AUD/JPY Market Analysis – February 16

The AUD/JPY, long regarded as a premier “risk-on” barometer in the global currency markets, currently finds itself at a pivotal technical and fundamental crossroads. As the pair stalls near the major psychological resistance of 110.00, it is being pulled by two powerful and conflicting forces: a hawkish shift in Australian monetary policy and a resurgence of the Japanese Yen as a preferred safe haven.

On one side, the Reserve Bank of Australia’s (RBA) surprise rate hike to 3.85%—driven by persistent, six-quarter-high inflation—has bolstered the Aussie’s “carry trade” appeal. However, this bullish momentum is increasingly offset by Japan’s shifting political landscape under Sanae Takaichi and rising JGB yields. Coupled with “risk-off” sentiment stemming from U.S.-Iran tensions, the market is now locked in a high-stakes tug-of-war that will determine whether the current uptrend continues or a significant bearish reversal begins.

AUD/JPY Key Levels

Supply Levels: 111, 112, 113

Demand Levels: 105, 104, 103

Technical Analysis: The 110.00 Ceiling and the “Double Top” Threat

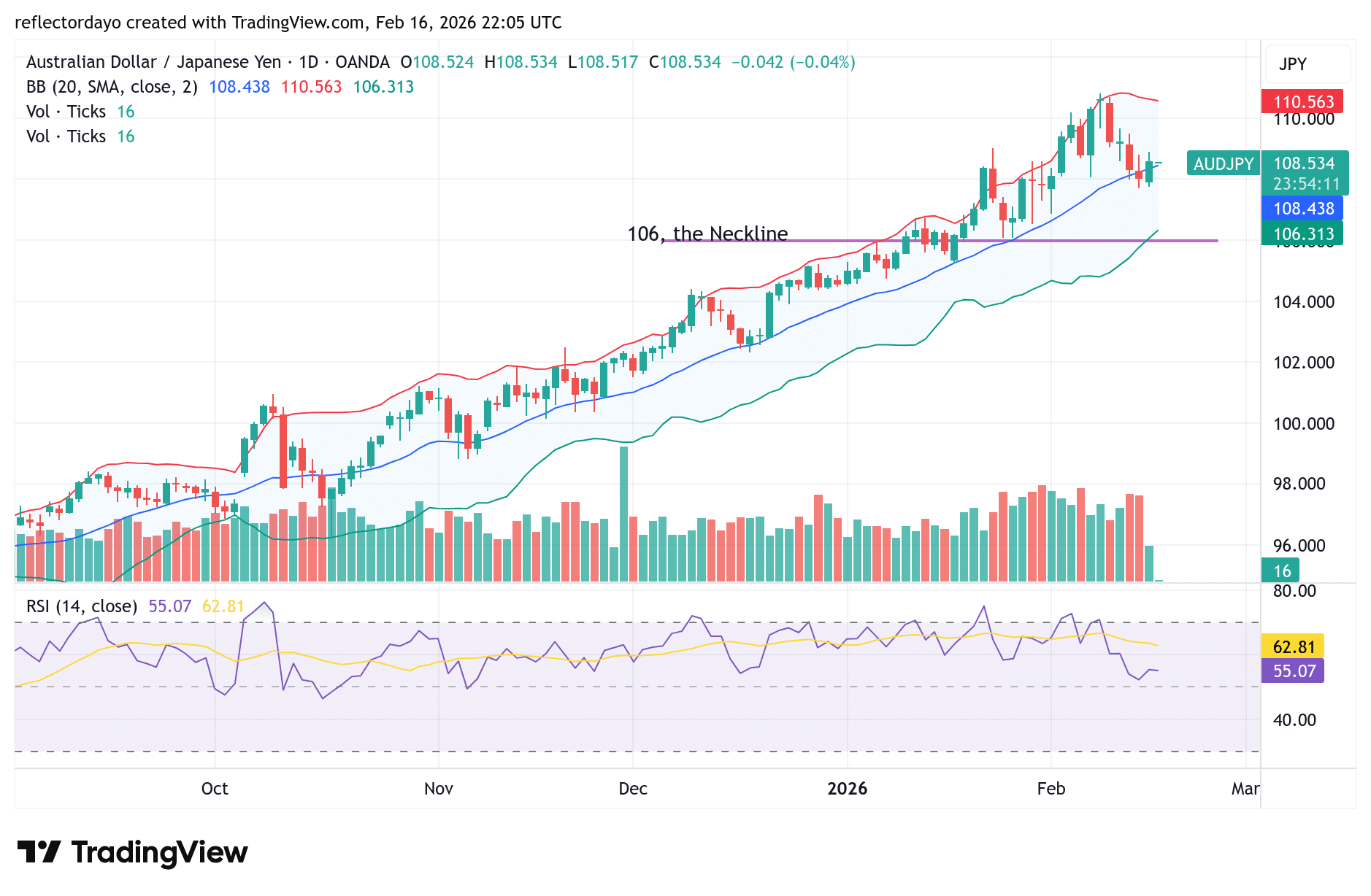

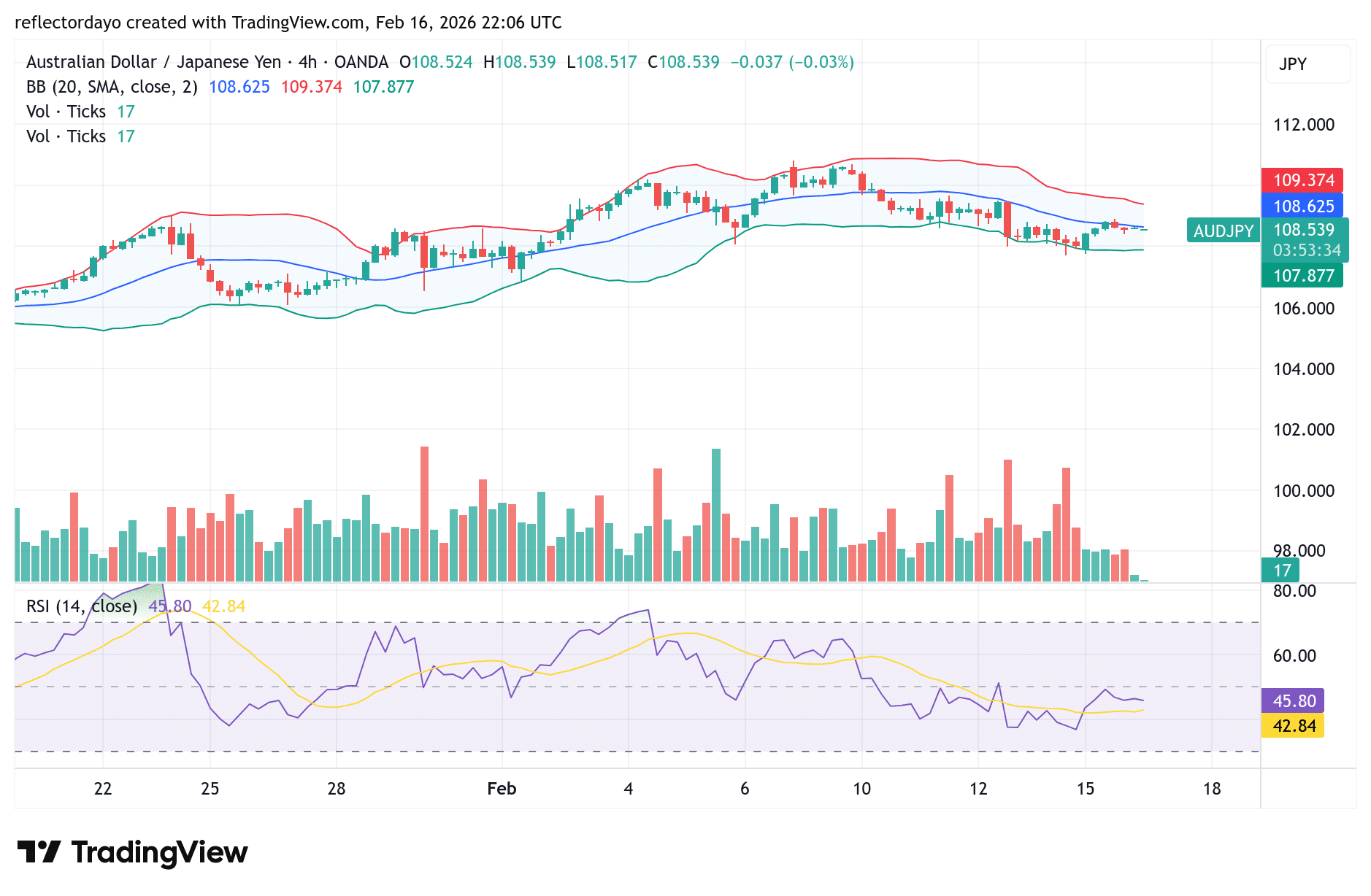

From a technical perspective, the AUD/JPY is currently testing the resilience of its long-term bullish trend as it faces a significant hurdle at the 110.00 psychological level. After peaking at a yearly high of 110.78 earlier this month, the pair experienced a sharp rejection, pulling back to find temporary footing in the 108.00 support zone. At present, price action is characterized by heavy consolidation between 108.50 and 108.80, signaling a struggle to regain the bullish momentum necessary for a breakout.

The primary concern for bulls is the emergence of a potential “Double Top” pattern. If the market fails to establish a higher high and instead decisively breaks below the recent swing low of 108.02, it would confirm this bearish reversal structure, likely triggering a shift in market regime. Traders should keep a close eye on the 110.00–110.80 “sell zone” for signs of further exhaustion. A failure here places the immediate support at 108.00 under immense pressure, with a breach potentially opening the doors for a deeper correction toward the structure’s neckline at 106.30.

Short-Term Trend

The current market structure for AUD/JPY suggests that the “easy money” on the long side has likely been made. While the RBA’s hawkish stance provides a fundamental floor, the inability of bulls to clear the 110.00 handle despite multiple attempts is a classic sign of trend exhaustion. The market is now entering a high-stakes distribution phase where the risk-to-reward ratio has begun to favor the bears.

For a bullish continuation, we need to see a decisive daily close above 110.80 to invalidate the current “Double Top” threat. Until then, the path of least resistance appears to be toward the downside. Conservative traders may want to wait for a break of the 108.00 support to confirm the start of a broader bear run, while aggressive traders will likely view any relief rallies toward 109.50 as an opportunity to sell into strength, targeting the neckline at 106.30.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.