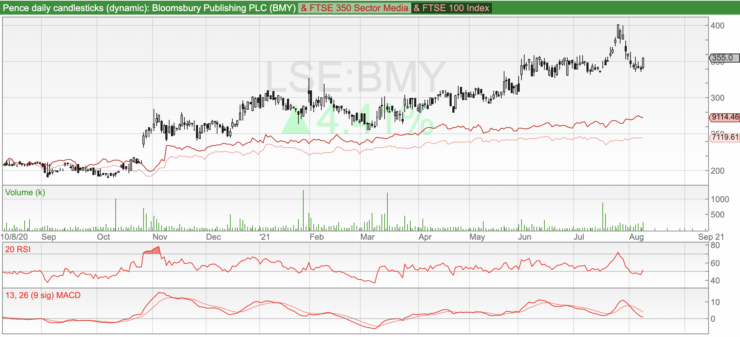

Bloomsbury Publishing (BMY) is a quality company at a good price and currently presents an especially attractive entry price, after its value declined from the end of July – but has not violated a bullish trend that began in March this year.

The rising fortunes of the stock of the Harry Potter publisher this year, continues an even longer trend dating back to October 2020, with the publisher emerged as a lockdown winner as more books were bought and read at home.

However, the same lockdown factors may have been at work (in a negative way) in the sharp reversal of the share price at the end of last month, with fears that the Delta variant of the virus could damage the reopening of the economy both in the UK and globally.

Bloomsbury reports strong growth in 4 months to June 2021

Nevertheless, looking back to the four months to June, the growth in revenues across both consumer and non-consumer segments has been very strong. Consumer was up 26% and non-consumer 31%.

Perhaps most encouragingly for shareholders, the management’s decision prior to the pandemic to re-energise its online offering of ebooks and audio books is paying off. So too is the attention given to academic publishing, with revenue growth of the academic and professional section of its non-consumer division improved 35%.

These results were helped by the recent acquisitions of Head of Zeus (consumer adult), and Red Globe Press (academic and professional), which added £859,000 and £478,000 to revenues, respectively.

The company expects performance for the year ending 28 February 2022 to be in line with market expectations – which, on the basis of previous projections, translates to revenue of £193.4 million and pre-tax adjusted profit of £19.3 million.

Bloomsbury in June said the strong revenues were also assisted by seasonal factors, namely the weather. In particular, two titles in the UK were cited as having seen sales benefit as a result of good summer weather: Tom Kerridge’s Outdoor Cooking and holiday read Psycho by the Sea by Lynne Truss. But the British weather being what it is, the sun has not been much in evidence lately, so some of the sales driven by good weather may have been curtailed somewhat.

Bloomsbury results for the six months ending 31 August 2021 are due on 27 October 2021, so we will have to wait until then for more pointers on whether the four-month performance to June is sustained or not and is on track to be in line with expectations as management forecasts.

Still, whatever the fluctuations as a result of shifting reading tastes during the summer holiday season, it is the company’s overall business strength and market positioning that is the ultimate guide for interested investors.

If you want to learn more about stock trading before buying Bloomsbury, check out the learn2trade stock trading page.

Strong management focus on online growth

We are drawn to Bloomsbury’s 2021 Annual Report, appendix 2 “principal risks and uncertainties” for a detailed look at management’s thinking and strategy going forward.

Our main focus here is the threat from online (and lockdowns – although that is receding in the UK), as the company points out in the risks column: “Growth of online retailers may impact on the discoverability of Bloomsbury titles and lead to a reduction in sales channels available to the Group.”

Its response to mitigating those risks has been mentioned but it is worth looking at in more detail. Here’s the exact text from the report: “Increased focus on promoting digital book sales (ebooks and audio books) and BDR [Bloomsbury Digital Resources] products (as academic institutional customers pivot to digital resources to support remote learning for students).”

So Bloomsbury is not only executing in the obvious areas of digital books but also has a keen eye on the changing e-learning environment that has been transformed by the pandemic. In this part of the business it is looking to not just deliver content across online channels, but also to introduce different ways of consuming, such as through subscription pricing and greater access flexibility.

Interestingly, some of the innovation from Bloomsbury is as a result of the competition it faces, such as in the emerging trend of text book rentals, which cuts publishers out of the revenue loop. By offering subscriptions that enable access to what would otherwise be expensive text books that may only be needed to be referenced for one semester/term or less, the company provides a much more flexible approach than renting.

One key risk not mentioned as a principal risk by Bloomsbury is the threat from foreign editions of UK titles being sold into the UK at cheaper prices, which could be a threat to UK publishers, depending on how the UK government crafts the forthcoming copyright laws for the post Brexit environment. Bloomsbury designates this as an “emerging risk” on the basis that it is not clear yet how this will manifest itself.

Revenue diversification: the ‘Potter risk’

One last consideration to be aware of before weighing up whether to invest is the ‘Potter risk’: what percentage of revenue comes from the sales of JK Rowling’s massively popular series and is the company over-reliant on this stream?

Stockpicker Richard Beddard estimates that the raw number is somewhere between £15 million to £37 million.

On projected earning of £193 million, that’s between 7.7% and 19% of total revenues. But with its push into academic and professional publishing and its acquisitive nature underlined by recent actions, the percentage of revenues dependent on Potter should continue to decline, thereby diversifying its sales and further strengthening the business.

Normalised earnings per share (EPS) has been growing consistently since 2017 and current EPS is 16.7p, forecast at 18p and 19.9p for 2022 and 2023 respectively.

Dividend yield is 2.78% and forecast p/e ratio is a very reasonable 18.1, ranking Bloomsbury 12th out of 30 companies in the media and publishing sector.

The shares are 5% higher today at 357p.

Bloomsbury Publishing is a long-term buy.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.