Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Market Analysis – February 12

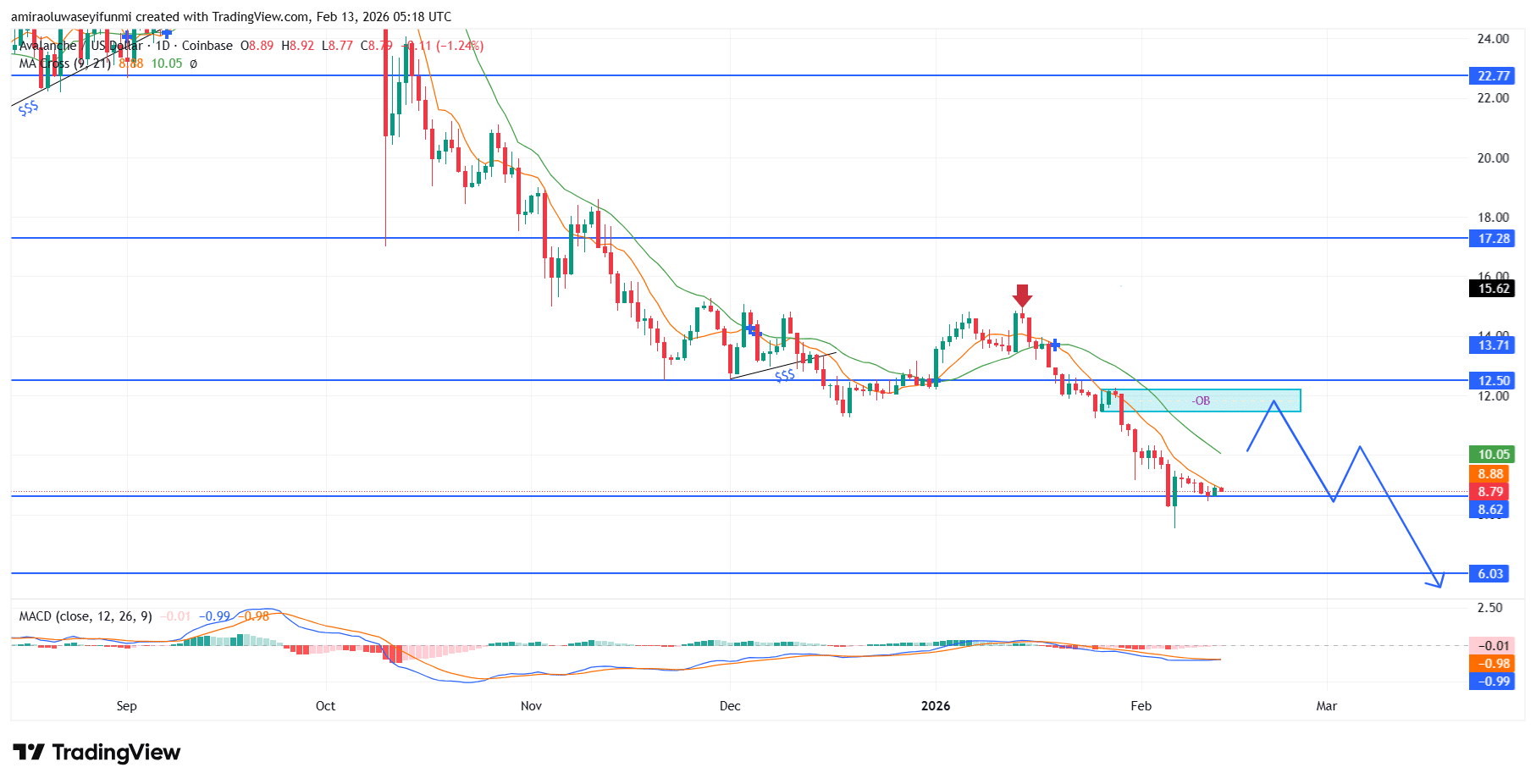

AVAXUSD exhibits persistent distribution beneath overhead barriers. AVAXUSD market remains firmly embedded in a clearly defined downward configuration on the daily chart, evidenced by a consistent sequence of declining peaks and troughs. Price continues to trade below the 9-period and 21-period moving averages, positioned around $10.05 and $8.90, thereby affirming prevailing negative momentum. Both averages are bearishly stacked and angled downward, reflecting ongoing supply-side control. In parallel, the MACD histogram hovers slightly below the equilibrium axis while its signal components remain in sub-zero territory, highlighting entrenched selling pressure and subdued upside conviction.

AVAXUSD Key Levels

Resistance Levels: $12.50, $17.30

Support Levels: $8.60, $6.00

AVAXUSD Long-Term Trend: Bearish

From a market-structure perspective, the instrument has conclusively breached the $12.50 and $13.70 support thresholds, effectively transforming former accumulation bases into layered resistance. The subsequent failure within the $14.00 to $15.60 corridor reinforced the integrity of the dominant downward cycle. Price activity is presently consolidating around the $8.80 to $8.60 demand pocket, yet rebound efforts lack the strength required to overcome the $10.05 dynamic ceiling. The repeated inability to secure acceptance above short-term trend metrics implies that upward retracements are being methodically distributed, signaling continued bearish order flow targeting deeper liquidity.

Looking ahead, the prevailing technical landscape supports a drift toward the $8.00 psychological marker, with scope for extension toward approximately $6.00 if downside velocity intensifies. Interim recoveries are likely to encounter supply friction between $10.00 and $12.50, coinciding with prior structural breakdown zones. Without a decisive reclaim and sustained stabilization above $12.50 on a closing basis, directional risk remains weighted to the downside, favoring gradual value erosion across the near- to medium-term horizon.

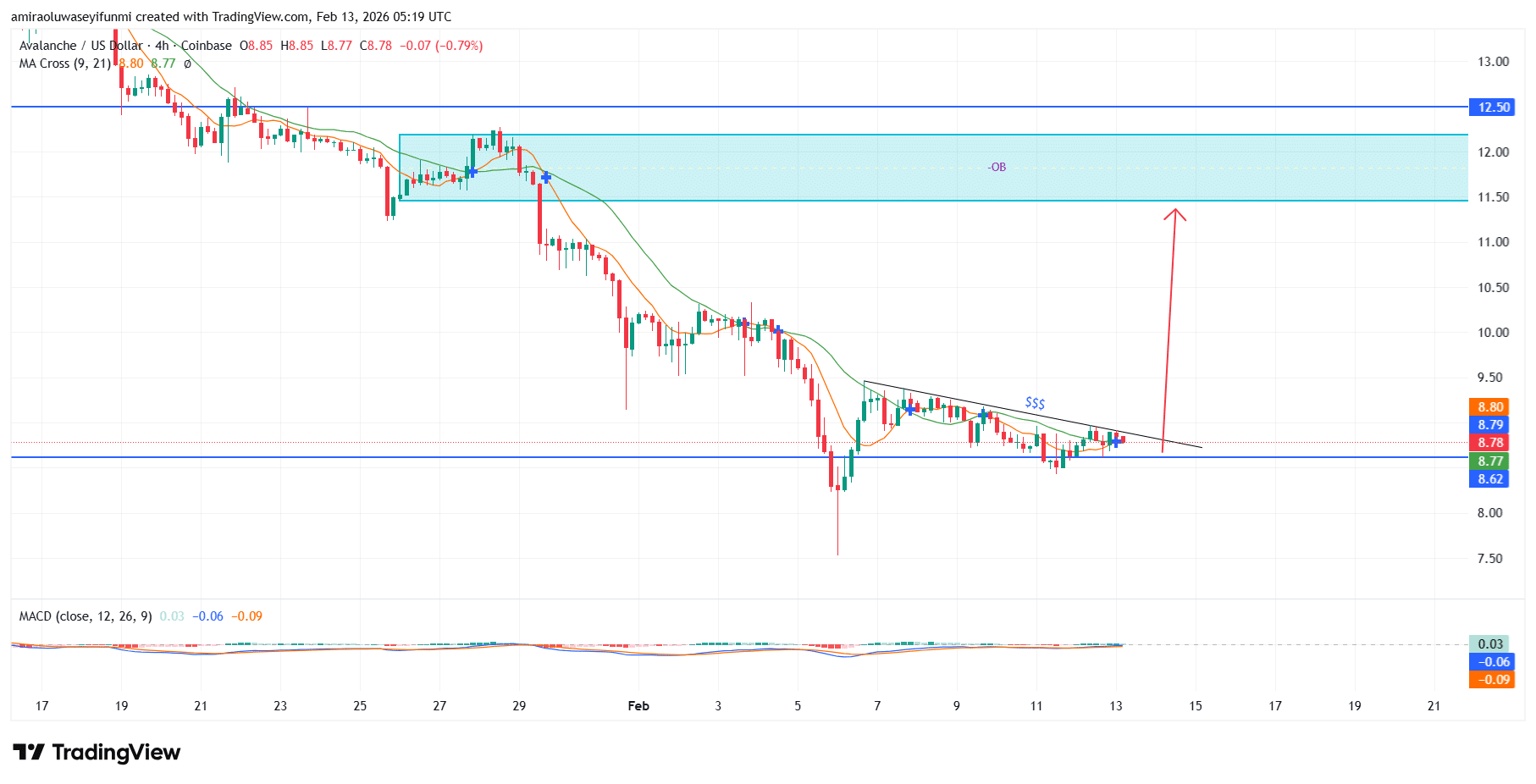

AVAXUSD Short-Term Trend: Bullish

AVAXUSD on the four-hour chart is exhibiting early bullish reversal characteristics, with price stabilizing above the $8.60–$8.80 support band and compressing beneath a descending trendline. The 9-period moving average is attempting to cross above the 21-period moving average near $8.80, signaling improving short-term momentum, while the MACD gradually rotates toward positive territory.

Repeated higher lows around $8.70 indicate accumulation and weakening downside pressure despite the broader bearish backdrop. A confirmed breakout above $9.00 would likely open upside continuation toward the $11.50–$12.50 supply zone, aligning with expectations derived from crypto signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.