Many people opt to buy and sell stocks from different corners of the world, rather than just stick to one marketplace. To successfully coordinate your international trades, you will need to know the opening hours, as well as key times to place orders.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

With this in mind, today we divulge the best time of the day to buy stocks!

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

We also list the opening hours from stock markets around the world and talk about potentially profitable times to trade. As you will need a good broker by your side to execute your orders – so we also offer a short review of the top three platforms for the task!

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What Are the Global Stock Market Trading Hours?

We couldn’t possibly list every single stock exchange in the world – there are tons if you include small economies. With that said, to give you a good idea of when the biggest markets open – you will see the trading hours from around the globe below.

Please note that we have listed the opening hours in UTC (Coordinated Universal Time) and in a 24-hour format. You can easily convert this to your local time with an online tool, or by performing a quick internet search.

North and South America Stock Markets

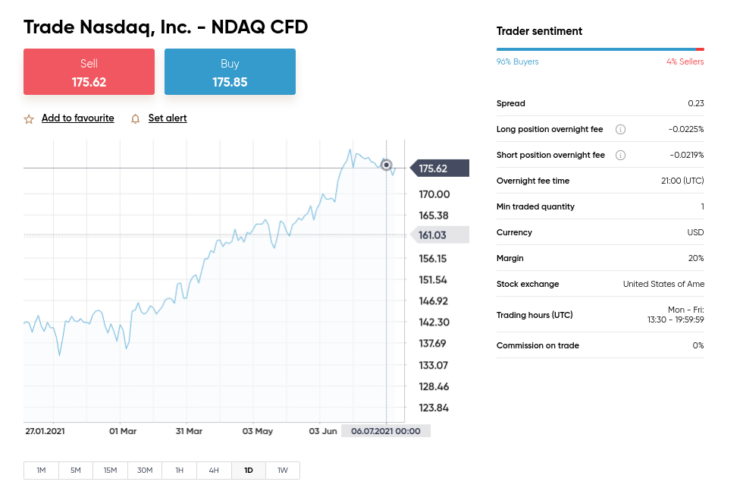

Some of the most popular marketplaces for buying and selling stocks are in the US. For instance, the NYSE, and Nasdaq – both based in New York – are the most heavily traded.

- US: New York Stock Exchange (NYSE) – 14:30 – 21:00

- US: Nasdaq – 14.30 – 21:00

- Canada: Toronto Stock Exchange – 14.30 – 21:00

- Mexico: Mexican Stock Exchange – 13:30 – 20:00

- Brazil: Brasil Bolsa Balcão S.A. – 13:00 – 20:00

- Argentina: Buenos Aires Stock Exchange – 14:00 – 20:00

- Chile: Santiago Stock Exchange – 12:30 – 19:00

We talk about the best time of the day to trade in these markets later on.

Euronext and The Rest of Europe Stock Markets

For those unaware, Euronext is a cross-border regulated exchange, created after the European Union was formed. This means it operates stock markets from multiple exchanges within the Eurozone.

Euronext is one of the leading marketplaces for derivatives and offers plenty of liquidity. Furthermore, this is the largest stock exchange in the world.

Below are the official opening times:

- Euronext Amsterdam – 08:00 – 16:40

- Euronext Paris – 08:00 – 16:30

- Euronext Lison – 09:00 – 17:30

- Euronext Brussels – 09:00 – 17:30

- Germany: Börse Frankfurt Stock Exchange – 07:00 – 19:00

- Russia: Moscow Exchange – 06:30 – 16:00

- Spain: Madrid Stock Exchange – 08:00 – 16:30

Remember, we have listed these trading hours according to UTC time.

Asian Stock Markets

We can trace Asian stock exchanges and securities markets back nearly 150 years. The main economic drivers of these markets in these times were post-WWII industrial expansion, a surge in population, and global trade deals.

See below a list of the most traded marketplaces in Asia:

- Japan: Tokyo Stock Exchange – 12:00 – 06:00, with a break 02:30 – 03:30

- Singapore: Singapore Exchange Limited – 01:00 – 09:00, with a break 04:00 – 05:00

- China: Hong Kong Stock Exchange – 01:30 – 08:00, with a break 04:00 – 05:00

- China: Shanghai Stock Exchange – 01:30 – 07:00, with a break 03:30 – 05:00

- National Stock Exchange of India – 03:45 – 10:00

- South Korea Stock Exchange – 12:00 – 06:30

Many investors of all shapes and sizes flock to the Asian stock markets. Some of these countries have enjoyed increasing GDP growth and are seen as great markets to trade and diversify in, due to their booming economies

Notably, there are varying conditions in these markets. For instance, Taiwan, Hong Kong, South Korea, and Singapore are often referred to as the ‘Asian Tigers’. And due to rapid industrialization, they became high-income economies over a relatively short period of time.

African Stock Markets

Africa is a huge continent and has 29 stock exchanges for its 38 nations. Below we have listed the opening hours of the most commonly traded. Johannesburg, for instance, is over 100 years old and is the largest in Africa.

See the opening hours of these markets below:

- South Africa: Johannesburg Stock Exchange – 07:00 – 03:00

- Kenya: Nairobi Securities Exchange: 06:00 – 12:00

The only way to trade stocks listed on these exchanges is to sign up with a suitable platform that covers the emerging economies.

Australian and New Zealand Stock Markets

These stock markets have a history of over a hundred years and the Australian Securities Exchange specifically now hosts over 2,000 companies.

See below the opening hours of these stock exchanges.

- Australia: Australian Securities Exchange (ASX) – 23:00 – 05:00

- New Zealand: New Zealand Exchange – 21:00 – 03:45

Many top online brokers list at least some stocks featured in the Australian and New Zealand marketplaces.

Best Time of the Day to Buy Stocks: Globally

It’s all very well knowing the opening hours of global stock exchanges, but – you need to know the best time of the day to buy stocks! Generally speaking, the best time is within the first hour or two of the markets being open.

See below a few of the most popular exchanges – and the best time of the day to buy stocks at each (all in UTC):

- New York Stock Exchange: The first two hours of the session are busiest – between 13:30 and 15:30

- London Stock Exchange: Volatility and liquidity is usually highest between 08:00 and 10:30

- Euronext: Trading volume tends to taper off around 11:30, so the best time to trade stocks on this exchange is between the hours of 08:00 and 10:00

- Hong Kong Stock Exchange: The best time to buy stocks here is between 01:30 and 03:30. Many people avoid this marketplace during the break, which is between 04:00 – 05:00

Notably, most Western stock exchanges close on weekends. You can, however, use pre and post-market sessions to your advantage and buy shares out of hours.

You might even use the time difference between where you live and the exchange you want to access to your advantage. On the other hand, in the Middle East, such as the Dubai Financial Market Exchange, the working week runs from Sunday to Thursday.

Best Time of the day to Buy Stocks: Pre and Post-Market Trading

Aside from the regular trading hours we have talked about so far, a small fraction of (usually experienced) traders prefer to buy and sell during pre-and post-market sessions.

To give you an example:

- The official opening hours for Nasdaq are between 14.30 and 21:00 UTC, Monday through Friday.

- The pre-market hours are 9.30 – 14.30.

- The post-market hours are 21:00 – 01:00.

Stock trading volumes are much smaller during these times, so you need to do some research before attempting to join seasoned traders during these hours.

- You may notice that most economic indicators are released at 13.30 UTC – one hour prior to the main two New York stock exchanges officially opening.

- In some cases, this can cause price fluctuations and set the tone for a volatile session.

After-hours sessions are useful when the price of stocks moves outside of ‘normal’ trading sessions. If a company you have a vested interest in makes a big announcement, or releases its latest earnings reports out of hours – you can react to the news as and when you sit fit.

Best Online Brokers to Trade Stocks 24/7

Rather than investing directly via a stock exchange, you are best to set up an account with a broker to safely guide you into the markets.

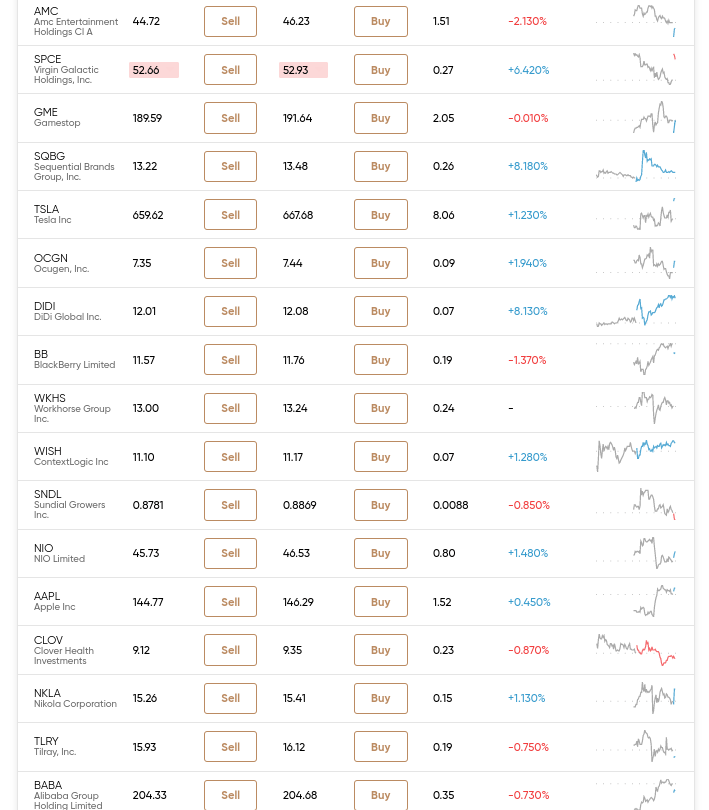

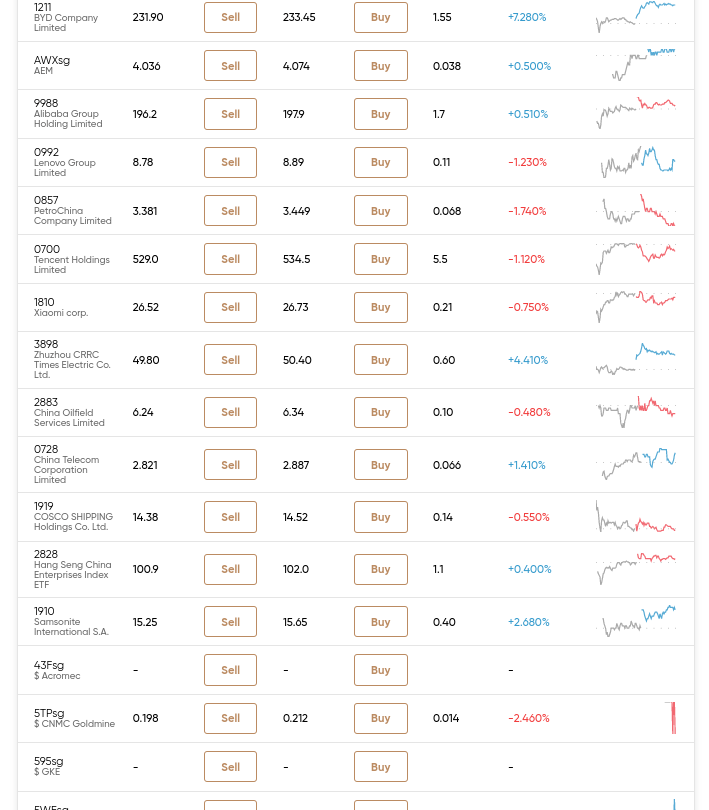

This usually enables you to trade stocks via CFD instruments, which affords you the opportunity to magnify your gains with leverage – and crucially, speculate on the future price of the underlying stocks without owning anything.

To save you some time we have reviewed the top three stock CFD brokers in the space.

1. AvaTrade – Overall Best Stock Broker 2021

Avatrade is a respected broker offering a long list of stock CFDs. As such, this means you can buy and sell shares in some of the world's biggest companies, and profit from both rising and falling prices. Markets listed here include stock exchanges in the US, the UK, and many more. As this is a CFD platform, you won't have to pay the hefty trading fees sometimes associated with traditional stocks.

This trading platform is 100% commission-free. Markets include companies such as Snapchat, Facebook, Groupon, Netflix, Twitter, Teva, Pfizer. Some of the biggest names here include Nike, Google, IBM, Disney, Walmart, and Coca-Cola, and Apple. All come with tight spreads, with the latter around 0.1%. This broker is watched over by 6 regulatory bodies, so you can trust that this is a regulated and safe environment to trade stocks.

As we have said, countries have different opening hours, and there are also various public holidays around the world. When a market is open that is listed by AvaTrade, you can trade it. Generally speaking, the AvaTrade opening times for stocks are Sunday 22:00 until Friday at 22:00 UTC. Accepted deposit methods include credit and debit cards, e-wallets like Skrill, and bank transfers.

The minimum deposit to trade stocks is $100. You download the AvaTRadeGO app free of charge, and can also link your account to MT5. Here you can access even more stocks, technical analysis tools, and even automated trading. Leverage of up to 1:500 is available on stock CFDs - although limits depend on your location and experience.

- Heaps of stock markets, minimum deposit is just $100

- Licensed in 6 jurisdictions such as the EU, Australia, Japan, and South Africa

- Trade CFDs with 0% commission on any stock market

- Admin and inactivity fee after a year

2. VantageFX –Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

3. EightCap – Trade Over 500+ Assets Commission-Free

Eightcap is a popular MT4 and MT5 broker that is authorized and regulated by ASIC and the SCB. You will find over 500+ highly liquid markets on this platform - all of which are offered via CFDs. This means that you will have access to leverage alongside short-selling capabilities.

Supported markets include forex, commodities, indices, shares, and cryptocurrencies. Not only does Eightcap offer low spreads, but 0% commissions on standard accounts. If you open a raw account, then you can trade from 0.0 pips. The minimum deposit here is just $100 and you can choose to fund your account with a debit or credit card, e-wallet, or bank wire.

- ASIC regulated broker

- Trade over 500+ assets commission-free

- Very tight spreads

- Leverage limits depend on your location

Best Time of the Day to Buy Stocks: Conclusion

What is the best time of the day to buy stocks? It will depend on your tolerance of risk, and which exchange the companies you want to access are listed on. For instance, it’s widely believed that the best time of the day to trade stocks listed on the NYSE is within the first and last 2 hours.

This is when the market is the most volatile, so traders can take advantage of the price shifts this invites. A key takeaway is to consider what sector or economy you are interested in and arm yourself with all the information you can surrounding that market.

You will also need to have a reliable stock broker on your side to execute your buy and sell orders – as and when you spot opportunities. AvaTrade and Capital.com both offer a plethora of commission-free stock CFDs.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts