further toward the $53,500 area, aligning with deeper range support and reinforcing the prevailing bearish continuation outlook.

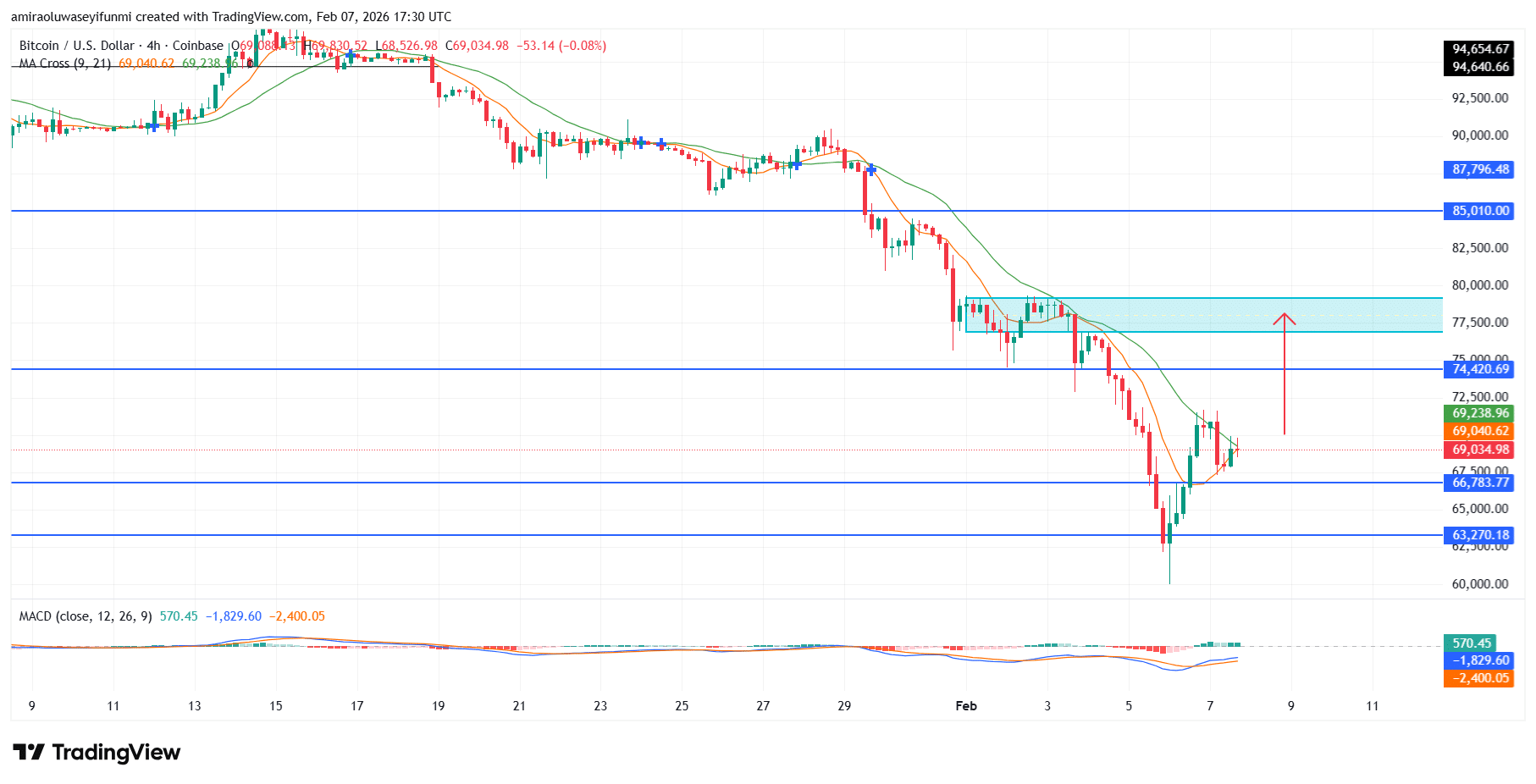

BTCUSD Short-Term Trend: Bullish

BTCUSD is exhibiting short-term bullish stabilization after defending the $63,300–$66,800 demand region, with price now recovering above the $69,000 level. Momentum conditions are improving modestly as the MACD begins to curl higher, indicating fading selling pressure and the early re-entry of buyers, a setup that often attracts attention within short-term crypto signals.

Technically, the emergence of higher intraday lows suggests a corrective rebound is unfolding rather than continued capitulation. A sustained move above $69,500 could allow a near-term advance toward the $74,400–$77,800 supply zone before broader bearish forces potentially reassert control.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.