The best way to invest money will depend on your own goals, tolerance for risk, and many other factors. The key is to conduct some research to see which market might be right for you – and find the best broker to facilitate your needs as an investor.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

In this guide, we discuss the best ways to invest money in 2023.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

This includes 10 investments that cover a variety of financial goals and risk profiles – alongside reviews of the best online brokers that can facilitate your asset purchases.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Best Ways to Invest Money 2023: Quick Preview

In too much of a hurry to read this guide in its entirety today? Below you will find a quick preview of the ten best ways to invest money in 2023.

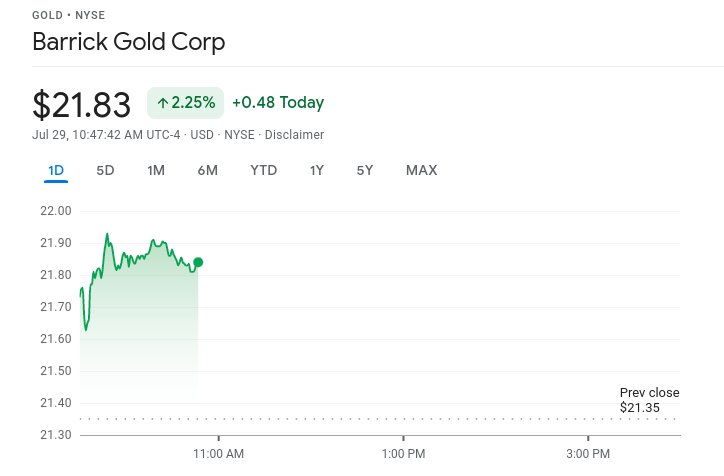

- No 1: Gold – Best Investment for Portfolio Diversification and Hedging

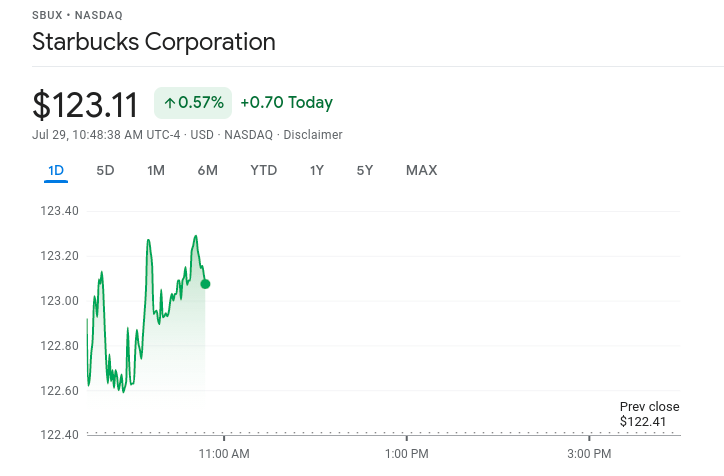

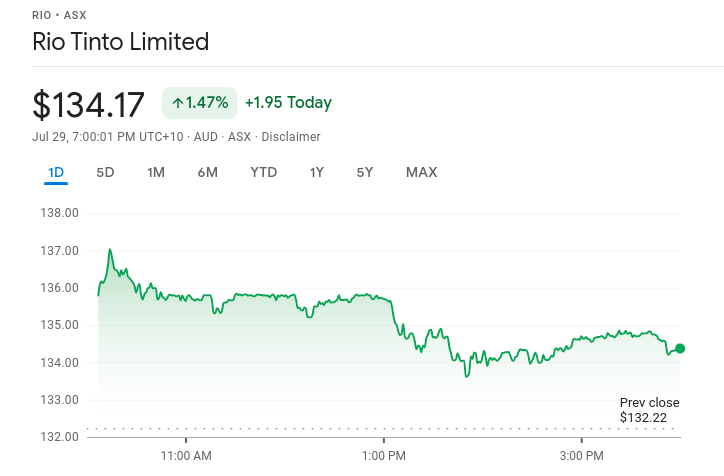

- No 2: Individual Stocks – For Those Looking to Invest in Companies

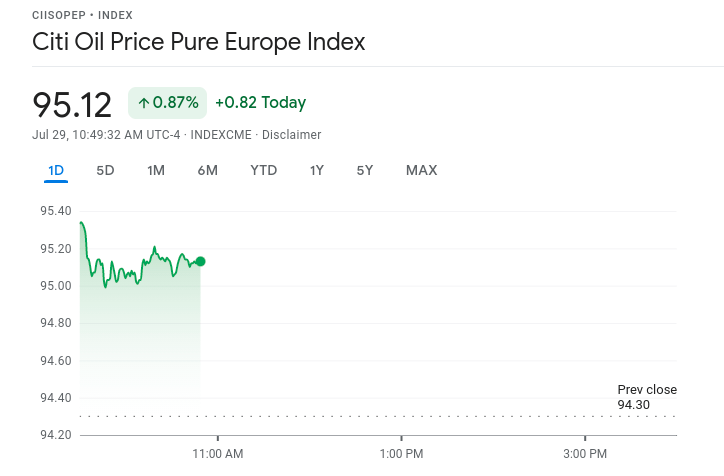

- No 3: Energy Commodities – An Indispensable Market With Inflation Hedging Potential

- No 4: ETFs – Best Reduced-Risk Vehicle for Big and Small Investors

- No 5: Dividend Yielding Stocks – Good for Investors Looking for a Regular-Income Plan

- No 6: Index Funds – Best for Long-Term Saving Objectives

- No 7: Government Bonds – Suited to Conservative Investors

- No 8: Growth Stocks – Best for Capital Appreciation

- No 9: Cryptocurrencies – Invest for Long-Term Value

- No 10: Value Stocks – Great Low-Cost Investing Opportunities

Importantly, the safest way to invest money in 2023 is via a reputable and licensed online broker. That being the case, we scrutinized the top-rated trading platforms to facilitate your transactions.

We offer a review of the best three providers later – after the full report on the above investment options.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Top Ten Best Ways to Invest Money 2023: Full Report

The key thing to note is that if you happen to be interested in a specific asset – there will usually be a few different ways in which you can invest in or trade it.

Take gold for instance – you can access this market in the following ways:

- Investing in individual gold mining stocks and associated companies

- Trading gold as CFDs

- ETFs – such as VanEck Vectors Gold Miners ETF (which can also be traded as CFDs)

- Buying physical bullions of gold

Still undecided on the best way to invest money in 2023? Next, you will see some key advantages of each of the ten investment options listed in our earlier preview – as well as a little information on what that might entail.

No 1: Gold – Best Investment for Portfolio Diversification and Hedging

We can trace the buying and selling of gold back over 2,000 years. To this day, the asset is still considered one of the best ways to invest money. This is a tangible asset – unless you elect to buy and sell CFDs so you don’t have to own or store anything.

It’s thought there’s less risk attached to investing in this resource in the long-term. After all, physical gold recovers in value quickly during a stock market downturn. For instance, during the financial recession in the late 2000s – this asset increased in value as other markets were struggling.

It’s thought there’s less risk attached to investing in this resource in the long-term. After all, physical gold recovers in value quickly during a stock market downturn. For instance, during the financial recession in the late 2000s – this asset increased in value as other markets were struggling.

Here are some key characteristics of gold with examples:

- Gold is almost indestructible – most of what we have mined is still in circulation today with only around 20% of the world’s supply still left to be excavated

- If the value of the US dollar is in decline – gold usually increases in price – making it perfect for hedging

- For instance, pandemic-related demand saw the US dollar decline, quantitative easing on bond purchases, and interest rate decreases in areas to try to fight against national recessions led to gold hitting a record high

- Due to the lack of a decline in purchasing power – gold increased

- Gold has risen from a value of $35/oz in 1970 to around $1,800/oz in 2022

Of course, the price of gold will always fluctuate, but as you can see, this precious metal is considered an advantageous investment for diversification and hedging in an uncertain economy.

Other things to be mindful of when you are considering ways to invest money in gold are logistics, storage, and security:

- A standard bar of gold weighs in at over 12 kilos

- If you opted for a third-party storage company or a bank vault to keep your investment safe – there are fees involved – which will vary

- A premium could cost you a fixed fee of say, $15 per month (for example), or a percentage of its value. In other words, these costs add up

There is also the argument that to make this asset liquid – you need to cash it out easily if you see an opportunity to take home a good profit. Owning physical gold presents challenges like having to have your investment refined by a professional to prove the gold content.

All is not lost – brokers such as AvaTrade and Capital.com allow you to buy, sell and store gold CFDs that represent the underlying value of the asset. Furthermore, commissions are low (if not zero) and you do not have to worry about storage.

This means you can buy and sell with ease – whether you wish to hold on to your investment for hours or years. For this reason, those thinking about ways to invest money in 2023 – who also want to create a diverse portfolio of assets – might well find gold a convenient option.

No 2: Individual Stocks – For Those Looking to Invest in Companies

Make no mistake, when thinking up ways to invest money, individual stocks are not the easy option. This type of investment takes time and dedication. You can’t throw all of your funds at one market without first performing the necessary fundamental and technical analysis.

With that said, if you are willing to take added risks, there are advantages to buying individual shares. You might also look to try a stock tracking app to aid you in monitoring and predicting the markets.

See some key characteristics of individual stocks below:

- The more time you hold on to your investments – the lower your ownership costs usually are

- Some brokers charge a fee to buy the stock – but there won’t be recurring asset management costs

- There is potentially an opportunity for greater returns

- The alternative option is individual stock CFDs. This enables you to buy or sell a fractional amount of a company – making it easier to diversify and profit from falling markets

One of the disadvantages of investing in individual stocks is the added risk. This is because you are quite literally exposing all of your money to one single asset class. Additionally, you have to keep one eye on each of the company’s that you own shares in at all times.

You may want to buy US stocks such as Alibaba, Microsoft, Starbucks, or Tesla. Alternatively, perhaps you would like to focus on UK-listed companies like BP, Rolls Royce, or Lloyds. If you want access to the pharmaceutical sector, for example – check that your chosen platform lists the market in question.

The brokers we review today facilitate fractional investments, which means if you wanted to invest in a big tech company like Apple – you wouldn’t need thousands to get your foot in the door. As such, many stock investors are now able to buy/sell a diverse selection of shares.

Some of the biggest stock marketplaces in the world include:

- The NYSE and Nasdaq in New York

- The London Stock Exchange

- The Shanghai Stock Exchange

- Japan Exchange Group

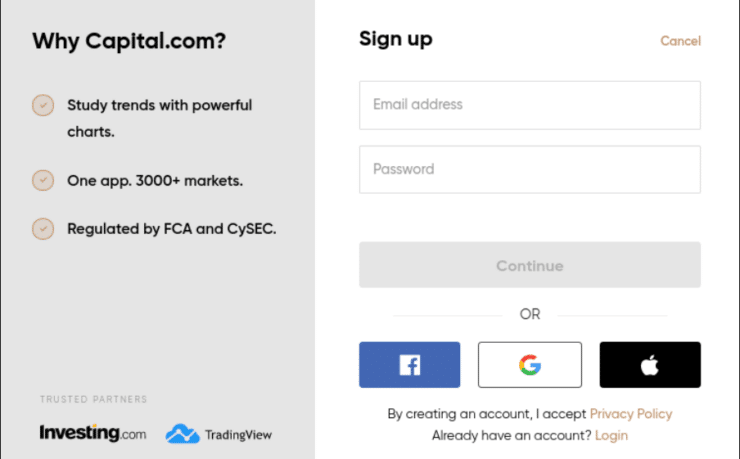

There are also tons of smaller economies. For example, Capital.com lists thousands of stocks from multiple exchanges – inclusive of the US, UK, the Netherlands, France, Spain, and Singapore. We offer a full review after this rundown of the top ten best ways to invest money.

No 3: Energy Commodities – An Indispensable Market With Inflation Hedging Potential

With the seemingly endless high demand for energy globally, it’s really no wonder many people consider this one of the best ways to invest money in 2023. For those unaware, this includes commodities such as crude oil, gas, and coal. In other words – sources of energy and power.

It has to be said – the future of coal could be bleak because of a global desire to reduce our reliance on fossil fuels and save the planet. With that said, you will see below just a handful of reasons other energy commodities could be a smart way to invest your money.

See some attributes and examples of how oil and gas behave:

- The global demand for oil stands at over 98 billion barrels every day

- The supply and demand of oil fluctuate due to natural disasters, political unrest i countries that supply it, and much more.

- This causes the kind of volatility that short-term investors particularly look to profit from

- The industry expects the world demand for US natural gas to increase year on year – by between 1% and 3%

- Approximately 8% of the US’s GDP is supported by the gas and oil industry. This encourages domestic growth and creates millions of jobs, thus having a knock-on effect on the economy

- Oil and gas are significant assets for diversification purposes – because of their ability to hedge against inflation

We mentioned that oil and gas can be used to hedge against inflation. A real-world example of a company doing this is the US airline Delta -which bought a run-down oil refinery to mitigate against rising fuel prices.

You can reduce your equity exposure to inflation with commodity hedging in a similar way. The world reserve currency – the US dollar and energies have a strong correlation with this market. This means if the USD is strong, these assets may rise in price.

You should also study fundamental analysis – including keeping abreast with global news. Many people trade commodity CFDs – to make gains from falling markets, as well as rising. Another major advantage is the ability to magnify your stake with leverage.

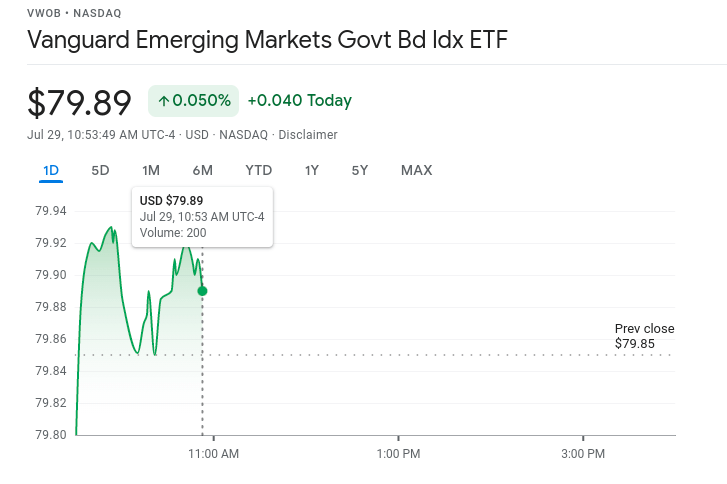

No 4: ETFs – Best Reduced-Risk Vehicle for Big and Small Investors

ETFs (Exchange Traded Funds) are one of the best ways to invest money in 2032 – for various reasons. This is a security product bought and sold on a stock exchange – whereby the fund merely tracks the price of the underlying asset.

The ETF will track the value of multiple equities or indexes (for example). This means you can build a mixed portfolio with one purchase – accessing a diverse range of industries within one basket. You also need the right broker by your side – we review the best later.

One of the best ways to invest money in 2023 is with stock ETFs. With one investment providing access to dozens or even thousands of shares at once. This saves you from having to perform analysis on each individual publically traded company.

Take a look at some stock ETFs to consider below:

- Invesco QQQ ETF

- SPDR S&P 500 ETF

- Vanguard FTSE Emerging Markets ETF

- Ark Genomic Revolution ETF

- iShares MSCI USA Min Vol Factor ETF

- Vanguard Information Technology ETF

We mentioned that energy commodities can be a good way to hedge against inflation. An alternative way to access the energies markets is via ETFs. As you now know, this gives you diverse exposure to the industry within one investment.

See some of the biggest US energy company ETFs below:

- VanEck Vectors Oil Services ETF

- PDR Energy Select Sector Fund

- iShares U.S. Energy ETF

- Vanguard Energy ETF

- SPDR S&P Oil & Gas Exploration and Production ETF

As is clear – ETFs come in all shapes and sizes. While one may concentrate on tech stocks another might contain banking firms. Another might focus on an index of a hundred equities, currencies, bonds, or commodities. You should always conduct your own research before investing.

No 5: Dividend Yielding Stocks – Good for Investors Looking for a Regular-Income Plan

Do you want to receive a portion of the earnings of the company you are invested in? If so, one of the best ways to invest money in 2023 is via dividend-yielding stocks. This can offer capital appreciation and a predictable stream of income for investors of all experience levels.

Let’s offer a quick example of how investing money in dividend-yielding stocks works:

- Let’s imagine you want to invest money by buying 100 shares of Telefonica – priced at $10 each

- Your total investment is $1,000

- Each share pays $0.40 dividends annually

- As such you receive dividend payments of $40 – this equates to a yield of 4%

- You receive this payment regardless of the fluctuating stock price – so long as the company is still paying dividends

What you do with this money is entirely up to you. Many people reinvest their dividend payments to purchase more shares in the same or alternative companies. The idea is to build wealth and mitigate risk with diversity. Some stocks increase their yield consecutively.

Fancy trading a full basket of high dividend assets? You may consider the iShares Core High Dividend ETF. This portfolio of stocks includes 74 stable holdings such as Johnson & Johnson, Coca-Cola, Proctor & Gamble, and more. This basket has a yield rate of around 3.59%.

No 6: Index Funds – Best for Long-Term Saving Objectives

ETFs and index funds do offer similarities – insofar that they bunch together multiple individual investments and roll them into one. This is highly compatible with the type of person that has long-term saving goals. One of the best ways to invest money is to create a diverse portfolio.

With that said, this type of investment does differ from ETFs – in the way they are traded and when you can buy and sell them. Index funds can only be purchased and sold after the market has closed – rather than all day like stocks.

Here we have listed a few of the best ways to invest money in index funds:

- Fidelity U.S. Sustainability Index Fund

- Schwab S&P 500 Index Fund

- Fidelity ZERO Large Cap Index

To clear the mist, the Fidelity ZERO Large Cap Index monitors an index of over 500 large-cap stocks in the US. In contrast to the official S&P 500, it avoids S&P Global licensing fees. The ZERO is a nod to the 0% expense ratio and lack of minimum investment amount.

Next, see some of the main traits of index funds:

- Index funds offer less risk-exposure in comparison to individual stocks – they hold multiple separate companies in a single basket

- This is a somewhat passive way to invest money – you don’t need to be well versed in the art of stock picking

- Index fund returns rarely outdo the performance of the underlying index

- You can purchase shares of mutual funds from an asset management firm – or you can buy and sell shares in ETFs via a broker

- Index funds are attractive to investors who want to target a specific market segment such as the US, or perhaps a particular sector, company size, or industry

Note that some index funds require a minimum investment in excess $1,000. This is one reason many newbie investors prefer to go down the route of the aforementioned stock ETFs. Reputable online brokers AvaTrade and Capital.com offer a multitude of CFDs on this product.

No 7: Government Bonds – Suited to Conservative Investors

When you are thinking up the best ways to invest money in 2023, be mindful that risk and reward are heavily correlated. In other words, the more tolerant you are of the potential dangers of investing – the more you stand to make if things go right.

With that said, if you consider yourself a conservative investor, you may want to invest money in a fixed-income security such as government bonds. This is a debt instrument issued by governments in order to fund and support their financial obligations and spending.

The government in question might need to raise money for day-to-day operations, infrastructure spending, and so on. As you are essentially agreeing to lend the govvernment funds – you will receive a fixed and regular interest rate payment which we talk about next.

See an example of how investing money in a government bond via a fund works:

- Let’s say you invest $1,000 in iShares UK Gilts All Stocks Index Fund

- Imagine the total coupon percentage for your investment is 10% per annum

- The maturity date on this bond is 10 years

- In this scenario, you will receive $100 per year for the next 10 years

- When the 10 years is up and the date of maturity has been reached – you receive your $1,000 back

The $1,000 received in the example above is known as the par value – the amount you initially invested. The coupon payment is the interest you are owed. This investment vehicle continues to pay the same amount until it reaches its expiry date, known as the date of maturity.

Meaningful variation exists with this asset. Government bonds from strong economies include the US, UK, Australia, New Zealand, Denmark, Sweden, and a few other developed countries. The yield is usually less in this instance because it is a low-risk investment.

Some of the primary advantages of choosing to invest money in government bonds are as follows:

- Fixed-rate returns – albeit this will generally be lower than other bond types

- Safer investment than most bonds – due to government backing

- Liquid marketplace – especially with US government bonds

- Usually exempt from local taxes

If you want flexibility and would like to make gains from falling markets, you can trade government bond CFDs. This also allows you to apply leverage. Another option is the plethora of ETFs tracking this asset class – such as the iShares International Treasury Bond ETF.

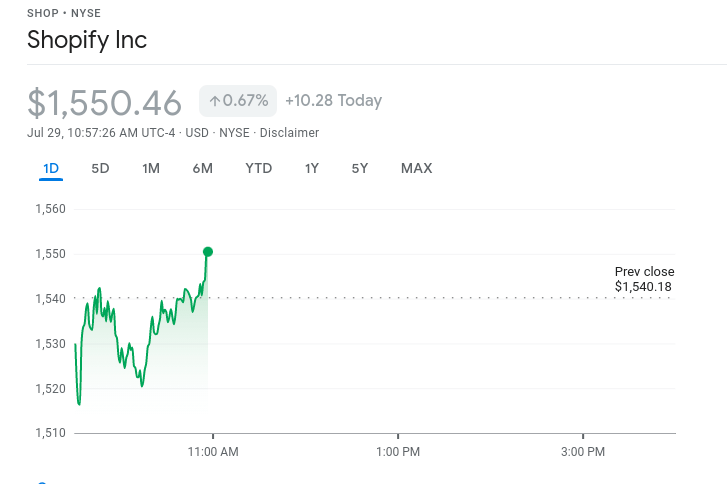

No 8: Growth Stocks – Best for Capital Appreciation

If you are searching for the best ways to invest money in 2023 to generate a sustainable cash flow – growth stocks might be the preferred route. In a nutshell, this will see you investing in a company that increases its growth and earnings much faster than the average market rate.

If you are targeting individual growth stocks, there is a high amount of risk involved. This investment can be extremely sensitive to price swings, which makes it much more volatile than the wider market. For this reason, many gain exposure to this asset via funds or CFDs.

Below you will see just some of the popular growth stocks, in different forms. Of course, there are many more to choose from:

- Individual Growth Stocks: Square, Fiverr, Amazon, Alibaba, Twitter, Zoom, Twitter, Everest, Shopify, Facebook, JD, and more.

- Growth Stock ETFs: Vanguard Growth ETF, iShares Russell 1000 Growth ETF, JPMorgan US Momentum Factor ETF, SPDR FTSE UK All Share UCITS ETF, and many others.

In the case of the Vanguard Growth ETF – this tracks large-cap US stocks. You can also gain exposure to growth stocks via the aforementioned CFDs. Your chosen online broker should offer access to a wide range of markets.

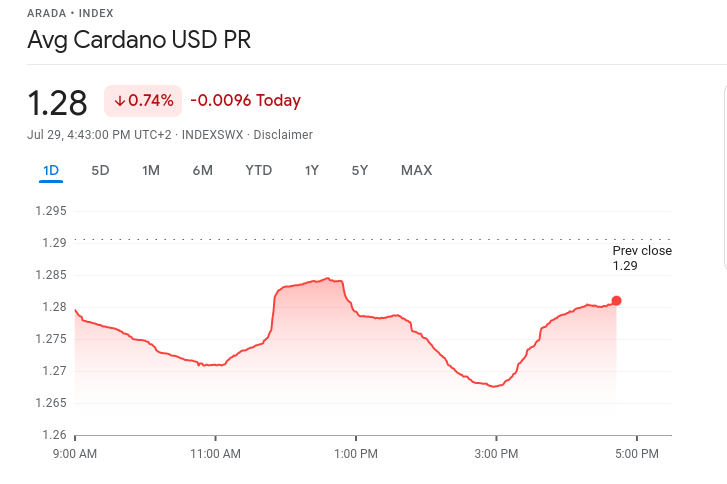

No 9: Cryptocurrencies – Invest for Long-Term Value

If you are thinking about the best ways to invest money in 2023 and are somewhat of a modern investor – consider cryptocurrencies. Not just reserved for short-term traders, digital assets such as this can be purchased and held – in the hope their value increases over time.

You may also use cryptocurrencies to diversify your investment portfolio. For instance, if you’re thinking about ways to invest money and decide to learn how to buy Ethereum, why not hedge against ETH coins by looking to buy Cardano as well?

See some examples below of why one of the best ways to invest money is in cryptocurrencies:

- Ethereum was launched in 2015 and was initially traded for $2.77 – one token is now valued at over $2,250 – showing an increase of 81,127%

- Bitcoin was introduced in 2009 and was valued at $0 ($0.0008) – a single token is now priced at over $39,500 – this is a rise of over 4.9 billion percent!

Using Ethereum as an example, if you had invested $1,000 in ETH coins in 2015 and stored them, your investment would now be worth over $800,000. When taking this route it’s important to carefully consider a broker and where you might store your digital assets.

There are plenty of criminals in the blockchain scene so you must ensure you are buying cryptocurrencies from a legitimate source. It’s also critical that you keep your investment safe. You could opt to download a wallet with various passkeys.

Alternatively, you might buy cryptocurrencies and store them at a safe online brokerage. Furthermore, unlike some traditional assets, you can invest small amounts in cryptocurrencies, making it much easier to diversify and add different markets to your portfolio.

No 10: Value Stocks – Great Low-Cost Investing Opportunities

Value stocks are what they sound like – this is an investment offered by a company that provides shares at a lower price than you might expect. If you are looking for the best ways to invest money in 2023 and want low costs and strong performance – this could be a suitable option.

To explain further, if you have ever conducted fundamental analysis and thought the share price seemed like an underevaluation (considering the data in front of you) – you could have been viewing a value stock.

See some characteristics of value stocks to clear the mist:

- The value is lower than similar stocks in the same area

- This category of stocks is usually less volatile than the wider market

- Value stocks often pay dividends

- The price to earnings ratio seems beneath that of the broader market

Some of the value stocks that investors flock to are as follows:

- Proctor & Gamble

- Hewlett Packard

- CVS Health

- Berkshire Hathaway

- Freeport-McMoRan

- Johnson & Johnson

If you would like to access value stocks via ETFs – Invesco S&P 500 Pure Value ETF is worth considering. If you like the idea of investing money in an asset like this, but it’s new to you, you can always try one of the many investing podcasts.

Choose the Best Platform to Invest Money 2023

See below our top picks when it comes to finding a safe place to invest in your chosen type of investment.

Here are just some of the details we look at:

- Market diversity

- Regulation and reputation

- Low commissions and fees

- Flexibility and usability

You can also consider handy tools and features, as well as accepted methods of conducting transactions. The three brokers listed below satisfy all the above requirements.

1. AvaTrade – Overall Best Platform to Invest Money 2023

AvaTrade is a low-risk brokerage - three tier-2 jurisdictions and three tier-1 jurisdictions regulate this space. Not only that, but the provider is a respected global brand serving investors from around the world. Please note that this platform offers CFDs (Contracts for Difference).

As this is a CFD broker, you can invest in heaps of different assets without the need to outright buy and own them. In contrast, let's say you were thinking about investing in an individual stock such as Amazon, one of the biggest companies in the world.

You would need to have over $3,600 to invest in one single share. However, because AvaTrade is a CFD broker, you can trade against the price movements of the underlying asset instead. This also entitles you to go short with a sell order when you think the price will fall.

As well as stocks, this guide also discovered tons of ETFs, bonds, cryptocurrencies, and indices. When thinking about the best ways to invest money via AvaTrade, you might also consider commodities - which includes energies like oil and gas, or metals such as gold.

At AvaTrade, once your account has been verified you can invest as little as $100 to get started. Payment methods offered here include credit and debit cards, wire transfers - and also e-wallets such as WebMoney, Neteller, and Skrill. This broker offers leverage to boost your stake.

- Heaps of markets to invest money - all commission-free

- Regulated by tier-1 and tier-2 jurisdictions

- Facilitates small investments

- Admin and inactivity fee after one full year no trading

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

3. EightCap – Trade Over 500+ Assets Commission-Free

Eightcap is a popular MT4 and MT5 broker that is authorized and regulated by ASIC and the SCB. You will find over 500+ highly liquid markets on this platform - all of which are offered via CFDs. This means that you will have access to leverage alongside short-selling capabilities.

Supported markets include forex, commodities, indices, shares, and cryptocurrencies. Not only does Eightcap offer low spreads, but 0% commissions on standard accounts. If you open a raw account, then you can trade from 0.0 pips. The minimum deposit here is just $100 and you can choose to fund your account with a debit or credit card, e-wallet, or bank wire.

- ASIC regulated broker

- Trade over 500+ assets commission-free

- Very tight spreads

- Leverage limits depend on your location

Best Ways to Invest Money 2023: Step-by-Step Guide to Get Started

As we mentioned a few times throughout this guide on the best ways to invest money in 2023 – having a broker behind you is the safest and most convenient way to buy any asset.

You will see below a generalized walkthrough of how to sign up with a broker and invest money today.

Step 1: Open an Account With a Broker

The best way to invest money in 2023 is to head over to the brokerage of your choice and look to sign up for an account.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Step 2: Complete KYC and ID Verification

Next, you should receive an email confirming your account. You will need to provide the platform with proof of ID and address at this stage.

- For your proof of ID: Most regulated brokers accept a passport, government ID, or driving license. This must contain a photo and be clear and readable

- To validate your address: The majority of platforms will accept a bank statement, tax letter, or utility bill. This must be dated from within the last 6 months and include your name and address – to match the details you gave when signing up

Once the broker confirms your account you can move to the next step to invest money in your chosen asset.

Step 3: Choose a Payment Method to Fund Your Account

Choose a payment method from what’s available. Next, enter the amount you would like to fund your account with – to begin to invest money.

The best brokers will accept a range of payment types covering credit and debit cards – as well as wire transfers and e-wallets such as Paypal.

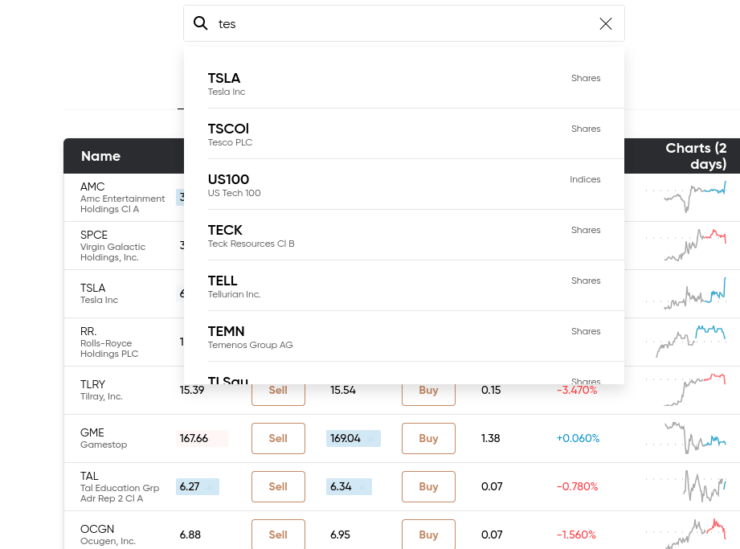

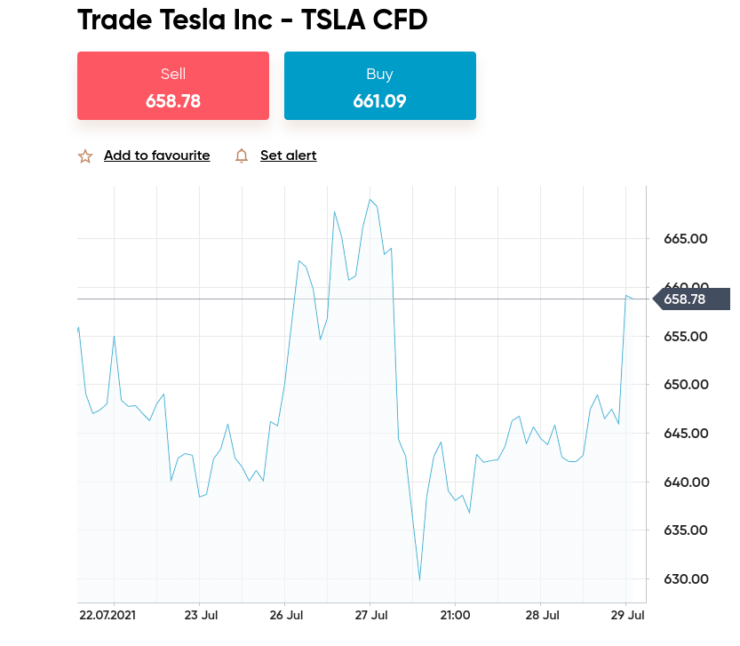

Step 4: Find Your Desired Investment

When you have decided on the best way to invest money for your personal goals – you can find the market on the platform. Here, we are searching for individual stock Tesla.

Step 5: Invest Money in Your Chosen Market

Now that you have funded your broker account – you can invest money in your chosen market.

Best Ways to Invest Money 2023:

In Summary

There is no shortage of options when it comes to the best ways to invest money in 2023. What your decision boils down to will depend on your personal goals and aspirations. For instance, if you aren’t keen on the idea of taking too much risk – you might choose government bonds.

Alternatively, if you are looking to hedge against inflation – you would likely look to gold or energies such as oil or natural gas. Choosing the right cryptocurrencies to invest money into can also be a great store of value for long-term investors – with some skyrocketing since creation.

It’s important to find a trustworthy broker to provide you with access to the markets and follow a high standard. Today we reviewed three regulated platforms – each offering a variety of assets with low fees, a range of deposit methods, and investment vehicles such as ETFs and funds.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

FAQs

What is the least risky way to invest money 2023?

What are the best ways to invest money to hedge against inflation?

How can I invest money in multiple assets at once?

What is the best broker to invest money in safety?

What is the most flexible way to invest money in cryptocurrencies?