Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Market Analysis – February 3

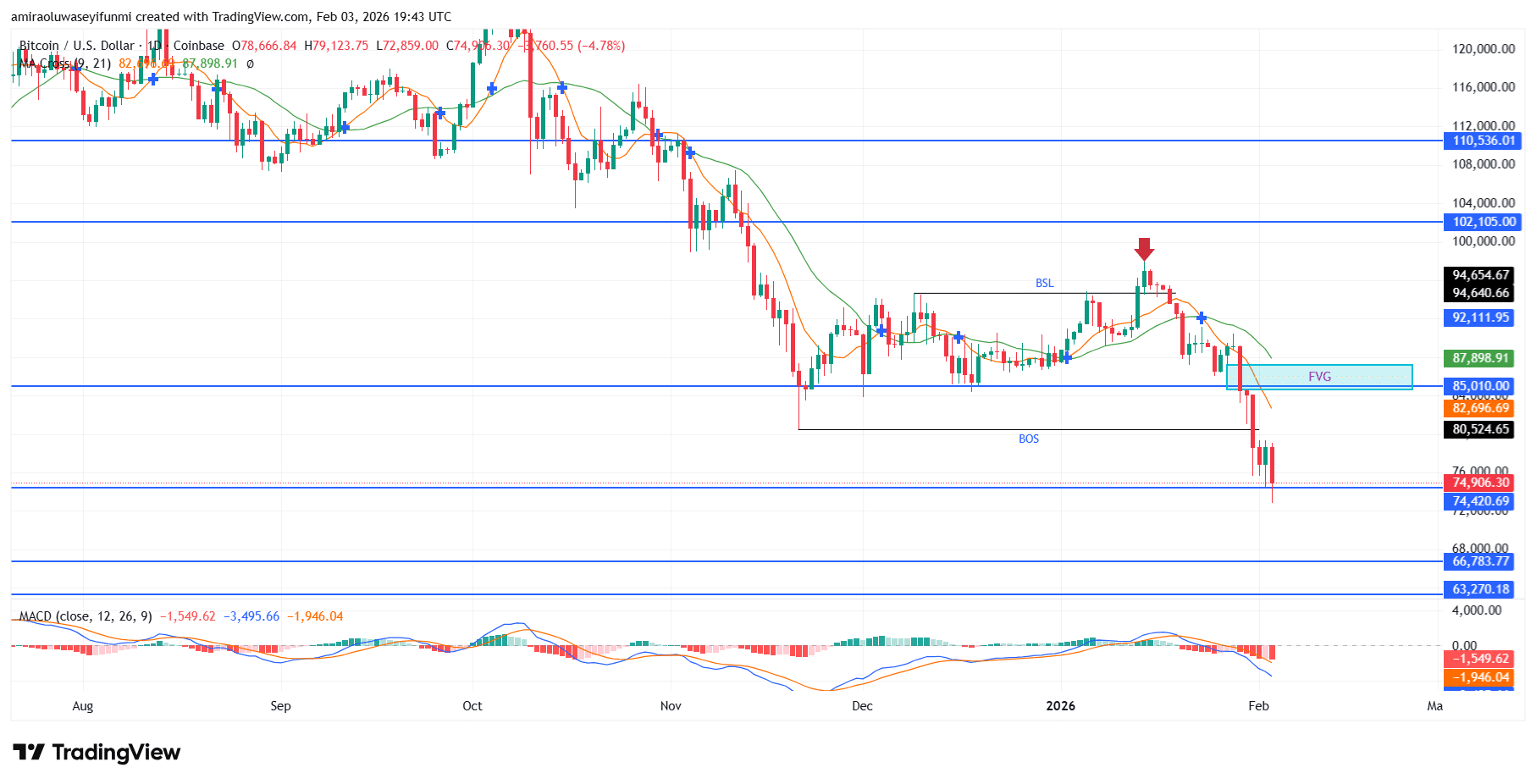

BTCUSD market transitions bearish following structural breakdown and momentum deterioration. BTCUSD has shifted decisively into a bearish phase, with broader price action now diverging from prior bullish conditions and trading firmly below key trend-defining averages. The short- and medium-term moving averages have rolled over and are acting as dynamic resistance around the $92,100–$94,600 region, reinforcing downside pressure. Momentum indicators support this transition, as the MACD remains deeply negative and continues to expand lower, signaling acceleration rather than stabilization. Collectively, these conditions reflect a market environment dominated by distribution and risk-off positioning.

BTCUSD Key Levels

Supply Levels: $85,010, $102,110

Demand Levels: $74,420, $63,260

BTCUSD Long-Term Trend: Bearish

From a structural standpoint, price has delivered a decisive break below support near $85,010, aligning with a bearish break of structure and a sharp impulsive sell-off. Attempts to stabilize beneath the former consolidation range have been rejected, while prior buy-side liquidity near $94,600 was swept before aggressive selling resumed. The failure to hold interim demand around $80,500 has exposed BTCUSD to lower value areas, and the absence of a meaningful bullish response highlights weak buyer participation, reinforcing the validity of downside continuation.

Looking ahead, BTCUSD is expected to remain under pressure while trading below $85,010 and, more importantly, beneath the $92,100 resistance zone. Focus now shifts toward the $74,800–$74,400 region, where short-term demand may attempt to moderate the decline. A decisive breakdown below this zone would likely open the path toward deeper downside objectives near $66,800, with an extended bearish scenario targeting $63,300. Any recovery attempts are anticipated to remain corrective in nature unless price can reclaim and sustain acceptance above $92,100, which currently appears unlikely.

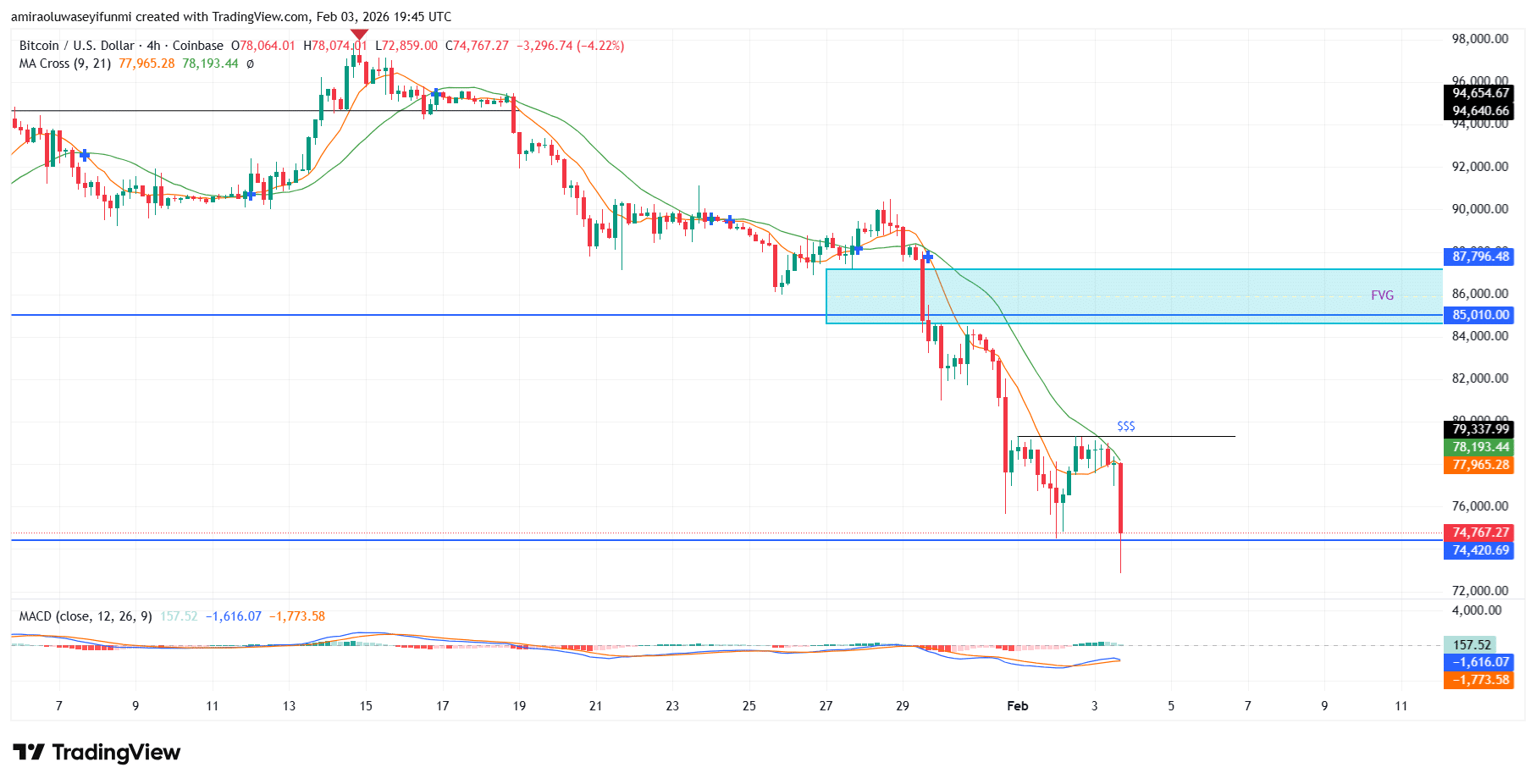

BTCUSD Short-Term Trend: Bullish

BTCUSD remains structurally bearish on the four-hour timeframe, with price holding below declining moving averages and momentum indicators continuing to favor sellers. The impulsive breakdown beneath the $85,010 support confirms dominant downside control, reinforced by weak rebound attempts and the formation of lower highs.

However, the sharp sell-off into the $74,700–$74,400 region raises the likelihood of a corrective rebound driven by short covering and mean reversion. Any bullish response tracked through crypto signals is likely to remain corrective and may target the premium supply zone around $85,000–$87,800, where renewed selling pressure is expected to emerge.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.