AUD/JPY Market Analysis – February 9

The recent consolidation of the AUD/JPY cross near the 110.00 psychological milestone is a classic tug-of-war between aggressive monetary tightening in Australia and a shifting political landscape in Japan. While the pair has enjoyed a sustained bull run, the current slowdown is largely driven by a “wait-and-see” approach from traders following the Reserve Bank of Australia’s (RBA) decision on February 3, 2026, to hike interest rates by 25 basis points to 3.85%. This move, fueled by sticky inflation and a resilient labor market, provided the initial fuel to pierce the 110 level. However, the momentum has stalled as the market digests the potential for a Bank of Japan (BoJ) policy shift amid the uncertainty of Japan’s February 8 snap elections.

AUD/JPY Key Levels

Supply Levels: 111, 112, 113

Demand Levels: 105, 104, 103

AUD/JPY Demand and Supply Lockhorns Above 110

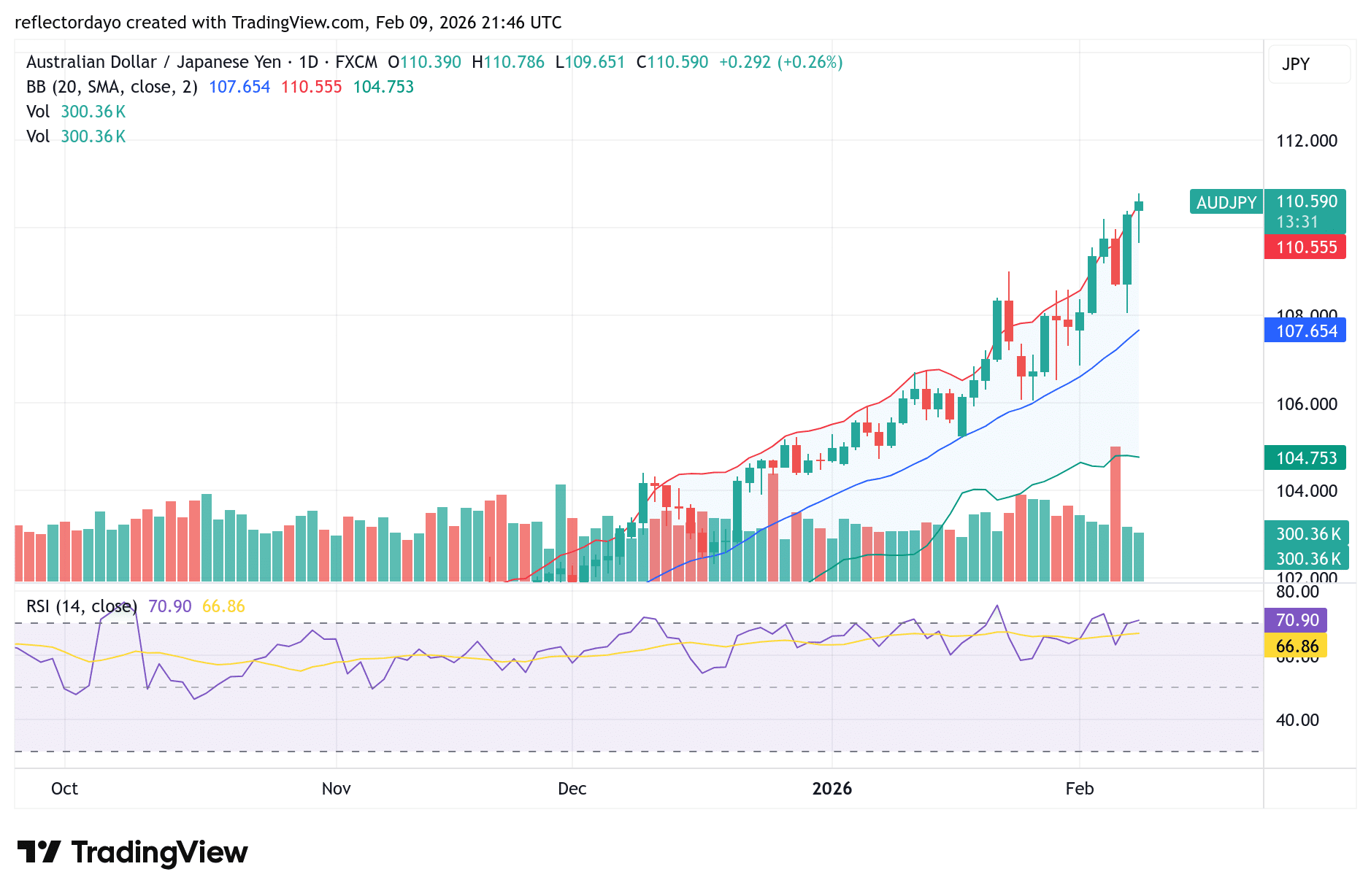

From a technical perspective, AUD/JPY price action today reflects a classic consolidation phase following a strong breakout. After rallying from the 107.80 region earlier in the month, the pair decisively cleared the 110.00 psychological level, which has now shifted from a key resistance into an immediate support zone.

The emergence of a dragonfly-type candlestick suggests potential market exhaustion, especially given that it has formed near the top of the recent bullish run. The long lower shadow indicates that notable selling pressure emerged during the session; however, buyers stepped in to recover losses. Despite this recovery, the candle closed with a small real body, highlighting growing indecision between bulls and bears.

This setup raises the question of whether the bullish trend can extend further or if a corrective move is about to unfold. It is worth noting that the 110.00 level remains the nearest and most critical support, and bulls will likely seek to maintain a firm hold above this zone to preserve the broader upside structure.

Short-Term Trend

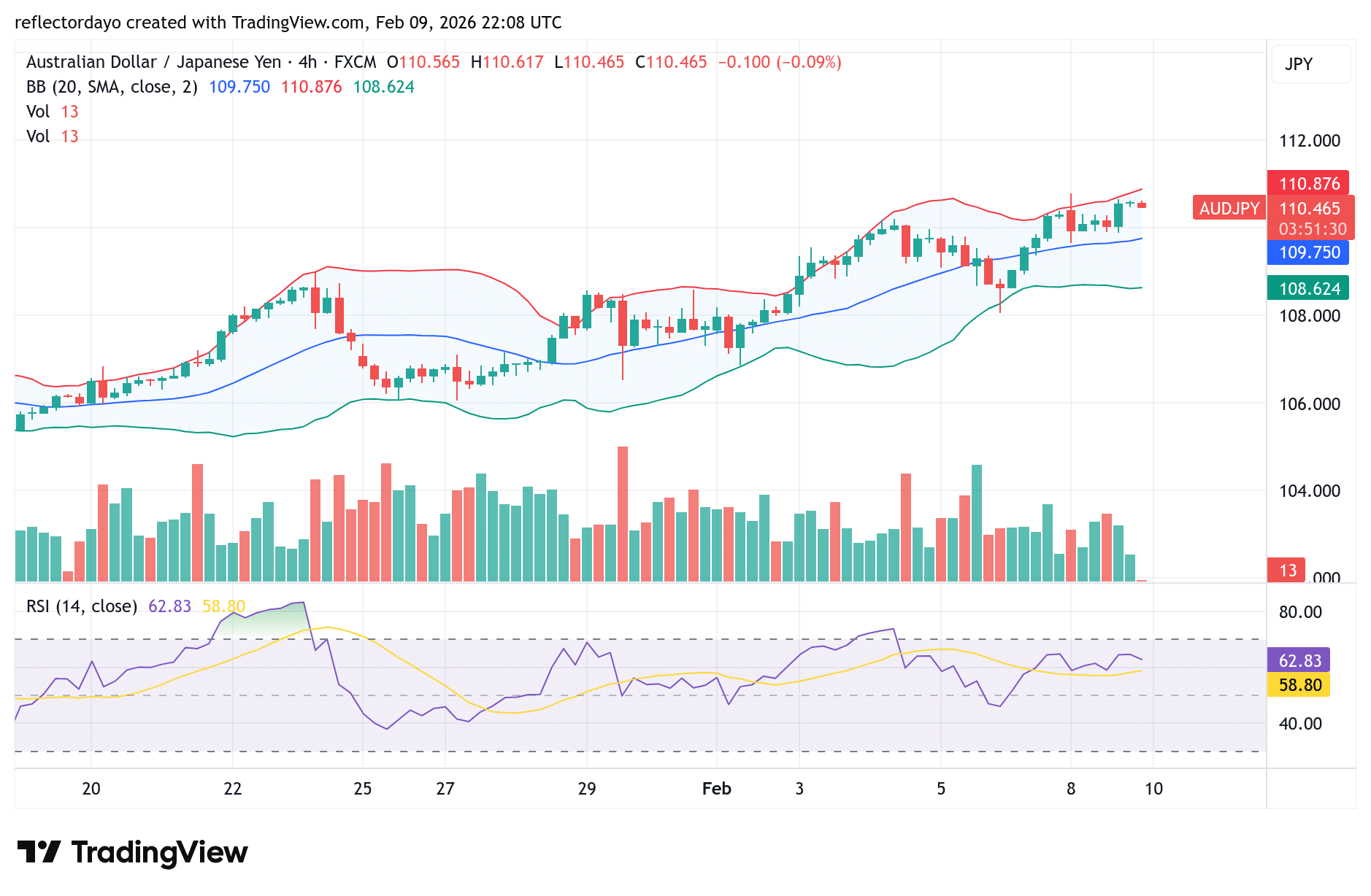

Shifting the analysis to the 4-hour timeframe, price action suggests that the 110.00 support level may hold if the market faces rejection near 110.59. A closer look at price behavior since February 8 shows persistent interaction between supply and demand around the 110.00 threshold, before the pair eventually broke out to the upside and tested resistance at 110.59.

Given that several bearish attempts have been rejected near this level since February 8, the market may once again find support here. If upside resistance at 110.59 continues to cap price action, a consolidation phase above the 110.00 level could unfold before the next directional move.

Make money without lifting your fingers: Start using a world-class auto trading solution.

Related Resources

- Forex Signals — live EUR/USD, GBP/USD and more

- What Are Trading Signals? — beginner’s guide to signal services

- VIP Trading Signals — join 40,000+ traders getting early signals

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.