These days, stock traders and investors come in all shapes and sizes. In other words, just about any average Joe with an internet connection and a mobile phone can buy and sell shares from the palm of their hands.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

If you are interested in accessing some of the biggest (as well as lesser-known) stocks from all corners of the world – read on.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Today – we discuss the best stock app for beginners in 2023. As well as reviewing five apps in full – we also divulge the ultimate checklist for you to consider when searching for a suitable digital platform to buy and sell stocks.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Best Stock App for Beginners 2023: Quick Run Through

If you are too busy to read our comprehensive reviews right now, you will see a quick run-through of the best stock apps for beginners below.

- 1: AvaTrade – All-Round Best Stock App for Beginners

- 2: EightCap – Best Stock App to Use With MT4/5

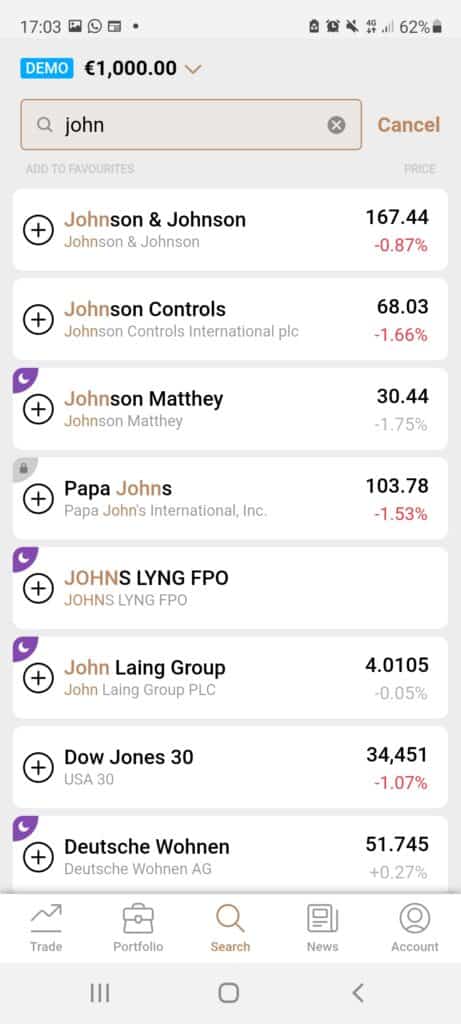

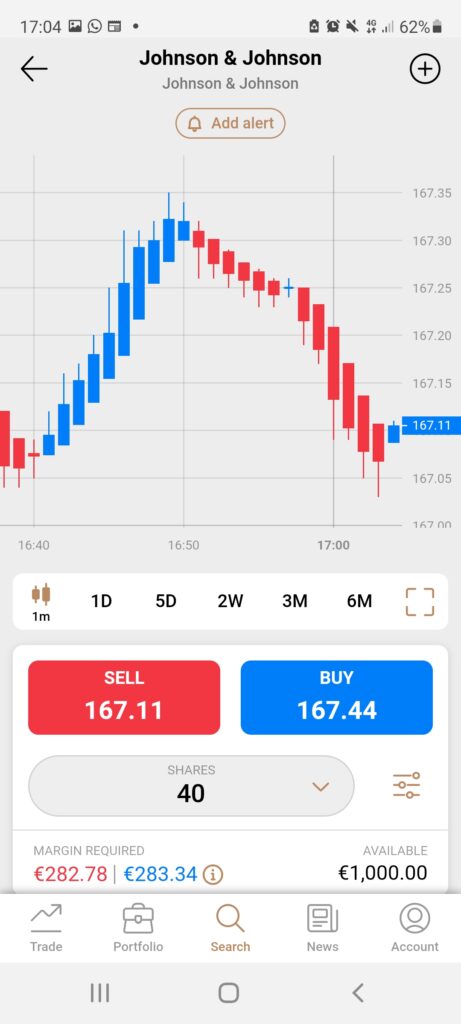

- 3: Capital.com – Best Stock App for Ease-of-Use

- 4. LonghornFX – Best Stock App for High Leverage

- 5. Currency.com – Best Stock App for Tokenized Shares

Finding the best stock trading app for beginners takes patience and requires a little knowledge of the providers behind them. To offer you a head start, you will find a full review on each of the above platforms – after the next section.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What is a Stock App?

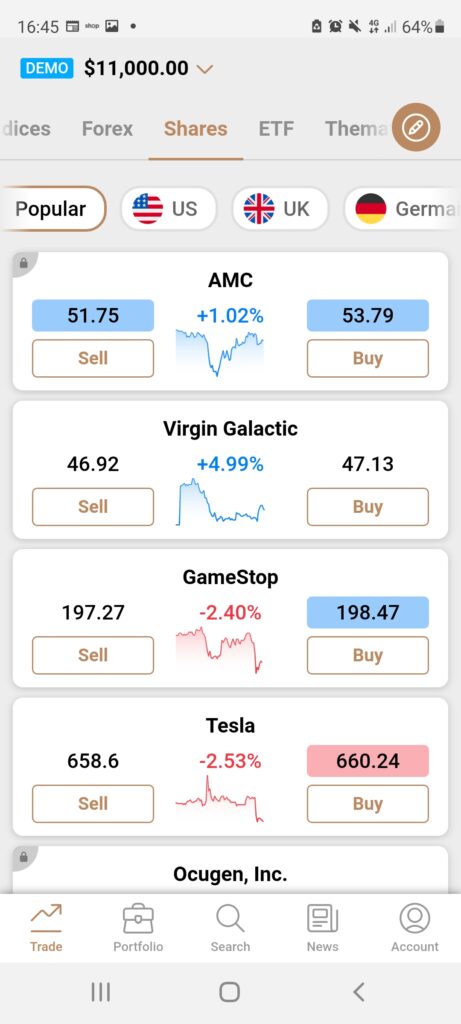

A stock app is quite simply an application you download and install on your mobile device that allows you to access your trading portfolio. You can also place buy and sell orders, fund your account – and in some cases access the charts and indicators needed to perform technical analysis.

Best Stock App for Beginners 2023:

Finding the best stock market app is no easy feat. As such, we look at various aspects like market diversity, licensing and reputation, fee structure, features, ease of use, and more.

We whittled our search for the best stock trading app for beginners down to five. To get the ball rolling, you will see a full review of each platform below.

1. AvaTrade – Overall Best Stock App for Beginners in 2023

Regulated in 6 jurisdictions, AvaTrade is a reputable CFD provider in the industry - also offering the best stock trading app for beginners. There are many positive attributes to the AvaTradeGO application, which we talk about in this review. Notably, you can download this application - but also hook your account up to social stock trading platforms. This includes AvaSocial, Duplitrade, and ZuluTrade.

All the above enable you to invest in and copy curated traders of stocks. As a beginner, this allows you to see how seasoned investors work. In most cases, you can also communicate with the experienced investor by asking questions. If you want to be more hands-on when trading share CFDs, you can link this stock market app to MT4 (MetaTrader4) for technical analysis.

This is a popular way to access heaps of price charts and indicators. All of which is essential for predicting the future price of an asset. We touch on CFDs and technical analysis later, for anyone unfamiliar with this aspect of trading. That's AvaTradeGO's key features out of the way - now onto the all-important subject of what markets are available - not least because there are tons on offer.

We found this to include huge companies, such as those listed on the following; London Stock Exchange, NYSE, NASDAQ, Paris Stock Exchange, Frankfurt Stock Exchange, and more. The minimum lot size is just 0.01. This means you don't have to worry about having thousands in trading capital available to access the likes of Amazon - as one example.

As such, you can also use the AvaTrade stock app to buy and sell fractional shares via CFDs. These contracts track the value of the underlying asset. You can also use this to your advantage by short selling if you feel the market will fall in value. This is because you do not actually own the shares. You will also notice blue-chip stocks such as Walmart, Google, Coca-Cola, Apple, Nike, Disney, IBM, and more.

Amongst the other 1,000+ markets, you can buy or sell on this stock trading app are Facebook, Netflix, Groupon, Teva, Pfizer, Mastercard, Twitter, Snapchat, and many more. Furthermore, if you connect to the third-party app MT5, you can also trade instruments like Starbucks, T-Mobile US, Colgate, PayPal, Chubb, Estee Lauder, Home Depot, eBay, Kraft, Tesco, and others.

A major advantage with this stock app is that it's commission-free, and the spread is tight - with Apple at approximately 0.1%. You may be offered up to 1:5 leverage - boosting your purchasing power five-fold. Via the aforementioned MetaTrader platforms, you can also practice on a free demo account with paper trading funds. To make the minimum deposit of $100, choose from various methods such as credit/debit cards, bank transfers, and e-wallets like Skrill.

- Minumum deposit of $100 to trade on stock app for beginners

- Stock app is regulated in 6 jurisdictions including Australia, South Africa, the EU, and Japan

- Trade CFDs with 0% commission on any stock market

- Inactivity and admin fees after 12 months no deposits or orders.

2. VantageFX – Best Stock App for Ease-of-Use

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

3. LonghornFX – Best Stock App for High Leverage

CFD provider LonghornFX adheres to AML (Anti Money Laundering) and CFT (Counter-Terrorism Financing) based on FATF recommendations, domestic law, and EU directives. This is also the best stock app for high leverage, with up to 1:500 available on the most traded markets globally. This will of course give you a much clearer idea of whether you are most likely to profit from a buy or sell order. You can trade lots as small as 0.01 on stocks such as those listed on exchanges in Australia, the UK, the US, Asia, and various parts of Europe.

This platform charges a commission of 0.0005 BTC which is super competitive - and we found spreads to be narrow on most markets. We found more than 40 stock CFDs listed on this app. This includes Procter & Gamble, Volkswagen, Siemens, Lufthansa, Tesla, Coca-Cola, Mapfre, Johnson & Johnson, Goldman Sachs Group, JP Morgan & Chase, and many more. The LonghornFX stock app is easy to get around and incorporating additional measures such as stop-loss and take-profit orders are possible on the move.

On the platform itself, you can take advantage of educational content such as video tutorials, daily technical analysis updates, lessons in calculating the spread, measuring lots, and using leverage. You will also be able to connect your account to MT4 to identify your next trading opportunity - using the previously talked about market data. When hooked up to MT4, you can also buy and sell share CFDs using a free demo account, with no deposit necessary. This will help you get used to the app, practice stock trading, and learn how to use leverage - if you haven't already.

This virtual portfolio aims to mimic real-world conditions. If you want to try something different, you can try MT5's WebTrader on your mobile. There are tons of payment methods accepted via this best stock app for high leverage. One which sets this share CFD provider apart is that it accepts Bitcoin deposits. Not only that, but you can still use standard payment types like credit/debit cards and bank wire transfers.

- CFD stock app for beginners with tight spreads

- Low commission and high leverage up to1:500

- Same-day withdrawals and wide range of assets

- Platform prefers Bitcoin deposits

4. Currency.com – Best Stock App for Tokenized Shares

A major European blockchain authority regulates Currency.com and this bests stock app for beginners offers tokenized shares. For those unaware, this is comparable to trading CFDs. You can make predictions and place buy or sell orders, based on the rising or falling prices of international stocks. Crucially, you will not take ownership as the technology behind it will track and match its value.

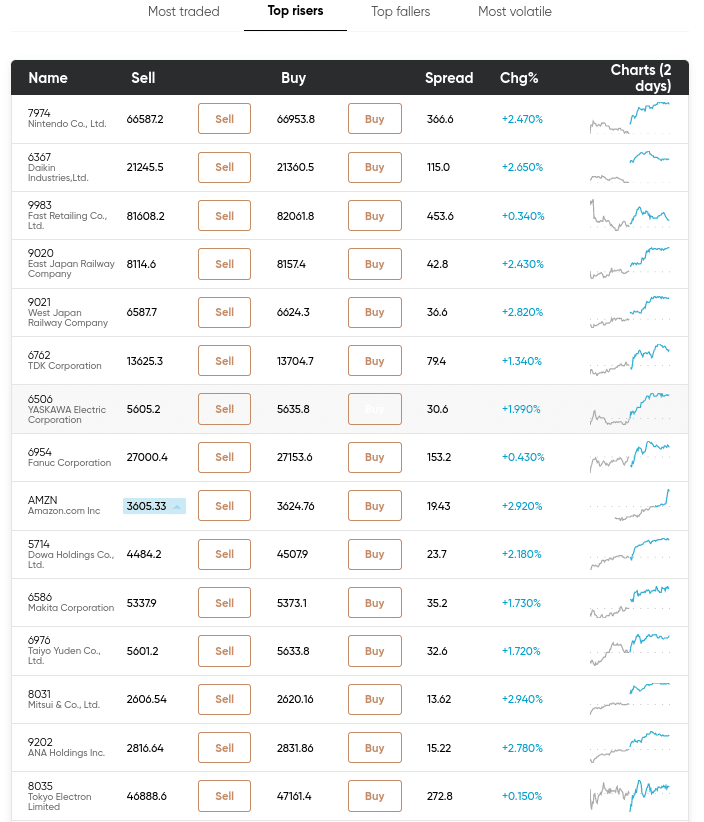

The flexibility of trading tokens that merely represent an underlying stock means you can still perform technical analysis as normal. This is because when the price of a stock rises or falls, so will the tokenized version. We found major exchanges listed on this app to include the London Stock Exchange, NYSE, Japan Exchange Group, and China - as well as marketplaces in Europe and beyond.

You will see some of the most well known tokenized stocks listed on this app. This includes Nintendo, AMC, Toshiba, Beyond Meat, Alibaba, Twitter, Bed Bath & Beyond, Amazon, Barclays, Google, Bank of America, Virgin, and many others. This guide found fees to be low when buying and selling tokenized shares on this application - with a spread of around 0.09% on Apple and 0.1% on Facebook.

This guide found a competitive commission of $6 for the equivalent of every BTC traded. Plus, the stock trading app is suitable for beginners - it's simple to navigate and you can take advantage of a free demo trading facility. This provider offers up to 1:500 leverage. Although, if you are new to stock trading, use this with care. It is not a requirement to link your broker account to MT4/5. Instead, you will find a plethora of technical indicators and other tools required to better gauge which direction your chosen market might go to make gains.

This includes Fibonacci retracement levels, adaptable trend lines, and various charting patterns. Other features include drawing tools and a variety of layout options. Much like with the aforementioned LonghornFX stock app - this platform welcomes Bitcoin deposits. You can also fund your new account with Ethereum, credit/debit cards, bank transfers, and Yandex. The minimum deposit to start buying and selling some of the biggest markets in the world is a newbie-friendly $10. If you opt for a bank transfer, you will need a minimum of $50.

- Tokenized stock app with tight spreads

- Competative commission fees and high leverage up to 1:500

- Same-day withdrawals

- You can not purchase traditional shares on this stock market app

5. EightCap – Trade Over 500+ Assets Commission-Free

Eightcap is a popular MT4 and MT5 broker that is authorized and regulated by ASIC and the SCB. You will find over 500+ highly liquid markets on this platform - all of which are offered via CFDs. This means that you will have access to leverage alongside short-selling capabilities.

Supported markets include forex, commodities, indices, shares, and cryptocurrencies. Not only does Eightcap offer low spreads, but 0% commissions on standard accounts. If you open a raw account, then you can trade from 0.0 pips. The minimum deposit here is just $100 and you can choose to fund your account with a debit or credit card, e-wallet, or bank wire.

- ASIC regulated broker

- Trade over 500+ assets commission-free

- Very tight spreads

- Leverage limits depend on your location

Best Stock App for Beginners: Ultimate Checklist

We are now going to divulge the ultimate checklist of how to find the best stock app for you and your financial objectives. This will aid you in discovering the stock app for your trading goals.

Is the Stock App Regulated?

There is no shortage of apps aimed at traders. What sets them apart, in terms of safety, is regulation. The best app to buy stocks will hold a license from one or more financial authorities. The most common are the FCA, ASIC, CySEC, and the FSCA, but there are others.

If you sign up with a stock app whereby the broker behind it is regulated – you can be all but sure it follows a wide range of rules to keep offering investors and traders a service. The exact regulations will depend on the jurisdiction the app falls under.

This might include a necessity to hold over a certain amount of capital or keep your money in the safety of a different bank account. It also includes sticking to KYC standards to verify who you are – as per anti-money laundering regulations.

What Global Stock Markets are Listed?

Another important factor is which stock markets you will have access to. Let’s say you want to trade blue-chip stocks in the UK (like the ones listed on the FTSE 100). First, you would need to ensure the app can provide access to the London Stock Exchange.

On the other hand, you may decide to focus on tech-based stocks. In which case, the exchange to look for is the NASDAQ. This is a very well-known US marketplace that focuses heavily on technology-based companies. This enables you to access shares in major companies such as Facebook, Netflix, Apple, Intel, Adobe, Alibaba, Cisco, and so on.

See below some other stock exchanges, listed on the best stock apps for beginners:

- Australian Securities Exchange: Australia

- Hong Kong Stock Exchange: Hong Kong

- Euronext: Amsterdam, Belgium, Brussels, Dublin, Lisbon, Milan, Oslo, Paris, and Portugal

- Shenzhen Stock Exchange/Shanghai Stock Exchange: China

- National Stock Exchange: India

- Swiss Exchange: Switzerland

- Bombay Stock Exchange: India

- Deutsche Börse: Germany

- Moscow Stock Exchange: Russia

- Toronto Stock Exchange: Canada

- Oslo Stock Exchange: Norway

- Madrid Stock Exchange: Spain

- Japan Exchange Group: Japan

Notably, US industrial, utility, and blue-chip stocks are usually listed on the Dow Jones index. This covers 30 highly established companies across both the NYSE and NASDAQ. This will include Nike, Walt Disney, and Johnson & Johnson to name a few. The best stock trading apps for beginners listed in our above reviews cover stocks from the most popular marketplaces in the world.

Are Commissions and Fees Reasonable?

Another worthwhile consideration is whether the stock app charges reasonable fees. Of course, the provider needs to make some money. However, the best app for stocks will keep commissions and spreads to a minimum.

See below some of the most commonly charged fees on stock market apps.

- Spread: The spread is the gap between the buy and sell price of the stock. So, if the difference is 0.1% and you are long – you need for the asset to rise by 0.1% to break even. Similarly, if you are short and the market falls by 2% – you make gains of 1.9%. The best stock trading app will offer narrow spreads – so look for low spread brokers.

- Commissions: Commission fees can quickly add up. Some stock apps will charge a variable percentage, or fixed fee – others only charge the aforementioned spread. This should be an important consideration when looking for the best stock market app for your needs. Most apps will stipulate this clearly in their fee structure.

- Swap Fees: When you are trading stock CFDs you will notice a charge called the daily, swap, or overnight fee. This is comparable to interest, and will be payable for every day you leave a position open past the market’s closing time.

It’s important to conduct your own research when looking for the best app for stocks. The chances are you will have your own preferences on other factors such as features. With that said – the lower the fees are – the better this is for your future profits.

Is the Stock App Suitable for Beginners?

It’s important that you make sure you can comfortably find your way around the stock app. This includes using the available features, but also placing an order in a flash when you recognize a potential opportunity to make gains.

One of the easiest ways to do this is to try a demo account, which we talk about shortly.

Best Stock App for Beginners: Useful Attributes

The best stock apps for beginners will provide access to trading tools to help you learn, or predict the markets. As such, we have listed below the most useful to keep an eye out for.

Forecast Future Stock Prices Using Trading Tools

As you know, you need to perform technical analysis to make informed choices when trading stocks. This means you need to ensure the app you are considering has plenty of charting tools and features. For instance, the best app to buy stocks will offer access to a good variety of indicators – to help you predict the fall or rise of your chosen market.

It doesn’t really matter whether this is on the application itself or entails connecting your account to MT4 or MT5 – the key is being able to view this helpful data with ease.

Some of the most utilized technical indicators offered by the best stock apps for beginners include:

- Ichimoku cloud

- Average directional index

- Standard Deviation

- Stochastic Oscillator

- Fibonacci Retracement

- Moving Average Convergence Divergence

- Relative strength index

- Bollinger bands

The best stock app for beginners will also offer drawing tools, customizable charts, and a range of timeframes. This allows you can see as much historical data as you need, and to switch between charts when necessary – crucially, on the go!

Option of Stock CFDs

As well as regulation, a wide range of markets and low trading fees – look for the option to short sell and apply leverage. With this in mind, we find that the best stock apps offer CFDs (or tokenized assets).

As we touched on in our best stock app reviews, this means you can place a sell order if you believe the value of the shares will fall – thus making gains if you are correct. Furthermore, if you opt for high leverage brokers, you can also boost your trading power with as much as 1:500 in some cases.

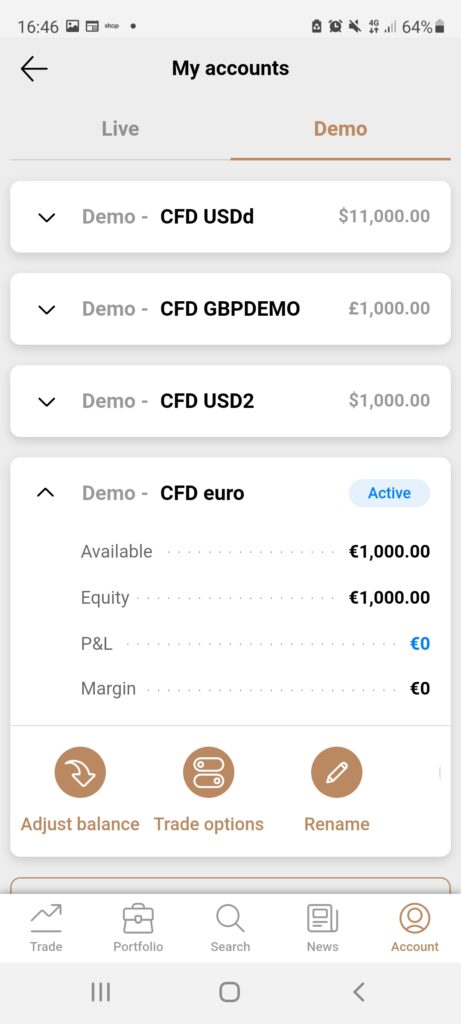

Develop Your Skills With a Risk-Free Demo Feature

When searching for the best app for stocks, you may wish to hone in on your skills with a demo trading platform. As we said, this is also a great way to find your feet on your chosen app.

The providers we reviewed earlier all offer this feature and preload your free demo account with anywhere up to $100,000 in virtual equity to hone in on your skills.

The Best Stock App for Beginners 2023: Join a Broker and Download Today!

Now that we have reviewed the best stock app for beginners – we can now show you how to get started with an account today.

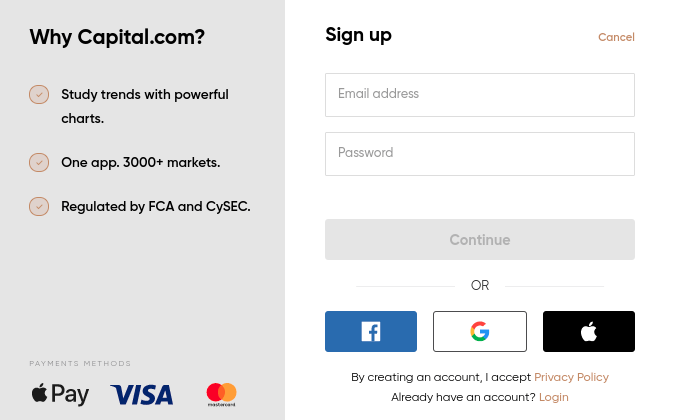

Step 1: Sign up With the Best Stock App Provider

Once you have weighed up your options and made your final decision, you can head over to the website of the broker behind the best stock app for beginners.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Step 2: Validate Your ID with Documents

You will now be asked for a government issues ID such as a driving license or passport. Next, you will be required to send a copy of a recent bank statement or utility bill. This is to verify your stated country of residence and home address.

Please note that most stock apps will accept a digital copy of your bank statement. You should receive an email within a few minutes confirming your new account.

Step 3: Download the Stock App

Now you are nearly ready to start stock trading from the palm of your hand. If you are an Apple user, you will need to go to the App Store to find the correct application.

Step 4: Choose Payment Type and Fund Account

The best stock app for beginners will accept a variety of payment methods, rather than just one type.

This might include Mastercard, Visa, bank transfer, cryptocurrencies such as Bitcoin – or e-wallets like Skrill, Neteller, and Apple Pay.

Step 5: Search for Stocks

Now you can look for the section dedicated to stocks on your chosen platform – or you can use the search box. Here we are searching for Johnson & Johnson using a demo account.

Step 6: Place Your First Order

Now, you can place your first order! We are looking to go long on Johnson & Johnson. As such, we are going to place a buy order.

The Best Stock App for Beginners 2023: Full Conclusion

To conclude, the best stock app for beginners will not only be easy to use for newbies – but will also charge low commissions and offer competitive spreads.

After all, the less you pay in fees, the more you have to allocate to your next trading position. You can also look for platforms that are able to offer you high leverage – the goal being to magnify your gains if you speculate correctly.

One of the main advantages of electing to sign up with a stock app backed by a legitimate and regulated broker is the privacy and security aspect. These platforms are often able to offer a more cost-effective way to trade stocks. Additionally, the best stock apps offer access to a plethora of fractional share CFDs covering marketplaces around the world.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

FAQs

What is the best stock app for beginners?

Can I use a stock app in demo mode?

What is the best stock to trade for beginners?

Will I be required to sign up with a stock market app and a separate broker?

How much money will I need to trade stocks on an app?